Disclosing APY in tiered CD ads

Stay in compliance as competition heats up

- |

- Written by Michael Prince, BKD, LLP

Tiered CD programs require a bit more effort on the compliance side.

Tiered CD programs require a bit more effort on the compliance side.

As banks look for more creative ways to increase deposit holdings, there’s been an uptick in tiered certificates of deposit (CD) during deposit compliance reviews. Since these accounts are making a “comeback,” here’s a quick review to help with compliance with the advertisement requirements.

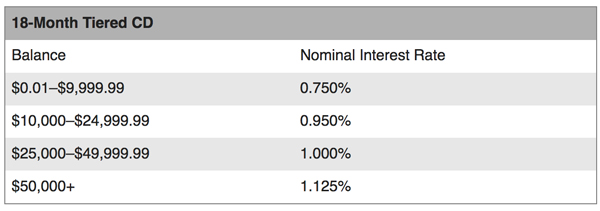

Before going into the exciting compliance and regulation jargon, it’s important to illustrate a tiered CD account. Start with the assumption your bank wants to offer a CD with the following tiers:

Other relevant terms include:

• Interest is assumed to remain on deposit until maturity.

• The daily balance computation method is used to calculate interest.

• Interest is compounded monthly.

• Each year is assumed to have 365 days.

The advertising requirements outlined under Official Commentary to 1030.8(b)—Regulation DD (Truth in Savings Act) specify the following:

“An advertisement for a tiered-rate account that states an annual percentage yield must also state the annual percentage yield for each tier, along with corresponding minimum balance requirements. Any interest rates stated must appear in conjunction with the applicable annual percentage yields for each tier.”

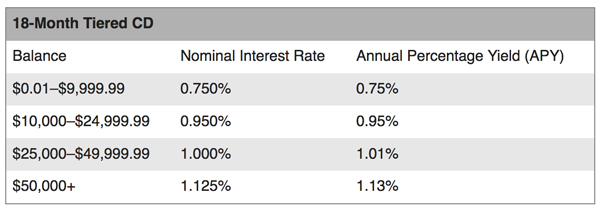

Therefore, an advertisement for the 18-month CD should look similar to the table below:

The above APY disclosures can be verified using the Office of the Comptroller of the Currency’s APY calculation tools.

Since the ad states the APY, keep in mind the following items also would need to be disclosed:

• Variable rate—If applicable, a statement that the rate may change after the account is opened.

• Time APY is available—The period of time the APY will be offered, or a statement that the APY is accurate as of a specified date.

• Minimum opening deposit—If the minimum balance to open the account is larger than amounts disclosed to obtain the APY, the minimum balance needs to be disclosed.

• Effect of fees—A statement that fees could reduce earnings.

• Term—The length of the CD term until maturity.

• Early withdrawal penalties—A statement that penalties will/may be imposed for early withdrawal.

• Interest payouts—If required, for noncompounding accounts with a stated maturity greater than one year, a statement that interest can’t remain on deposit and payouts of interest is mandatory. Note that in our example above, interest is assumed to remain on deposit until maturity.

Using this information can help you in disclosing tiered CD accounts in your advertisements.

About the author

Michael Prince is managing consultant, financial services, at BKD, LLP.

Tagged under Retail Banking, Compliance, Compliance Management,