How to pump growth is question

SNL Report: Loan growth moderate in Q2 and some bankers cautious about Q3

- |

- Written by SNL Financial

SNL Financial is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the subscriber side of SNL Financial's website.

SNL Financial is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the subscriber side of SNL Financial's website.

By Ken McCarthy and Razi Haider, SNL Financial staff writers

Growth in markets including "white hot" San Francisco led to banks in the western states seeing the strongest loan growth in the second quarter of 2015.

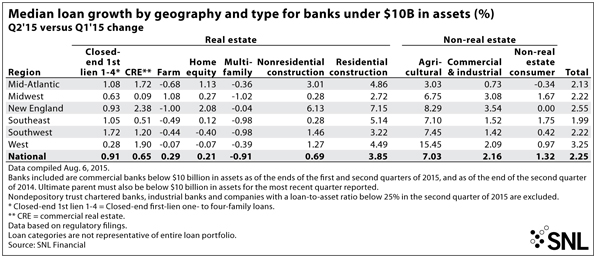

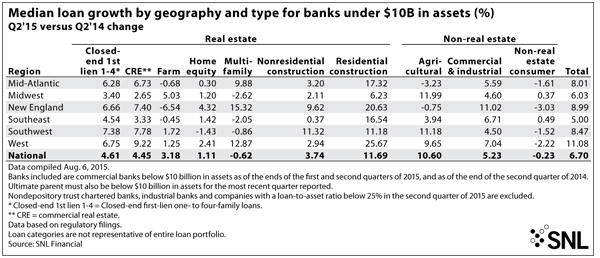

Overall, median second-quarter loan growth among U.S. commercial banks with less than $10 billion in assets, when compared with the preceding quarter, came in at 2.25%, an SNL analysis of regulatory filings found. Compared with a year earlier, median growth was up 6.70%.

When compared with the linked quarter, the West showed the best growth, coming in at 3.25%, according to the SNL analysis. The New England region fared second-best with 2.55% growth, while the Southeast produced the weakest result with a gain of 1.99%.

California’s Summit State Bank saw its total assets increase 6% to $492.3 million at June 30, 2015, compared to $463.5 million a year ago primarily driven by loan growth, the company said in its second-quarter earnings release. President and CEO Thomas Duryea told SNL that he believes banks mirror the economy and the GDP is a good marker for realistic, sustainable growth. Still, the Santa Rosa-based company is targeting 10% organic growth for the full year 2015. The loan pipeline is currently double the previous high in its history, he said.

"But I want to be very careful that we don't do too much too fast or too much in one year, especially with where rates are these days," said Duryea.

Sonoma County is "extremely hot" and the local economy is benefiting from being just an hour due north of San Francisco, which the Summit State Bank chief executive called "white hot."

The bank is generally never the lowest priced for loans in the market but tries to win with better service. "It's amazing to me how much that sells in the marketplace," he said. "Now it doesn't sell with everybody. For some people that's not important. But for the type of customers we're targeting, it is."

At least 20% of the bank's business comes from referrals, he said.

Median year-over-year growth was notable in some regions, but still hovered mostly in the single digits. The West region produced the strongest median expansion, at 11.08%, while the Southeast pulled up the rear with median loan growth of just 5.00%, SNL found.

Joseph Matisoff, executive vice-president and chief credit officer at Marlton, N.J.-based Liberty Bell Bank, told SNL the bank has made good progress in the past year or so and expects that to continue. He said the bank is pleased with its loan growth, although it has been a "little spotty."

"Competition is very tough on rate," Matisoff said. "We're trying to improve our net interest margin but facing significant price competition."

The bank saw loans decrease 0.10% compared to the linked quarter, but Matisoff said he prefers looking at loan performance rather than total loans, and the bank experienced a "nice reduction" in nonperforming loans in the second quarter. "Our pipeline continues to be pretty good with loans that I think will hold up and maybe even improve our NIM over time," he said.

But Matisoff said he does not foresee strong growth in the third quarter as a couple of loans are threatening to pay off. Liberty Bell is more active these days in construction loans, which have a good NIM but typically pay off when the project is completed. He said the bank could see modest loan growth for the third quarter, "but I can't be real comfortable with that yet."

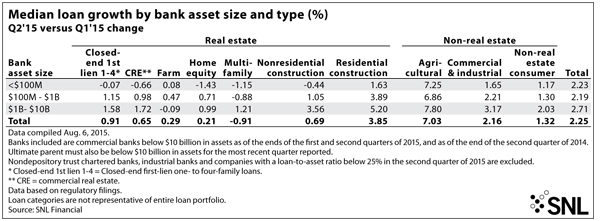

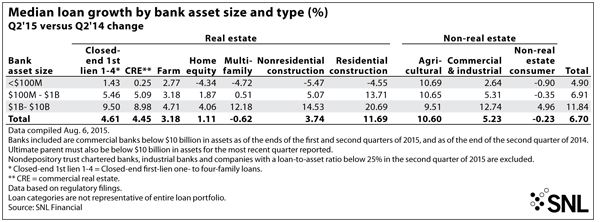

Banks between $1 billion and $10 billion in assets had better growth than their smaller counterparts during the quarter and experienced total median loan growth of 2.71%. Residential construction loans were one of the bright spots in the second quarter, growing 1.63% for banks of less than $100 million in assets, 3.89% for those between $100 million and $1 billion and 5.20% for companies between $1 billion and $10 billion in assets.

State Bank of Cross Plains CFO Mark DeBiasio told SNL that the Wisconsin-based bank is "hopeful" regarding loan demand. The bank is seeing many opportunities in the commercial real estate area, particularly for financing the construction of multifamily projects. "The competition for the high-credit quality deals, as you might expect, has been fierce," he said. "So, while we are not lowering our standards with regard to credit quality, we are agreeing on deals—at times—at less than optimum yields."

But with plenty of liquidity to deploy, properly structured, high-quality loans remain a better investment for the bank than cash, he said.

The bank saw 0.75% quarter-over-quarter loan growth and 4.51% compared to the year-ago quarter, SNL found.

The demand for traditional commercial and industrial loans and lines of credit remains less than brisk in the market, DeBiasio said. The bank is not seeing the magnitude of business formation that it has in prior years. And its existing customer base is not utilizing the same level of borrowing that was the norm in prior periods. "My opinion is that many businesses have very strong balance sheets and are self-funding new projects or are choosing to grow at a slower pace to avoid leverage," he said.

This article originally appeared on SNL Financial’s website under the title "Loan growth moderate in Q2 and some bankers cautious about Q3."