Worth their weight—in gold?

Part 5 of a series: “Human capital metrics” look at employees’ value, not just their cost

- |

- Written by Crowe Horwath Compensation Study

One of the most frequent criticisms about human resource departments is the perception that they tend to focus on administrative details and compliance, rather than taking a more strategic view of an organization’s success. Some of the findings of the 2013 Crowe Horwath LLP Financial Institutions Compensation and Benefits Survey dispels this perception.

Every year Crowe Horwath LLP surveys U.S. financial institutions about salary, incentive, and benefits issues. This article, fifth in a series exploring the 2013 survey findings, focuses on data that confirm the positive contributions human resource departments have made over the past few years. as they helped organizations survive and recover from the economic slowdown.

To demonstrate these contributions, it is necessary to move beyond traditional human resource metrics. Instead, we’ll concentrate instead on measures known as “human capital metrics.”

Human capital versus human resource metrics

The Society for Human Resource Management defines human capital as “the collective knowledge, skills, and abilities of an organization’s employees.” Pioneered in the 1960s by “Chicago school” economists such as Gary Becker and Theodore Schultz, human capital theory advocates the idea that by investing in these employee attributes, organizations can create economic gain.

One critical question, of course, is how to measure that value.

Many traditional human resource metrics—such as head count, absenteeism, and turnover—are essentially measurements of cost, not value. That is, they focus on the costs involved in recruiting, training, compensating, and managing a bank’s workforce.

Human capital metrics, on the other hand, focus on the opposite side of the employer-employee transaction. In exchange for the cost it incurs in employing a worker, what value does an institution receive? Such measures can reflect the immediate bottom-line contribution an employee makes as well as his or her long-term contribution to the overall value of the institution.

By measuring the potential benefits of training, incentives, and other human resource functions—not just the costs—human capital metrics provide tools that track the human resource function’s contribution to the success of the organization and demonstrate the return on investment that this function provides.

Rebound in net income per employee

One very useful human capital metric is net income per employee—how much the average employee contributes to the bottom line. Dividing net income by the total number of full-time equivalent (FTE) staff produces a metric that is consistent and easy to measure and also demonstrates a clear impact on the bank’s financial results.

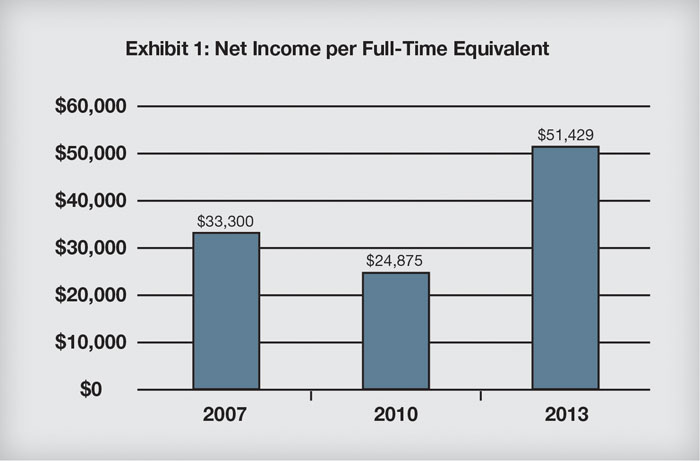

The 2013 Compensation and Benefits Survey illustrates how this metric can be helpful in measuring human resource effectiveness. Exhibit 1 compares net income per FTE in 2013 with comparable figures from the last pre-recession year (2007) and the low point of the recession in 2010.

Among the banks in the survey, average net income per FTE more than doubled from 2010 to 2013. In addition, the 2013 figure is higher—by more than 50 percent—than pre-recession performance.

These results obviously reflect a rebound in profitability stemming from the cleanup of loan portfolios during 2011-2012. In addition, though, these calculations also suggest the industry is making significant strides in using staff more efficiently.

Controlling benefits costs

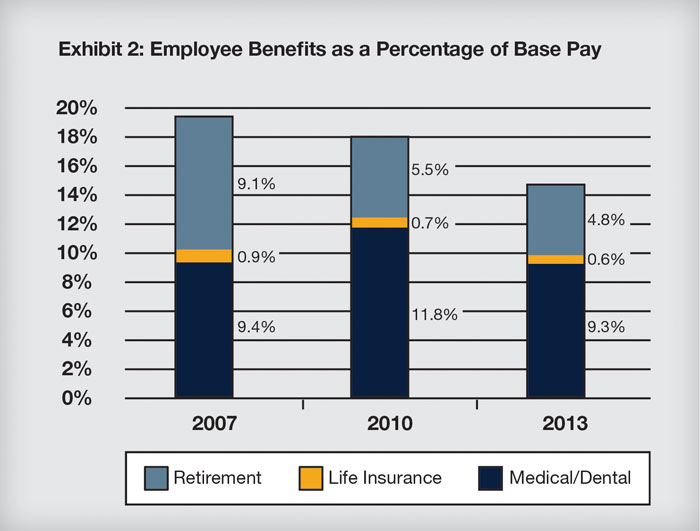

One area in which human resource departments have a direct and obvious financial effect is the management of benefits programs. A comparison of the 2007, 2010, and 2013 surveys (Exhibit 2) indicates that many financial institutions have made sizable reductions in employee benefits costs in recent years.

Survey respondents in 2007 reported their average medical, dental, life insurance, and retirement plan contributions were equal to 19.4% of average cash base pay. That figure dropped to 18% at the bottom of the recession and dropped even further (to 14.7%) as the recovery gained speed.

Some of the decrease might be attributed to cost shifting and uncertainty associated with the implementation of healthcare reform. However, banks’ contributions to life insurance and employee retirement funds have also decreased.

Linking pay to performance

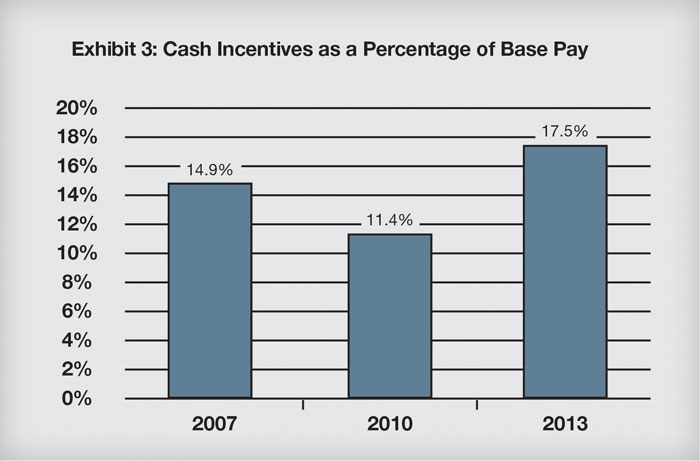

The positive effects of the economic recovery on shareholder value are obvious, but the 2013 survey indicates employees are also experiencing benefits—particularly those employees who demonstrate strong performance. As Exhibit 3 illustrates, incentive payments to employees have rebounded solidly from the lows of the recession.

In addition to reflecting the overall better health of the banking industry, the survey results indicate more institutions are succeeding in linking pay to performance. A shift to greater use of incentive pay is one of the most effective ways to motivate employees, and it helps demonstrate an institution’s willingness to make the human capital investments that are needed to add genuine value.

Making human capital a priority

By focusing on human capital metrics in addition to traditional human resource statistics, human resource professionals not only help demonstrate the value of the human resource function, they also position themselves to play a more strategic role in a financial institution’s overall success. For this reason alone, the development and publication of meaningful human capital metrics should be among the highest priorities of the human resource function in most institutions.

The next article in this series will examine the issue of human resource priorities in more detail, including a look at how to align stated priorities with actions.

Editor’s Note: Bankers will also want to check out ABA’s Compensation and Benefits Survey. Read a summary from Banking Exchange’s “Bank Notes” section here. Contact Mike Mazur, senior manager, ABA Benchmarking Survey Research Group.

Tagged under Human Resources, Management, CSuite, Feature,

Related items

- Banking Exchange Hosts Expert on Lending Regulatory Compliance

- Merger & Acquisition Round Up: MidFirst Bank, Provident

- FinCEN Underestimates Time Required to File Suspicious Activity Report

- Retirement Planning Creates Discord Among Couples

- Wall Street Looks at Big Bank Earnings, but Regional Banks Tell the Story