Banks increase provisioning modestly

SNL Report: Energy appears to be only significant credit risk category

- |

- Written by SNL Financial

SNL Financial is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the subscriber side of SNL Financial's website.

SNL Financial is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the subscriber side of SNL Financial's website.

By Brad Bracey and Zach Fox, SNL Financial staff writers

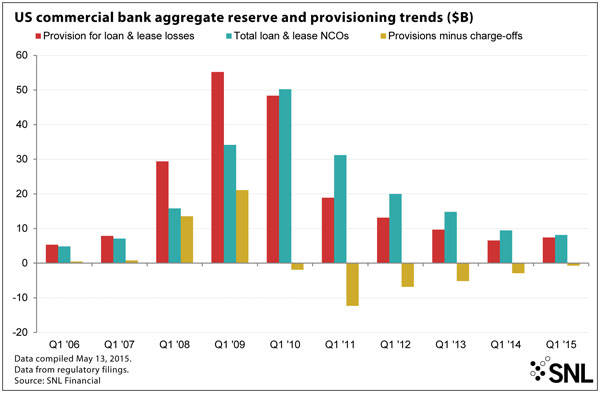

The days of reserve releases boosting bank earnings appear to be well over, with large-bank provisioning roughly the same amount as total net charge-offs in the first quarter.

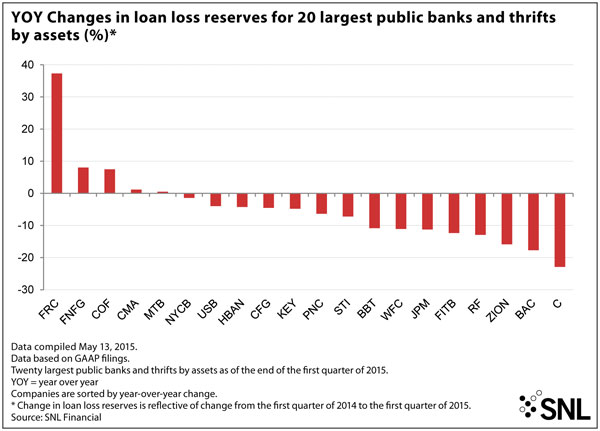

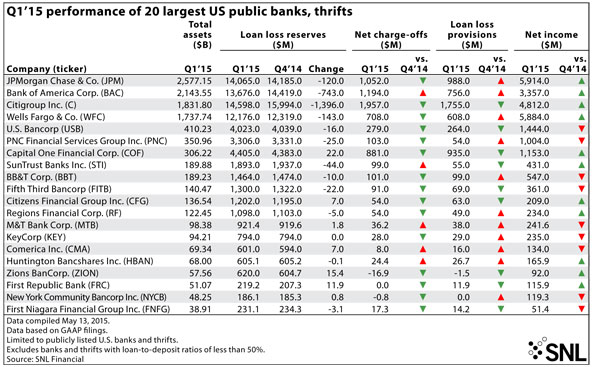

Reserves continued to shrink in the first quarter as credit quality remained strong for the banking industry. Overall, commercial banks, in aggregate, reported a total of $111.80 billion of loan loss reserves in the first quarter, down from $113.00 billion in the fourth quarter of 2014 and $122.88 billion in the first quarter of 2014.

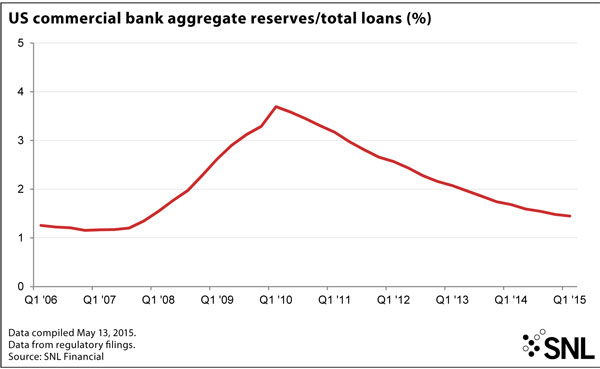

Relative to all loans, the reserves represented a ratio of 1.45%, down from 1.68% a year ago. The ratio of reserves to all loans has been on a steady decline since peaking at 3.69% in the first quarter of 2010, though the level remains higher than the pre-crisis level of roughly 1.20%.

Provisioning was up slightly in the first quarter, increasing to $7.43 billion for the industry, compared to $7.22 billion in the fourth quarter of 2014 and $6.56 billion in the year-ago period. However, outside of the energy sector, there are few signs of credit deterioration, with analysts attributing the uptick in provisioning as simply necessary to keep pace with loan growth.

"Reserve releases are becoming a thing of the past because you can only take your reserve level down so far, and, also, you have to provision for some loan growth," said Frederick Cannon, an analyst with Keefe Bruyette & Woods.

Cannon did say there was a "very select pick-up" in provisioning for banks with significant exposure to the energy sector.

One of the banks with the largest quarter-over-quarter increase in provisioning in the first quarter was Comerica Inc., which does have noticeable oil exposure as a Dallas-based financial institution. The bank set aside $16 million for provisioning in the first quarter, up from $4 million in the prior quarter and $8 million in the year-ago quarter.

During the bank's conference call to discuss first-quarter earnings results, executives declined to break out the reserve ratio for the energy portfolio specifically after providing a total figure of approximately 1.45% for the fourth quarter, other than to say the ratio has increased since then. However, executives did say that the bank has been active in reviewing its energy portfolio and that they have yet to uncover any serious issues.

“As far as the energy services portfolio goes, we've reviewed 50% of the energy services portfolio since the beginning of the year and we've seen some migration in that portfolio, which is not surprising at all," said Pete Guilfoile, chief credit officer for the bank, according to a transcript of the earnings call. "We've downgraded about 50% of the risk ratings we've reviewed in the services area. Only about 10% of those, though, are in the criticized category. We've had no new non-accruals, no new charge-offs."

Further, Guilfoile said later in the call that the bank's review process has not resulted in meaningful redeterminations since nearly exactly half of the portfolio saw loan-to-value ratios increase and the other half saw ratios decrease as part of the process.

Bob Ramsey, an analyst with FBR Capital Markets & Co., was comfortable with Comerica's energy exposure, reiterating a "market perform" rating on the bank in an April 20 note. Ramsey noted that provisioning should continue to increase throughout the year as the bank continues its loan review process. But Ramsey noted that the jump in provisioning expense in the first quarter did not materially impact the bank's earnings, which still fell in line with estimates.

Comerica's provisioning was actually double the level of net charge-offs in the quarter, which put it on the conservative side of provisioning relative to charge-offs among large banks. The median ratio of provisions to net charge-offs for the top 20 banks by assets, excluding those with loan-to-deposit ratios less than 50%, was 92.33% in the first quarter. That figure spiked in 2007 as the credit crisis hit and then dipped well below 100% in 2011 as banks worked through problem loans and were able to release reserves. Prior to the crisis, the figure hovered right around 100%, and KBW's Cannon said he expects the industry to return to that level.

As the industry's provisioning trends return to the pre-crisis norm, Cannon said investors and analysts should expect provisioning to act as a drag to earnings.

"One of our concerns for the industry in terms of improved profitability is that, over the next couple years, unless interest rates increase a lot more than what is indicated by the [Federal Reserve], the increase in provisions could offset the benefits from higher net interest margins," he said.

This article originally appeared on SNL Financial’s website under the title, “Banks continue to increase provisioning modestly.”

Tagged under Management, Financial Trends, Feature, Feature3,