Why we are stopping our marketing

... for November and December, that is. Don’t waste your dollars this time of year

- |

- Written by Chris Nichols

Yearend is a bad time to invest in marketing, but ROI on marketing dollars rises in January.

Yearend is a bad time to invest in marketing, but ROI on marketing dollars rises in January.

The reality is that the last two months of the year are among the worst to market a bank brand or product.

People don’t seem to care. And with all the retailers running ads for the holiday season, advertising is crowded and expensive.

This is why we dramatically reduce marketing for the last two months of the year.

However, that doesn’t mean our marketing efforts are on autopilot.

It so happens that January is one of the best times of the year, so it behooves every bank to put all their efforts into opening with a bang in the New Year. I’m going to share some of my bank’s own data below and provide some ideas on how to take advantage of these trends to make your marketing efforts more efficient.

“January Effect”

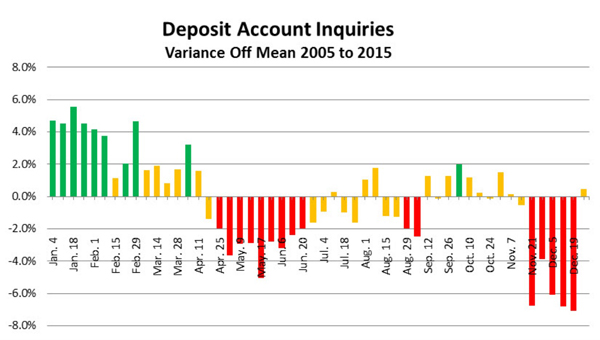

The first two weeks in January makes an excellent time to market and convert customers. As the chart below shows, both inquiries and account openings are strong.

Why? The first five weeks of the year is a time when many households and businesses start to execute on their New Year’s resolutions, getting their proverbial financial house in order.

Bank switching is at its high, as is new account opening for things like 401Ks, 529 college savings plans, health savings accounts, checking, and savings.

The digital effect

The second interesting aspect that the above data shows is that the January Effect is more pronounced than as it has been in past years.

This is due to two factors.

One is that with the rise of mobile banking, we find more customers doing research on both banks and products on their phones. In 2016, for example, a record 36% of customers and potential customers accessed our website via phone. This is more than just cannibalization of desktop search. It represents an expansion of research by both consumers and businesses.

Another driver of the digital January Effect is the fact that more banks have online account opening capabilities, so weather becomes less of a factor. When a potential customer does his or her research online, they can now shorten the conversion time cycle and go right to the bank of choice and open an account online.

Weather, it now seems, presents less friction.

To that point, 2015 marked the first year that “online” appears in the top five search terms in most every major category. Thus, not only do potential customers want to research savings or checking accounts, but they are now specifically looking for “online savings accounts” and moving directly to opening them online. This trend has served to amplify the January Effect.

Other actionable takeaways from the data

In addition to the above, here are ten other items from the decade of data that we have collected that every bank manager and marketer should know:

1. Taxing time to market. Next to November and December, the post-tax time period between mid-April through mid-June is the next worst time to market deposit products.

2. January prompts retiring thoughts. Retail customers are very sensitive (and responsive) to anything having to do with retirement in January.

3. Consider HSAs. Marketing health savings accounts (HSA) is a bank’s best marketing return on investment.

Not only are customers responsive, but few banks offer HSAs, so you stand out. If you are going to market your accounts, it is best to market in February to new customers and October for existing customers (reminding them of the account and how to use it).

4. Checking outmoves savings. It is 26% more effective to market a checking account than a savings account.

5. Savings outmoves MMDAs. It is 20% more effective to market a savings account over a money market account.

6. MMDAs outflank CDs. It is 50% more effective to market a money market account over a certificate of deposit (CD).

7. CD marketing only pays one way. Unless you are marketing on rate, CDs are one of the worst marketing investments you can make of any major deposit account category.

8. “Free” and promo rates still sell. Customers are very responsive to any account that is “free” and any rate promotion.

Bucking the trend

One notable exception to the lull in bank interest in November and December is Fifth Third Bank” #Banklove campaign.

This campaign revolves around all the ways customers love the bank. Centerpiece of the effort is a singing comedy duo that sings tweets and Facebook postings of thanks from Fifth Third fans.

The effort is well done and was specifically design to boost engagement during this seasonal lull.

We are not convinced that the campaign will be able to cut through the clutter. However, we agree that if any campaign stands a chance of making a difference around the holidays, it is one that is centered on love—even bank love.

Putting data into action

It is important to remember that marketing responsiveness varies by customer base and geography. This is why it is important for every bank to experiment, record, and analyze their own data in order to improve their return.

In general, banks can make better use of their marketing efforts by frontloading their budget during the first quarter of the year and then going dark through the “red times” highlighted on the chart.

Marketing specific products like HSAs, free checking, interest checking, business checking, and any account that you can open online (if you have the capabilities) is usually your best deposit account marketing return on investment.

Over the next couple weeks, my LinkedIn blog will be looking at marketing mortgage, commercial loan, and fee lines of business.

Until then, one more major insight to ponder—marketing ROI and interest rate movement are positively correlated.

That is, when rates rise, consumers and businesses are more responsive to deposit account marketing.

Given that the Fed is likely to raise rates soon, after nearly nothing for seven years, January could be the best time in more than a decade to market your deposit products.

You should get your campaigns ready.

This article is adapted from Chris Nichol's blog on LinkedIn.

Tagged under Retail Banking, Customers, Feature, Feature3,