How to keep ALCO well-tuned

Harmony and execution in pricing decisions require balanced assessment

- |

- Written by Neil Stanley, The Corepoint

When a guitarist tunes his instrument, all the strings get checked. So too each element of the ALCO's responsibility must be harmonized, says The Corepoint's Neil Stanley.

When a guitarist tunes his instrument, all the strings get checked. So too each element of the ALCO's responsibility must be harmonized, says The Corepoint's Neil Stanley.

Clearly and consistently navigating the route to optimized future balance sheets and income statements is the responsibility of the Asset-Liability Management Committee. Effective ALCO meetings can be some of the most dynamic and participatory events in a bank when a practical, efficient, and effective process is used to create harmony and execution in optimizing ALCO loan and deposit pricing decisions.

Pricing managers recognize that pricing affects revenue in two ways:

• A higher sales price increases the revenue on the realized business, while making the sale more difficult.

• A lower sales price tends to increase the likelihood of the sale while reducing the profitability of any sales achieved.

This conundrum often discourages those without an effective framework to anticipate and properly deal with key decisions. High-performance pricing managers have learned how and where to make optimal pricing adjustments. They do so through the following process.

Finding the right price points

The process begins with the recognition that price is a major factor both in volume and in interest spreads and that the combination of volume and interest spread produces profits. So, price is ultimately a primary determining factor of profit.

Simple enough. The harder part to understand and apply is that some pricing increases cause improved performance, while other pricing increases diminish performance.

For example, ALCO could decide to raise loan rates. It’s always profitable to increase the price of a loan—if nothing else changes as a result. But customer behavior in response to an increase in loan rates—such as deciding to go elsewhere for the loan or deciding not to borrow—could reduce the bank’s revenue and overall profitability.

Every pricing adjustment tends to produce a combination of results. We like improved revenue from higher profit margins, but dislike the lower volumes likely to result from the price increase that created them.

ALCOs must continuously work diligently to create and maintain margins and liquidity. But often it’s less intuitive to many others in the bank that ultra-high margins and liquidity are undesirable.

Excessively high margins drag down performance because they inhibit new business. In addition, they tend to create adverse selection, attracting undesirable credit quality. Ultra-high liquidity is also detrimental, because it represents untapped opportunity for serving more customers and growing the balance sheet and improving the income statement.

ALCO can decide to take either side of the balance sheet components in either direction regarding pricing. The committee can increase loan rates, decrease loan rates, increase deposit rates, or decrease deposit rates. At today’s extreme liquidity and margin conditions only one of these four options is beneficial.

Using a schematic for assessment

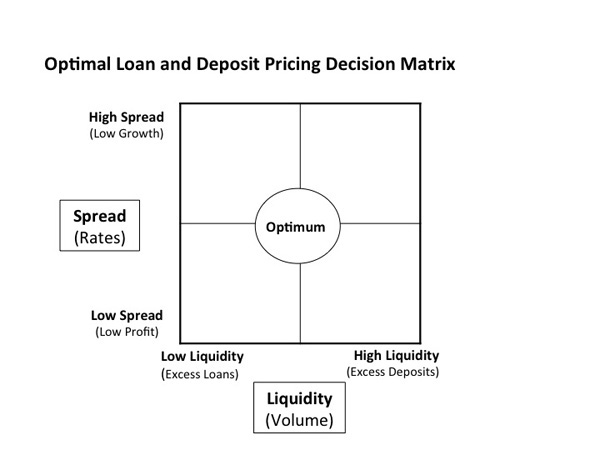

To be effective, the process begins with an assessment of the situation. The following graphic is posted and participants are asked to plot their general assessment of the current state and trend of the organization’s relative margin and liquidity position on it.

Consider an extreme case—the corners of the graphic, where liquidity and spread are either very high or very low. At these extreme positions on the chart, only one thing can be done to improve both spread and liquidity at the same time.

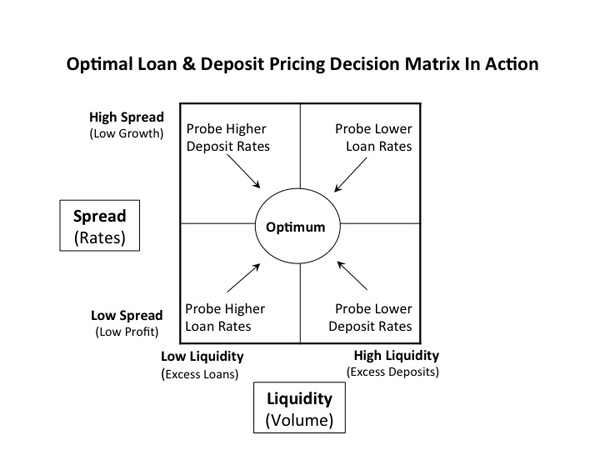

You can see what action is indicated by each position marked in the graphic below.

In working the process, we might find, for example, that we’re in the middle of the top right quadrant of the graphic. This should lead to exploring the impact of lowering loan rates. But if we find the bank is off to the right, but neither at top nor bottom, we should lower both loan and deposit rates.

Why? If they are lowered together, spread is maintained and the bank will move from high liquidity to more normal liquidity.

Building on the principles

With these perspectives ALCO can appropriately adjust for the relative impact of the “good” and “bad” on margins and volumes.

This means, for example, that the “bad” associated with lower margins can, under the right circumstances of liquidity, be more than offset by the “good” associated with growing the volume of business and serving more customers.

So, the net impact of pricing adjustments is clearly situational. We can determine the proper direction of pricing adjustments only after we correctly assess our current liquidity and margin positions.

Creating clarity of the required decisions based on the margin and liquidity situation means that ALCO need only debate the relative position and momentum of these factors. Then the process can drive the appropriate optimal decision.

From the resulting mutual assessments, senior management is often completely informed and united in the view that the resulting ALCO pricing initiative(s) are appropriate. The transparency and collaborative nature of this process produces many benefits.

Benefits of this approach

An ALCO that adopts this way of looking at pricing will find that it:

• Sets the expectations of a dynamic ongoing process.

• Transforms ALCO into a collaborative decision making body.

• Uses objective and subjective information to define the current situation and momentum.

• Uses fundamentally sound analyses to determine what direction and velocity is needed.

• Reduces resistance as it provides a forum for talking about outlier assessments.

• Develops a united awareness and effort unleashing the team’s collective energy and potential.

About the author

Neil Stanley is founder and CEO of The CorePoint, Omaha, Neb. His firm offers a web-based retail deposit pricing and sales platform and performance analytics. Stanley is also president of Community Banking at TS Banking Group, Treynor, Iowa. He can be reached at [email protected]

Tagged under Bank Performance, HowTo, Community Banking, ALCO, Feature, Feature3,