Bond portfolios submerge in Q4

SNL Report: Paper loss compares to gain year earlier

- |

- Written by SNL Financial

By Harish Mali and Nathan Stovall, SNL Financial staff writers

Banks saw their bond portfolios move underwater in the fourth quarter.

As long-term interest rates rose and closed 2013 at levels not seen since the summer of 2011, many banks saw values in their bond portfolios come under pressure and fall into the red. U.S. commercial banks reported net unrealized losses in the portfolios of $7.44 billion at the end of the fourth quarter, compared to net unrealized gains of $1.17 billion in the prior quarter and $3.07 billion at the end of the second quarter.

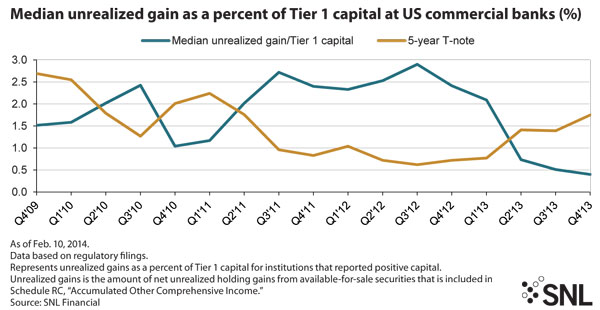

Unrealized gains washed away as the yield on the 10-year Treasury increased 40 basis points in the fourth quarter, closing the year at 3.04% compared to 2.64% at the end of the third quarter, while the yield on the 5-year Treasury rose to 1.75% at the end of the fourth quarter, up 36 basis points from the linked quarter.

Ups and downs in portfolios

Long-term rates began rising off historic lows in the late spring and early summer and many banks saw higher rates as an opportunity to put funds to work at higher yields, particularly late in the second quarter and early in the third quarter. Purchases of rate-sensitive bonds have likely come under pressure since then, with long-term rates rising close to 100 basis points since the end of the first quarter.

The Federal Reserve's H.8 data—which tracks asset and liability balances at commercial banks, excluding international banking facilities—show that those banks in aggregate actually began reporting net unrealized losses in July. Net unrealized losses in banks' bond portfolios eventually exceeded $10 billion in August, according to the Fed’s data, only to come back down to below $5 billion as the end of the third quarter approached. The banking industry as a whole, though, when including international banking facilities, still managed to report unrealized gains in aggregate at the end of the third quarter.

Long-term rates stabilized and then fell again in October and unrealized losses at commercial banks fell to below $1 billion at the end of the period. However, the tide turned again in the coming months. Unrealized gains turning into sizable losses in December, when the yield on 5-year Treasury rose close to 40 basis points and the yield on the 10-year Treasury climbed close to 30 basis points.

With the industry reporting balances in the red, many banks finished 2013 with net unrealized losses in their available-for-sale investment portfolios.

Assessing potential Basel III impact

Under the final Basel III rules, changes in accumulated other comprehensive income, or AOCI, which captures unrealized gains and losses of banks' available-for-sale securities, will flow through regulatory capital. Banks with more than $250 billion in assets will be subjected to the rule, while smaller institutions will have the opportunity to opt out of the provision. Banks looking to opt out of the provision must make that election during the first call report they file after Jan. 1, 2015.

Many observers believe most banks will choose to opt out of the AOCI provision because the inclusion of unrealized gains and losses in recent years would have added significant volatility to banks' capital ratios. Market watchers will have to wait to see how the process progresses and whether or not the investment community's preference to compare all banks, large and small, on an apples-to-apples basis, plays a role in smaller institutions' decision to opt out of the provision.

The inclusion of unrealized gains and losses in regulatory capital ratios would have inflated banks' capital levels for much of the last few years, but the tide is showing signs of turning with long-term rates rising off the lows. SNL found that banks would have experienced an increase of 2.02% in their Tier 1 capital on a median basis over the last 17 quarters beginning in the fourth quarter of 2009, according to SNL data. In the fourth quarter of 2013, though, the median level of unrealized gains would have increased banks' Tier 1 capital by 40 basis points.

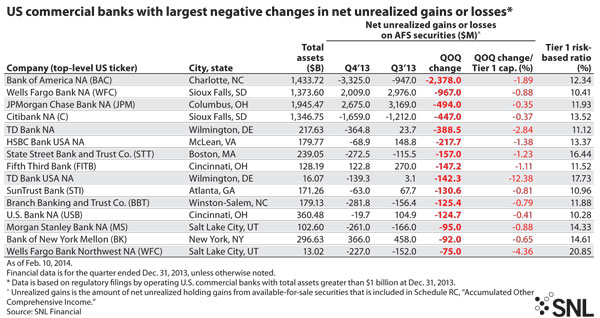

More than a handful of banks reported negative changes in unrealized gains or losses in their portfolios in the fourth quarter, even as the overall size of the portfolios held fairly steady when compared to the prior quarter. Bank of America Corp. unit Bank of America NA reported the largest, negative dollar change in net unrealized gains or losses in its available for sale portfolio, disclosing $3.33 billion in net unrealized losses in the fourth quarter, compared to $947.0 million in net unrealized losses in the third quarter.

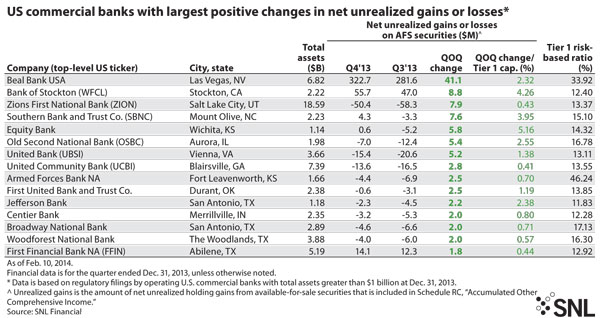

Even as interest rates rose in the fourth quarter, some banks reported positive changes in the level of unrealized gains or losses in their portfolios in the period. However, many of those same institutions still disclosed that their portfolios stood in an unrealized loss position at the end of the fourth quarter despite the positive change.

For example, Zions Bancorp. unit Zions First National Bank reported a $7.9 million positive, quarter-over-quarter increase in the value of unrealized gains and losses in its investment portfolio in the fourth quarter. However, the company disclosed that it had $50.4 million in net unrealized losses at the end of the period, compared to $58.3 million at the end of the third quarter.

Looking ahead to the Volcker Rule

However, some extraordinary items impacted the value of Zions' portfolio. The initial Volcker Rule's prohibition on CDOs backed by trust preferred securities prompted the company to announce plans to reclassify all of covered CDOs in its held-to-maturity portfolio as available-for-sale, which would have resulted in a sizable charge to earnings.

After regulators issued an interim final Volcker rule, allowing for banks to hold many TruPS CDOs, Zions said it would not take the previously disclosed impairment charges, but did plan to sell a portion of its total CDO portfolio. Zions later reported a positive change in net unrealized losses when reporting its fourth-quarter earnings and said the "primary" improvement came from its recognition of unrealized losses on CDO securities and an increase in fair value on CDO securities.

The Volcker rule could impact banks' investment portfolios again in the future as it prohibits institutions from holding many collateralized loan obligations, or CLOs.

Under the Volcker rule, banks will have to dispose of prohibited CLOs by July 21, 2015, unless, upon application, the Federal Reserve grants extensions to July 21, 2017.

Banks held close to $70 billion in CLOs before the Volcker Rule's prohibition on many of the instruments surfaced and three institutions—JPMorgan Chase & Co., Wells Fargo & Co., and Citigroup Inc.—owned 73.7% all of the CLOs outstanding in the banking industry. CLOs did make up sizable portions of more than a handful of banks' investment portfolios beyond the three largest holders of the assets.

Looking ahead for 2014

Many bank investment portfolios might sit in a more favorable position today than the level reported in the fourth quarter given the recent move in interest rates. Long-term rates have actually declined early in 2014, with the yields on the 5-year and 10-year Treasury falling 21 basis points and 29 basis points, respectively, since the end of 2013.

If those rates hold through the end of the first quarter, banks just might see their portfolios return to or at least close to positive territory.

Tagged under Management, Financial Trends, Risk Management, Rate Risk, Bank Performance, Performance,