JP Morgan Drops Almost 5% After Disappointing Wall Street

"we remain alert to a number of significant uncertain forces"

- |

- Written by Banking Exchange staff

While JP Morgan profit rose 6% with its 2023 First Republic takeover being the catalyst, Wall Street punished one of the nation’s largest banks.

The bank said that the net interest expectation was $90 billion despite credit costs and trading revenue surpassing expectations. Profits were about $13.42 billion and revenue increased by $42.55 billion.

Higher interest rates helped keep profit high. Still, large banks are still expected to outperform community banks in 2024 due to various pressures including profits being diminished by costs, interest rate fluctuations and commercial loan losses.

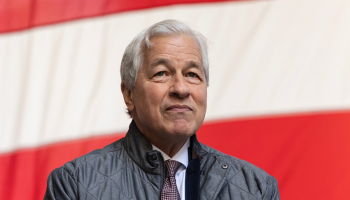

Jamie Dimon stated, “Many economic indicators continue to be favorable. However, looking ahead, we remain alert to a number of significant uncertain forces”.

Dimon repeated his previous concerns about global instability, even as Iran threatens to strike Israel.

Tagged under Risk Management, The Economy, Feature, Feature3, Management,