5 ways to get your game back

Do banks satisfy customers? Disconnect between what banks and customers think

- |

- Written by Website Staff

Banks can regain their position at the center of evolving financial ecosystems—overseeing and orchestrating a broad range of best-in-class services for their customers, according to Stuart Bilick, global banking industry market segment manager, IBM, in a recent company blog.

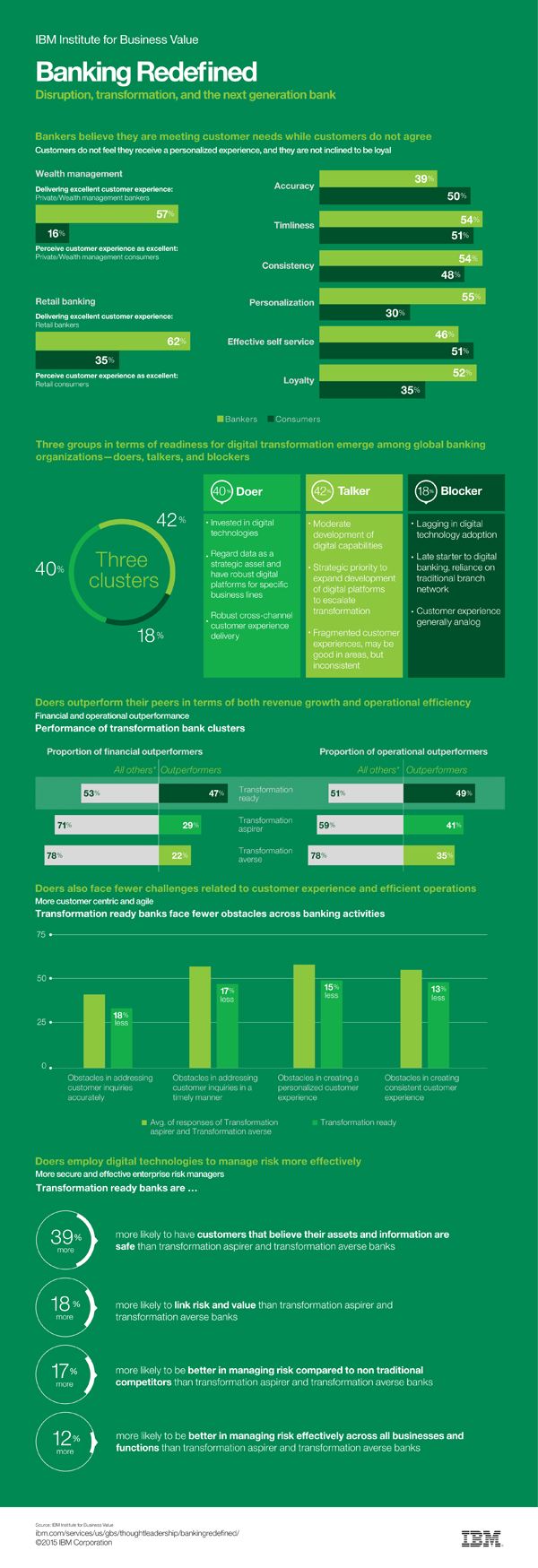

That’s important, because IBM research indicates a disconnect: While bankers generally believe they currently meeting customer demands, a majority of customers disagree.

5 key strategies

Bilick’s blog is based on a report drawing on insights from 1,060 banking executives and 1,600 retail banking and wealth management customers. The report suggests that by embracing five principal capabilities, traditional banks can accelerate the changes they must make to prepare for ecosystem leadership, says Bilick:

1. Partnering: Making partnering and collaboration a core business capability across the organization.

2. Agility: Adapting rapidly and cost effectively to change.

3. Analytics: Applying predictive analytics based on big data and cognitive computing, in particular, will enable banks to deepen and scale workforce capabilities.

4. Digitization: Becoming digitally integrated, but also open to flexibly connect and interact with partner organizations.

5. Risk management, compliance, and security: Incorporating enterprise risk management, already a key concern, will only grow more important.

“Banking executives and employees must recognize that transformation will be a permanent condition, with change the only constant,” writes Bilick. “Those organizations that cannot adapt quickly enough will face marginalization and decline.”

Read Bilick’s complete blog here

Read IBM report, Banking Redefined: Disruption, Transformation, And The Next-Generation Bank

Tagged under Management, Duties, Technology, Feature, Feature3,