Pushing for credit momentum

SNL Report: Loan growth remains challenge for community banks

- |

- Written by SNL Financial

SNL Financial is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the subscriber side of SNL Financial's website.

SNL Financial is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the subscriber side of SNL Financial's website.

By Ken McCarthy and Razi Haider, SNL Financial staff writers

Loan growth for U.S. community banks continued to be less than stellar in the third quarter of 2015, although banks in the western states continued to outpace those in other regions of the country.

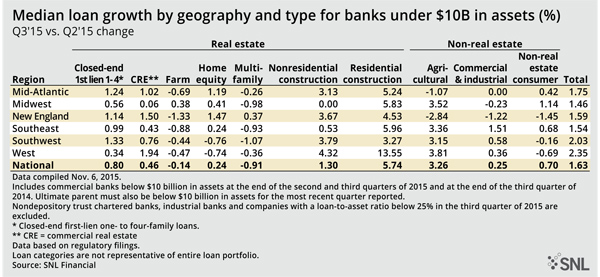

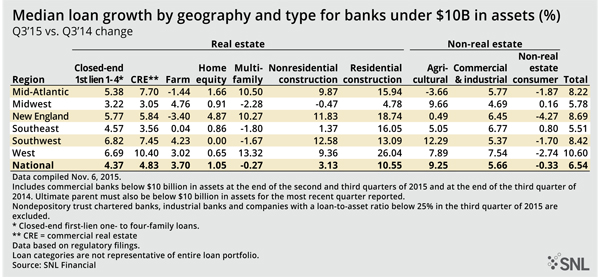

An SNL analysis looked at the regulatory filings for U.S. commercial banks with less than $10 billion in assets. Overall, median third-quarter loan growth was 1.63%, compared to the second quarter, and 6.54%, compared to the year-ago period.

When compared to the linked quarter, the West showed the best growth, coming in at 2.35%, according to the SNL analysis. The Southwest region fared second-best with 2.03% growth, while the Midwest produced the weakest result with a gain of 1.46%.

Heartland Financial USA Inc., which has branches in the Midwest, West, and Southwest regions of the country, saw its organic loan growth slow a bit in the third quarter to $39 million. But growth for the year sits at $217 million, which the company said is close to its 6% target.

CFO Bryan McKeag told SNL that third-quarter loan growth was a little weaker than the Dubuque, Iowa-based bank had seen in the first half of 2015. Heartland did see growth in most categories, though, with growth in ag and residential leading the way. The commercial book had good new business but experienced some payoffs, which muted the net growth in that category, McKeag said.

New commercial business was spread out within all of the states where the bank does business, with Arizona being the strongest, and its core Midwestern states of Iowa, Illinois, and Wisconsin showing some good new business as well.

"While we expect loan growth to continue, we think the pace may be slowing a bit, with competition for new business being very high," he said.

Jeff Aden, chief lending officer for Portland, Ore.-based Albina Community Bank, told SNL that the bank experienced a good third quarter for loan growth with much of it centered in commercial real estate—primarily rate and term refinances.

"I attribute this to a favorable rate environment and a number of loans that originated five or ten years ago that were repricing," Aden said. "The growth is the result of our marketing efforts and hard work. It is a very competitive environment with all banks looking to grow their loan portfolios."

Median year-over-year growth was notable in some regions, but still hovered mostly in the single digits. The West region produced the strongest median increase, at 10.60%, while the Southeast pulled up the rear with median loan growth of just 5.51%, SNL found.

Eugene, Ore.-based Pacific Continental Corp. President and CEO Roger Busse, speaking during the bank's third-quarter earnings call, said the company achieved record quarterly loan growth of $50.9 million, up from $50.3 million in the second quarter. That marked the bank's 17th straight quarter of expansion and its second consecutive quarter of record loan growth.

The organic growth was achieved in all markets and across a wide spectrum of loan segments, Busse said. "We have not relaxed our credit standards to achieve short-term growth and gains. Loan quality remains strong, and positive migration in all key credit quality statistics continues," he said.

COO Casey Hogan said loan growth was notable in the bank's national dental lending area, which grew more than $20 million, or about 12%, during the quarter and now represents approximately 13.6% of the loan portfolio. The growth in that niche was impacted by the bank's expansion efforts that began in the first quarter and included adding a loan production office and dental banking officer in the San Francisco market.

Hogan noted that the Portland market grew approximately $16 million in the quarter.

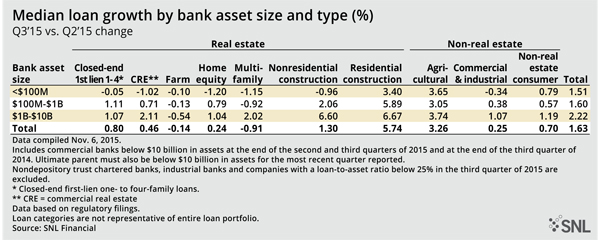

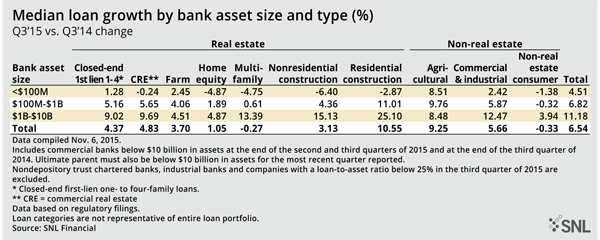

Banks between $1 billion and $10 billion in assets had better growth than their smaller counterparts during the quarter and experienced total median loan growth of 2.22%. Residential construction loans were one of the bright spots in the third quarter, growing 3.40% for banks of less than $100 million in assets, 5.89% for those between $100 million and $1 billion and 6.67% for companies between $1 billion and $10 billion in assets.

Tim Scholten, president of Columbus, Ohio-based consulting firm Visible Progress, told SNL that growth on the commercial and industrial side has been fairly strong for many community banks.

"But I have seen banks take on a bit more risk in the process," Scholten said. "And I think the recent FDIC guidance for banks involved in participations provides some evidence their concern."

On the consumer side, auto has been strong, but regulators have expressed concerns about sub-prime lending, Scholten said. Some banks have assumed a bit more risk to achieve higher volume. Scholten said he is aware of a few community banks and credit unions with aggressive auto lending strategies although there is little room for error with consumer loans because margins are "pretty slim."

Scholten said he does not see any obvious signs pointing to promising loan growth in coming quarters. "With more non-banks entering this space all the time, smart growth will be a challenge," he said. "Banks need to stick to the solid lending principles that have endured volatile market swings and let these new competitors weed themselves out during the next down cycle."

Related items

- Spain Blocks BBVA-Sabadell Merger for at Least Three Years

- Bank Merger Activity Stays Steady Despite Early-Year Headwinds

- Thank You to Our Attending Banks

- Banking Exchange Would Like to Thank Its Amazing 2025 Partners for the Banking Exchange National Conference in Chicago June 19

- Abrigo Executive Joining Two Banking Leaders for Discussion on Managing Fraud and Risk June 19th