Lending favors western community banks

SNL Report: Overall, banks in Western region generate strongest loan growth

- |

- Written by SNL Financial

SNL Financial is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the subscriber side of SNL Financial's website.

SNL Financial is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the subscriber side of SNL Financial's website.

By Kevin Dobbs and Razi Haider, SNL Financial staff writers

Loan growth in the West proved relatively robust in the second quarter, as banks in the region capitalized on booming markets in some cases and continued to ride a steady wave of economic activity in others.

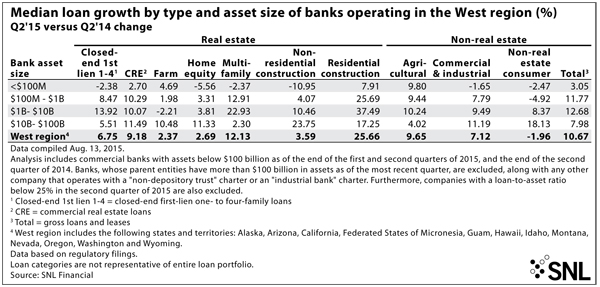

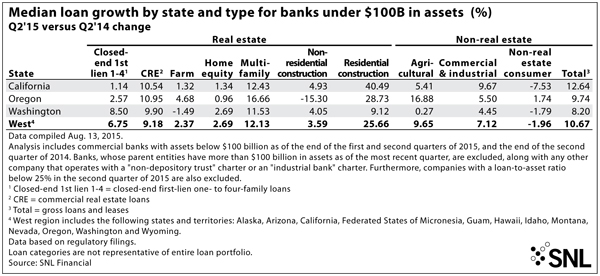

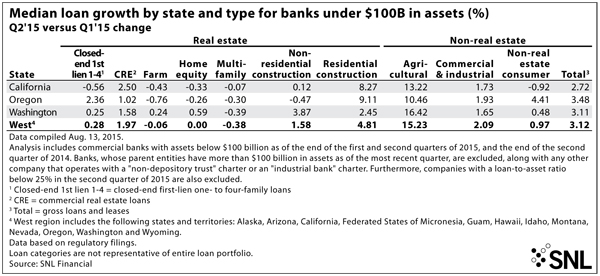

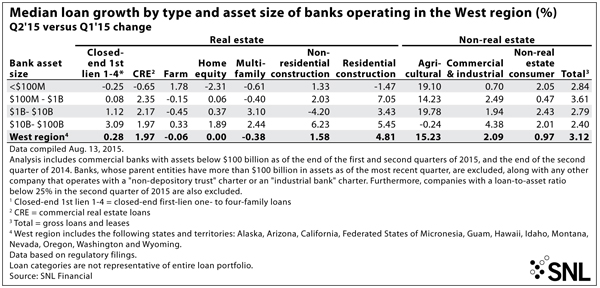

The Western region—California, Oregon and Washington, along with Alaska, Arizona, Hawaii, Idaho, Montana, Nevada, Wyoming, and certain island territories—produced double-digit loan growth when compared with a year earlier. Second-quarter median growth among banks based in the region with less than $100 billion in assets reached 10.67%, according to an SNL Financial analysis of regulatory filings.

Community banks led the way. Banks with between $100 million and $1 billion in assets produced second-quarter median growth from a year earlier of 11.77%, SNL found. That was better than what a companion SNL analysis found for banks nationally; the national median for banks in that group was 6.91%.

Among Western banks with assets between $1 billion and $10 billion, median loan growth from a year earlier was 12.68%. That beat the national median of 11.84% for banks in that range.

Sung Won Sohn, an economist at California State University, Channel Islands, told SNL that much of the Western region, notably including California, suffered more from the aftershocks of the last recession than other parts of the country because it is more dependent on real estate and the last downturn was driven in large part by a real estate bust.

But now, as the recovery has taken hold and economies are rebounding in the West, they are doing so even faster than other regions.

"So on the upswing now, we are seeing really broad-based growth," Sohn said.

California, the most populated state in the West, easily beat the region's average and helped lead the way, with banks under $100 billion based in the state collectively producing loan growth of 12.64%, the SNL analysis shows.

Broadly, Sohn said, real estate markets in the state have recovered and both commercial and residential activity is solid. State and local governments, too, are ramping up again after years of cuts, with hiring solid at everything from state universities to city-level maintenance crews.

"That is reversing, the government sector," Sohn said. "They are hiring again."

A thriving technology industry also is driving economic activity in major markets across the state, Sohn said, including in Los Angeles and San Diego in Southern California. In the northern part of the state, San Francisco is thriving in large measure because of the growing tech industry, he said, and tech-centric Silicon Valley "is really experiencing its best economy ever."

The tech surge—from start-ups to established powers such as Amazon—also is lifting markets such as Seattle in the Pacific Northwest, he said. "That's been a very big factor," Sohn said.

Stephen Gordon, chairman, president, and CEO of Irvine, Calif.-based Opus Bank, told analysts after the bank reported a second-quarter profit that strong loan growth in several major West Coast markets helped bolster the company's overall revenue and its net interest margin.

He expects more growth to come. "We've always ramped up as the year goes along, with the first quarter generally being our lowest quarter and the fourth quarter being our highest quarter. And I wouldn't expect anything different over the course of this year," Gordon told analysts. "Our pipeline has increased in size and improved in mix."

D.A. Davidson & Co. analyst Jeffrey Rulis agreed with Sohn that tech is driving an abundance of economic activity, from Silicon Valley to Seattle, and leading to increasingly more investments in office spaces and helping to drive demand for both home purchases and new apartment buildings. Along with this has come improving loan demand, he told SNL.

"We continue to hear very positive things," he said. "I think the read overall is that origination volumes have picked up some, and along with that payoff levels have come down enough to allow the growth to really show through."

Other areas of the Western region are strong as well, analysts say. Growth may not be on par with the likes of Silicon Valley, but economic activity is steady and reliable in states such as Hawaii and Montana. And states such as Arizona that were hard-hit by the last downturn are on the mend and helping contribute to the Western region's overall health, Rulis said.

Phoenix-based Western Alliance Bancorp., for one, reported solid loan growth in Arizona during the second quarter. It also boosted lending in California, executives told analysts after reporting results in July, despite stiff competition from larger banks. Western Alliance, which has nearly $13.5 billion in assets, is looking for more growth in the second half of 2015.

"We expect growth to accelerate from the second quarter," Robert Sarver, Western Alliance's chairman and CEO, told analysts.

This article originally appeared on SNL Financial’s website under the title "Banks in Western region generate strongest loan growth."