Zelle and future of payments for community banks

A banker’s take on the accelerating availability of P2P payments

- |

- Written by Chris Nichols

Community banks can't ignore the immediate, and longer-term implications, of P2P payments as Zelle goes live.

Community banks can't ignore the immediate, and longer-term implications, of P2P payments as Zelle goes live.

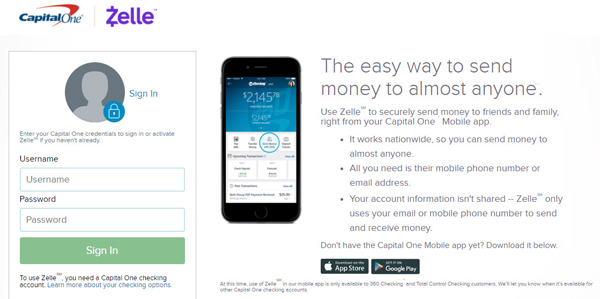

Person-to-person (P2P) payment service, Zelle, is going live and is being introduced into the market by more than 30 major financial institutions, including Bank of America, Chase, US Bank, Capital One and Wells Fargo.

Operated by a bank partnership, the technology will be incorporated into many banks’ online and mobile applications and will displace PayPal’s Venmo, Square Cash, and P2P integrations in both Facebook and Apple’s ecosystem. In this article, I will look at why Zelle is important and how community banks are thinking about refining their payment strategy.

Setting a strategy

If you attend most banking conferences, experts talk to community banks as if we have the ability to create our own payment application.

Save for our nation’s few top banks, payment systems are expensive and rely on scale, which puts it out of reach for almost every community bank in our universe.

As such, a community bank strategy comes down to choosing an existing platform and then figuring out innovative ways to leverage the technology in order to create value. By far the most profitable use is to focus on the commercial side which I wrote about here. Next to going after the merchant or small business with payments as part of a treasury management offering, making sure your retail customers are taken care of should probably be your next priority.

Here, banks have a number of options. Let’s break down the universe of substantial payment options to the four on the left of the graphic below and present the competition on the right.

I

Power of P2P

The adoption of P2P as a must-have banking tool is growing fast. Users can use applications like Venmo tied to their debit card, but then the user needs to transfer the funds back into their account. As such, having your P2P application tied directly into your account makes more practical sense.

Using the data from the Federal Reserve and in talking to each of the major banks, I estimate that almost 23% of all banking customers have sent a payment electronically to another person. This is just a small fraction of the total digital market (less than 3% by volume), but this activity is expected to grow exponentially in the next couple of years.

In a survey this week, when a person needs to be paid back, 69% said they would like their money within minutes. This makes a P2P application ideal to take care of small-dollar payment transfers. Already, P2P capabilities rank among the top ten reasons that are considered when choosing a retail bank.

Soon, I predict that P2P functionality will surpass free foreign ATM access and will be in the top three reasons. As more and more customers practice moving money through these apps, having these capabilities is critical to continue to grow retail customers.

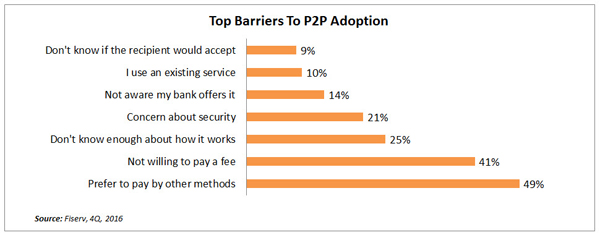

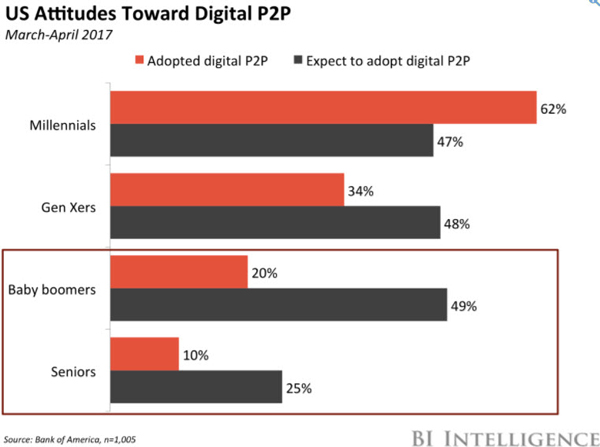

A recent Bank of America study shows the significant current adoption by Millennials and GenX plus the huge opportunity with the Baby Boomers (below).

In addition to the substantial upside, having a P2P application makes your bank more attractive for customer acquisition, increases engagement and boosts retention by some 9% or more. What these trends add up to is a P2P application is a must-have for retail-focused banks.

Why community banks need to consider P2P

Of your choices, Zelle is shaping up to be a suitable option worth deep consideration. This comes down to two main reasons:

Scale: In payments, scale is everything, and Zelle will immediately have the largest mark share. From the start, Zelle will have 86 million mobile banking users. That’s a base that is likely to grow faster than competitors, given the network effect of bringing other community banks and credit unions on board. Fiserv is now offering turnkey integration of Zelle which will speed adoption.

Because of Zelle’s partnership with both Mastercard and Visa, nearly any customer with a debit card, even those at banks that are not integrated with Zelle, will soon be able to use the service.

Real time (sort of): While still technically batch processed, due to the bank connections, the application will have the appearance of a real-time transfer so users can usually have immediate use of transferred funds. This is a major competitive advantage, as most fintech applications takes three days to complete a transfer.

Now let’s consider some additional factors.

Focus on bank customers: Zelle’s main marketing push is to provide convenience to GenX, Boomers, and Seniors. By design, Zelle is not including social media streams like Venmo, so the application looks to be attractive to a wider variety of customers that want a higher level of privacy.

Pricing: With no fee to the user (most banks), Zelle is attractive. Banks need to think of P2P applications not as an added expense, but as a long-term replacement of the branch and ATM structure.

Shifting customers to P2P functionality can either reduce the need for current branches/ATMs or slow the need to build future branches. Consider that if a customer walks into a branch to get cash, your incremental cost is over $2.00 of teller time and resources. If you use a universal banker model, the cost is closer to $3.00. If that customer uses an ATM, that cost is about $0.03, and if they use the mobile app, the cost is likely less than $0.02. When looked at as a retention or branch/ATM replacement tool, a P2P application can generate a positive return over time.

Integration: Carried by Fiserv, FIS, Jack Henry, and Co-op Financial Services, Zelle is the only platform with complete integration to the major core systems. This is a major decision point for most financial institutions and will serve to help make an easy, turnkey decision.

Considering the future

Banks that have a longer-term planning horizon will understand that there is no stopping this trend. The non-currency transfer of value isn’t just a passing trend, and it will only accelerate.

In less than ten years, banks will need to charge for branch and maybe ATM access to currency the same way we charge for paper statements.

As cash usage drops, the incremental cost of maintaining cash availability will rise. Who is going to reconcile, change over. and manage a drawer in a branch for five transactions per day? When market penetration of P2P and remote check deposit shrinks ATM usage, it will be harder to justify the cost of off-premise ATMs in their current form.

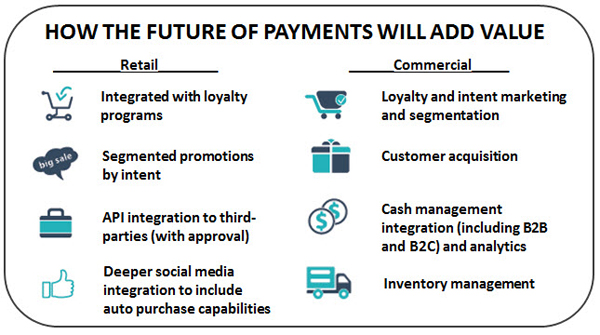

Retail and commercial customers, on the other hand, will find new ways to integrate with mobile payments. Being able to send cash back or immediate offers to P2P users will be an advantage. Platforms like Venmo and Zelle will continue to monetize their value by providing greater points of integration, APIs to leverage the data, and the ability to segment customer channels (graphic below).

In addition to the evolution of P2P payments from the merchant or small business side of the equation, the technology behind P2P will continue to develop.

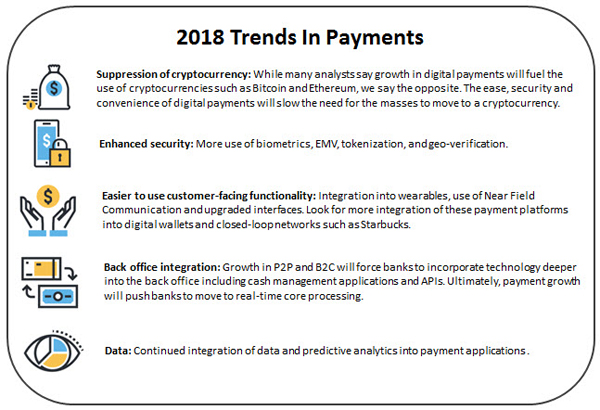

The ease of use will create less need for a cryptocurrency, security will be greater, the application will be easier to use, back office integration will be deeper, and the data will be easier to access and leverage (graphic below). All these factors will continue to make P2P more valuable.

Conclusion

If your bank is retail focused, a P2P application is worth serious consideration. I would say it’s a must-have application as Zelle presents a great alternative and will be changing the game because of its sheer scale.

• If your bank is metro-focused, then the density of customers will create additional value that your customers will enjoy by getting on a P2P platform.

• If your bank is rural-focused, then the larger proximity to branch or ATM will add that same value. Either way, the benefit of real-time cash transfer is just too great.

For every person that is on the ecosystem, the platform becomes more valuable until it reaches a tipping point where everyone must have the application to stay relevant. Banks will only be able to ignore this product for so long.

This article originally appeared on Chris Nichol’s LinkedIn blog

Tagged under Retail Banking, Payments, CSuite, Channels, Mobile, Community Banking, Feature, Feature3,