Can we build a better mousetrap?

6 strategies for community bank success in 2012

- |

- Written by Brad Smith

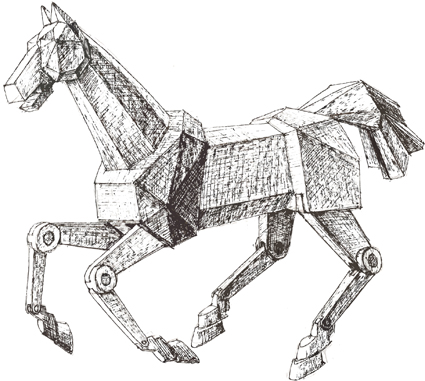

Don’t just build a robot horse, advises strategy 3.

Top concerns for community bankers today are the continued weak economy, anemic loan demand, increased regulatory compliance, and operational efficiency.

No huge surprises there. Each year my firm, Abound Resources, surveys senior executives at community banks across the U.S. about their priorities, plans, and challenges for the upcoming year.

But what do you do about these challenges? Community banks will need to balance growth, efficiency, and compliance. Here are six strategies to help you master that balancing act.

Strategy 1: Improve sales and marketing (finally)

Make a 2012 resolution to improve--really improve--sales and marketing.

Sales has always been a dirty word in community banks. And while a hard-sales approach probably doesn’t fit your brand, it’s likely that turning employees into consultative advisors who serve customers by recommending the right products and solutions does and can differentiate you from the big banks.

On the marketing side, evaluate both what you are saying and how you deliver it. Identify what will make you stand out in a very crowded marketplace. If your message highlights your great rates, great service, and how you love small businesses, you have not yet identified your competitive differentiation, since every other community bank, credit union, and even some big banks say the exact same thing.

What really makes you unique?

Once you’ve honed your message, get the word out. Incorporate many different media. The most effective marketing campaigns use electronic lead generation tools that may include e-newsletters, webinars, Google AdWords, and social media such as Facebook, LinkedIn, and Twitter that complement traditional marketing such as print and radio advertisements.

Make a 2012 resolution to improve--really improve--sales and marketing.

Sales has always been a dirty word in community banks. And while a hard-sales approach probably doesn’t fit your brand, it’s likely that turning employees into consultative advisors who serve customers by recommending the right products and solutions does and can differentiate you from the big banks.

On the marketing side, evaluate both what you are saying and how you deliver it. Identify what will make you stand out in a very crowded marketplace. If your message highlights your great rates, great service, and how you love small businesses, you have not yet identified your competitive differentiation, since every other community bank, credit union, and even some big banks say the exact same thing.

What really makes you unique?

Once you’ve honed your message, get the word out. Incorporate many different media. The most effective marketing campaigns use electronic lead generation tools that may include e-newsletters, webinars, Google AdWords, and social media such as Facebook, LinkedIn, and Twitter that complement traditional marketing such as print and radio advertisements.

Strategy 2: Drive fee income

Over the past several years, our industry became intoxicated on overdraft and nonsufficient funds fee income. As consumer fee income declines, many community banks have become “damsels in distress,” waiting for a new product or service that will rescue them.

But the truth is that there is no slam-dunk new product that will replace lost consumer fee revenue.

And even if a new fee-generating product were to appear, the Consumer Financial Protection Bureau (CFPB) or the court of popular opinion will pounce on it.

Just ask Bank of America or Verizon how new consumer fees worked out for them.

There’s two bright spots for community banks: commercial and industrial (C&I) lending and the small business market.

In addition to great underwriting, the key to growing C&I lending is owning the entire relationship. Since there’s a strong correlation between C&I lending and cash management, make your cash management offering competitive.

The best opportunity for fee income in the small business market is payment services (ACH, cards, and RDC). The good news is that you probably already have most of the products you need. Now tie these products together in a comprehensive package using fundamental sales and marketing techniques: competitive differentiation, target marketing, lead generation campaigns, sales targets, training and coaching, and accountability and incentive rewards.

Over the past several years, our industry became intoxicated on overdraft and nonsufficient funds fee income. As consumer fee income declines, many community banks have become “damsels in distress,” waiting for a new product or service that will rescue them.

But the truth is that there is no slam-dunk new product that will replace lost consumer fee revenue.

And even if a new fee-generating product were to appear, the Consumer Financial Protection Bureau (CFPB) or the court of popular opinion will pounce on it.

Just ask Bank of America or Verizon how new consumer fees worked out for them.

There’s two bright spots for community banks: commercial and industrial (C&I) lending and the small business market.

In addition to great underwriting, the key to growing C&I lending is owning the entire relationship. Since there’s a strong correlation between C&I lending and cash management, make your cash management offering competitive.

The best opportunity for fee income in the small business market is payment services (ACH, cards, and RDC). The good news is that you probably already have most of the products you need. Now tie these products together in a comprehensive package using fundamental sales and marketing techniques: competitive differentiation, target marketing, lead generation campaigns, sales targets, training and coaching, and accountability and incentive rewards.

Strategy 3: Focus on efficiency

In the survey, the CEOs’ number-one cost-savings priority is becoming more efficient. Technology can certainly help drive efficiencies, but the biggest efficiency gains come from streamlining workflows.

Remember the story about two guys in the 1800s that wanted to speed up transportation? Since horse drawn carriages could only travel 6 mph and required stops for rest and feeding, one built a mechanical horse that could go 10 mph and didn’t need to stop.

The other built a train.

A lot of banks add workflow technologies to the new accounts or loan origination process and end up with a mechanical horse. Sure, they get improvements. But to get breakthrough efficiency and customer service improvements, revisit policies to determine if they are driving more work than is needed. Instill a culture that tracks production metrics (loan turnaround times, new account opening error rates). Empower your employees to make decisions.

Proper vendor management can drive efficiencies as well. Although often synonymous with gathering financials and Service Organization Control Reports before examiners visit, vendor management should be a strategic initiative and included in your technology planning (more on this below).

In the survey, the CEOs’ number-one cost-savings priority is becoming more efficient. Technology can certainly help drive efficiencies, but the biggest efficiency gains come from streamlining workflows.

Remember the story about two guys in the 1800s that wanted to speed up transportation? Since horse drawn carriages could only travel 6 mph and required stops for rest and feeding, one built a mechanical horse that could go 10 mph and didn’t need to stop.

The other built a train.

A lot of banks add workflow technologies to the new accounts or loan origination process and end up with a mechanical horse. Sure, they get improvements. But to get breakthrough efficiency and customer service improvements, revisit policies to determine if they are driving more work than is needed. Instill a culture that tracks production metrics (loan turnaround times, new account opening error rates). Empower your employees to make decisions.

Proper vendor management can drive efficiencies as well. Although often synonymous with gathering financials and Service Organization Control Reports before examiners visit, vendor management should be a strategic initiative and included in your technology planning (more on this below).

Strategy 4: Create a technology plan

There’s a disconnect in community banks between what the CEO wants to achieve strategically and what technology COOs, CIOs and CFOs are planning to deliver.

While CEOs told us that they want to use technology to drive efficiencies (think document management and workflow or process automation), COOs, CIOs and CFOs prioritize mobile banking and online account opening--a customer convenience play. This disconnect can be very expensive for the bank--not to mention costly to the COO, CIO, and CFO’s career.

To avoid a disconnect between the CEO and the rest of the C-suite, create a technology plan.

Start with your strategic plan (whether written or in the CEO’s head) and gather input from the business lines and IT about how technology can support the plan. Whittle the list down to the top five technology projects or purchases for the next three years and assign dates, dollars, and accountability to each. Whenever a new technology request is made, refer back to the plan and ask, “Is this request more important than these top five, and if so, which one gets taken off the list?”

The answer becomes straightforward and strategic.

There’s a disconnect in community banks between what the CEO wants to achieve strategically and what technology COOs, CIOs and CFOs are planning to deliver.

While CEOs told us that they want to use technology to drive efficiencies (think document management and workflow or process automation), COOs, CIOs and CFOs prioritize mobile banking and online account opening--a customer convenience play. This disconnect can be very expensive for the bank--not to mention costly to the COO, CIO, and CFO’s career.

To avoid a disconnect between the CEO and the rest of the C-suite, create a technology plan.

Start with your strategic plan (whether written or in the CEO’s head) and gather input from the business lines and IT about how technology can support the plan. Whittle the list down to the top five technology projects or purchases for the next three years and assign dates, dollars, and accountability to each. Whenever a new technology request is made, refer back to the plan and ask, “Is this request more important than these top five, and if so, which one gets taken off the list?”

The answer becomes straightforward and strategic.

Strategy 5: Explore new regulatory compliance models

More than two-thirds (67%) of CEOs said that dealing with regulatory burdens is their top concern in 2012 and it’s no wonder: Regulatory compliance is eating up more time and resources than ever before and the trend shows no sign of abating.

Improve regulatory compliance cost-effectively with two tactics.

First, “bake” compliance and risk management into workflow or efficiency process improvements. For example, when you redesign loan origination, build in controls to capture and resolve exceptions before they become a reporting issue. Pay for an interface to minimize styling differences on legal names. Automatically notify the credit officer if a document is missing before you get to closing.

Second, consider co-sourcing regulatory compliance. Regulators expect you to add staff to stay current with compliance demands but you will never be able to afford the number of experts required. Also, legal and consulting firms are expanding, creating a talent shortage and driving up salaries. Co-sourcing is a cost-effective alternative to building expertise in house. You still own the process (it’s co-sourcing, not outsourcing) but benefit from outside expertise. As an added bonus, examiners look more favorably on independent external reviews.

More than two-thirds (67%) of CEOs said that dealing with regulatory burdens is their top concern in 2012 and it’s no wonder: Regulatory compliance is eating up more time and resources than ever before and the trend shows no sign of abating.

Improve regulatory compliance cost-effectively with two tactics.

First, “bake” compliance and risk management into workflow or efficiency process improvements. For example, when you redesign loan origination, build in controls to capture and resolve exceptions before they become a reporting issue. Pay for an interface to minimize styling differences on legal names. Automatically notify the credit officer if a document is missing before you get to closing.

Second, consider co-sourcing regulatory compliance. Regulators expect you to add staff to stay current with compliance demands but you will never be able to afford the number of experts required. Also, legal and consulting firms are expanding, creating a talent shortage and driving up salaries. Co-sourcing is a cost-effective alternative to building expertise in house. You still own the process (it’s co-sourcing, not outsourcing) but benefit from outside expertise. As an added bonus, examiners look more favorably on independent external reviews.

Strategy 6: Begin the move to enterprise risk management

As many CEOs and boards discovered over the past few years, strong net worth and earnings doesn’t guarantee careful risk management. You’ll need to ramp up risk management and get a holistic view of risk across the enterprise.

Determine how much risk your bank should, must, and can afford to take to reach its strategic business objectives and prepare a comprehensive enterprise-wide “risk appetite” statement. For example, calculate best, expected, and worst-case loss scenarios based on planned loan types and amounts. If you don’t have sufficient net worth to absorb the possible worst-case scenario, rethink your strategy.

Once you have a risk appetite statement, translate it into specific and measurable risk guidelines by specific industry, geography and lending type and track key leading indicators such as loans made as exceptions to credit scores or policy guidelines rather than lagging indicators such as past dues.

If employment is a significant risk to your portfolio, track the employment rate in your area.

If your risk guidelines set a limit for member business loans as a percentage of new worth, track that. Consider tracking the dollar-weighted risk grades of loans in particular segments to look for signs of deteriorating quality.

View vendor demonstrations of enterprise risk management (ERM) systems that automate risk assessments, create audit reports and track audit findings. Although these systems are still evolving, you can learn a lot about the concepts of managing enterprise-wide risk from vendors even if you’re not ready to buy a system.

As many CEOs and boards discovered over the past few years, strong net worth and earnings doesn’t guarantee careful risk management. You’ll need to ramp up risk management and get a holistic view of risk across the enterprise.

Determine how much risk your bank should, must, and can afford to take to reach its strategic business objectives and prepare a comprehensive enterprise-wide “risk appetite” statement. For example, calculate best, expected, and worst-case loss scenarios based on planned loan types and amounts. If you don’t have sufficient net worth to absorb the possible worst-case scenario, rethink your strategy.

Once you have a risk appetite statement, translate it into specific and measurable risk guidelines by specific industry, geography and lending type and track key leading indicators such as loans made as exceptions to credit scores or policy guidelines rather than lagging indicators such as past dues.

If employment is a significant risk to your portfolio, track the employment rate in your area.

If your risk guidelines set a limit for member business loans as a percentage of new worth, track that. Consider tracking the dollar-weighted risk grades of loans in particular segments to look for signs of deteriorating quality.

View vendor demonstrations of enterprise risk management (ERM) systems that automate risk assessments, create audit reports and track audit findings. Although these systems are still evolving, you can learn a lot about the concepts of managing enterprise-wide risk from vendors even if you’re not ready to buy a system.

A word about the “mood”

As a final note, the CEOs responding to our survey are generally optimistic about the future at the same time they understand that they won’t be able to rely on business-as-usual practices. Instead, they’ll need to find ways to drive fee income, improve sales and marketing, align technology purchases with strategic objectives and explore new models of cost-effective compliance. There may be some hard work ahead, but we agree that the future is bright for community banks and their customers.

As a final note, the CEOs responding to our survey are generally optimistic about the future at the same time they understand that they won’t be able to rely on business-as-usual practices. Instead, they’ll need to find ways to drive fee income, improve sales and marketing, align technology purchases with strategic objectives and explore new models of cost-effective compliance. There may be some hard work ahead, but we agree that the future is bright for community banks and their customers.

About Brad Smith

Brad is co-founder and president of Abound Resources , an advisory firm helping community banks make the right growth, cost, and technology decisions. For more information, click here. To download the entire white paper with detailed survey results, please click here.

Brad is co-founder and president of Abound Resources , an advisory firm helping community banks make the right growth, cost, and technology decisions. For more information, click here. To download the entire white paper with detailed survey results, please click here.

Tagged under Management, Duties, Community Banking,

Related items

- Wall Street Looks at Big Bank Earnings, but Regional Banks Tell the Story

- CFPB’s Auto Finance Data Collection Proposal Faces Backlash

- JP Morgan Drops Almost 5% After Disappointing Wall Street

- Banks Compromise NetZero Goals with Livestock Financing

- Consumers Seek Increased Online Safety Training from Banks