Cloud: A Business Strategy for the Future of Banking

Cloud technology has the banking sector firmly in its sights, and the industry can no longer ignore the opportunity

- |

- Written by David Rimmer, Research Associate at Leading Edge Forum

A peculiar discovery of Clayton Christensen, the pioneer of innovation theory, was that disruptive technologies “introduce a very different package of attributes from the one mainstream customers historically value, and they often perform far worse along one or two dimensions that are particularly important to those customers.” For instance, the picture quality of early digital cameras was poor, though they made up for this by dispensing with film. Photography buffs did not see the point and dismissed the innovation.

The same pattern occurred with the public cloud. When AWS first commercialized public cloud services, the offering was confined to Infrastructure-as-a-Service (IaaS). Developers were delighted. They saw that they could spin up infrastructure really fast without waiting for procurement, delivery and installation of a physical kit. IT infrastructure managers, with their ‘operations goggles’ on, could only see the deficiencies of cloud – such as the risks of moving data outside a data center. The features that they wanted applied to run, not change.

This failure to see cloud for what it is and what it offers is being repeated, though now it is because cloud computing itself has evolved. First, many of the features that (to some) were lacking in IT infrastructure services have been added (for example, on-premises and in-region compute to address concerns about the location of data processing). Next, services have been provided for developers to build systems designed to exploit the flexibility of cloud – so-called cloud-native applications.

Perhaps more significantly, a vast range of business value-adding components are now being added, making possible a further step, the construction of cloud-native business capabilities, where from Day 1 a new business capability is conceived and designed on the basis of exploiting components from the cloud. This has the potential to make a strategy for cloud much more than an IT strategy – it can be a business-shaping strategy.

Why a strategy for cloud is a business-shaping strategy, not just an IT strategy

Cloud today is as much about delivering business capabilities as it is about IT. The hyperscalers are rapidly building out the range and number of services that they offer. For instance, at the end of 2017 AWS offered around 90 services; today the number is 225. Although the hyperscalers continue to extend their infrastructure and developer portfolio, the crucial departure from around 2017 onwards has been the addition of value-adding business components.

In particular, the hyperscalers are building specialist services targeted at the major technology trends – for example: blockchain, Internet of Things, edge computing, immersive real-time experiences through 5G, streaming and visualization, machine learning and artificial intelligence, unstructured data extraction and analysis, digital identity management, marketing analytics and automation.

The hyperscalers are also adding industry-focused solutions – for instance in banking: fraud APIs, payment services, financial data services and solutions optimized for specific core banking systems. Yet for many this mental transition has not yet been made, with people continuing to think that cloud is all about IaaS, when today it is as much about business components, and, in future, this will be even more so, especially since the vast revenues (over $18bn in Q1 2020) of the hyperscalers give them huge scope for investment.

Indeed, if we look beyond the hyperscalers then we see a whole range of specialist firms that now provide componentized business services via the cloud – for example, in banking: know-your-customer, anti-money laundering, payments and clearing. Through this evolution of technology, enterprises have the potential to turn from being builders of IT systems to assemblers of business capabilities.

What differs here from the traditional software model is that these components are pay-per-use, scalable and designed for interoperation with countless other components. This flexibility and the options created give banks freedom: freedom to experiment, freedom to scale, and freedom to configure and create distinct products and services.

How can cloud be used by banks to help drive business strategy and support banking innovation?

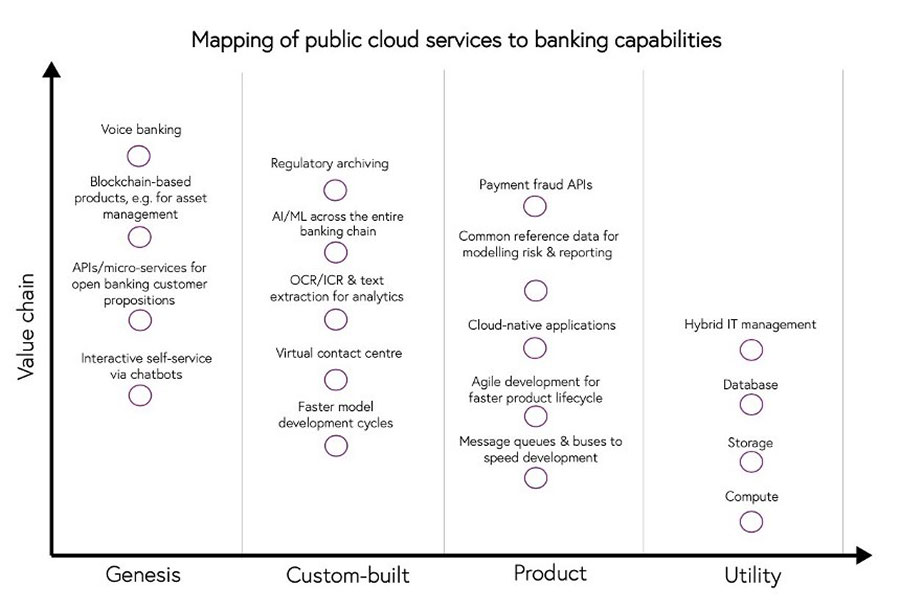

A Wardley map is a valuable aid in developing a strategy that makes optimal use of external capabilities and focuses a bank’s resources on the areas that will deliver the greatest return. It shows the structure of a business or service, mapping the components needed to serve the customer or user on two axes. The vertical axis reflects the degree to which a capability adds value to end customers (say, in commercial industries through new products and services); the horizontal shows the evolution of technology as it passes through stages from genesis, to custom-built, product and commodity/utility.

In the Wardley map below for the banking industry we have picked out just a fraction of the public cloud services now available to illustrate how these can directly transform customer products and services, or provide capabilities for internal customers (developers, data scientists, UX designers, analysts, etc.) to create transformed products and services.

What does this look like in practice?

Following is an example of how cloud services can be assembled to deliver cloud-native business capabilities in the banking environment.

The Fundamental Review of the Trading Book (FRTB) is a set of rules, introduced under Basel III, to standardize the treatment of market risk and impose stricter capital requirements. In order to comply with FRTB, the main steps that banks need to take are develop enhanced risk models; populate models with bank positions and market data, such as prices and credit ratings; and runthe models.

Banks can assemble capabilities from the cloud to meet FRTB in a faster and more effective manner than is possible using traditional solutions:

- Faster model development cycles allow “strats”and “quants”to tune their models to reduce the amount of capital that the bank needs to hold.

- Common real-time reference data removes the need for the disparate reference data and interfaces to be found in most banks. The result is reduced cost, less complexity and standardization between different parts of the bank.

- Since FRTB requires an increase in the number of models and their complexity, greater compute capacity is necessary (some experts project a twenty-fold increase). Moreover, risk models are run only on an occasional basis to provide internal and regulatory reports, the burst capacity of cloud compute is a natural fit for running FRTB models. In contrast, traditional infrastructure would be sized for the peak, with substantial capacity remaining idle for most of the time.

By adopting a cloud delivery model to address FRTB, banks not only minimize their upfront investment and speed implementation, but going forward have greater flexibility, with ability to scale to meet new demands and capitalize on future investment by the cloud providers in model development and data services.

All this potential to exploit cloud for new products and services comes with a colossal proviso. Today’s catalogue of public cloud solutions can make a direct contribution to new products and services, but fundamentally what they offer is a basket of much more sophisticated components. These components still have to be assembled and configured. Business capabilities have to be built: processes redesigned, staff trained in new skills, culture aligned, new KPIs put in place, new organization structures set up. Of course, for anyone with experience of business transformation this is no surprise.

At this point it is clear that the transformation from build to assembly is of such a wide-ranging and fundamental nature that the active intervention of CEOs, COOs, CFOs and other business leaders is essential.

So how can banks best move forward?

Success in driving a cloud business strategy (as opposed to a cloud IT strategy) entails major changes. Following are questions that banks should address:

- What are the new products and services that will add most value to our internal and external customers?

- Which components are available from the cloud to support new products and services?

- How does the map look for each of the hyperscalers – they each have very different strengths and strategies – and which will provide the best fit for our business?

- How many cloud providers will we use? Will we go deep with one to drive fast and transformational change? Or will we partner with several to tap into different streams of innovation and maintain leverage in negotiations?

- In which areas will we want to devote our own resources to custom-build differentiating capabilities that cannot be sourced from elsewhere?

- Where will we use partners to assemble and manage cloud components because they bring distinct experience and skills?

- What changes are required in our bank’s operating model to take advantage of potential to build cloud-native applications and assemble (rather than build) cloud-native business capabilities?

- And of course, where do we begin?

An opportunity that can’t be ignored

Banks that can crystalize a strong cloud strategy, and act on the business transformation needed to make it a reality, will open up the potential for market leading competitive advantage that allows them to build new products and services, and replace aging infrastructure. They will be able to do this at speed, responding to market demands, and with low technical, regulatory and financial risks. The cloud has decided it is ready for banking, now the banks need to decide whether they can really afford to ignore the opportunity.

David Rimmer is a Research Associate at Leading Edge Forum

Tagged under Technology, Outsourcing/Cloud, Core Systems, Tech Management, Mobile, Online, Feature, Feature3,