Quarterly earnings calls detail rate impact

SNL Financial: As rates fall, some banks investing cautiously in bond markets

- |

- Written by SNL Financial

By Nathan Stovall and Robin Majumdar, SNL Financial staff writers

Falling long-term interest rates in 2014 left many bank portfolio managers apprehensive about investing at such low yields.

Banks closed 2014 with their bond portfolios in the black but rather than harvesting those gains, many banks opted to keep their powder dry than put money to work in the market ahead of an expected change in the rate cycle. [Editor’s note: Recent statements by the Federal Reserve add yet more uncertainty to the picture.]

For a larger version, click on the image.

For a larger version, click on the image.

Long-term rates fell considerably in 2014, with the yield on the 10-year Treasury ending the year at 2.17%, down 35 basis points from the end of the third quarter of 2014 and down 87 basis points from the close of 2013. With rates back near historical lows, some banks said on their fourth-quarter earnings calls that they were approaching the current investment environment with caution.

Commentary from Fifth Third

Fifth Third Bancorp CFO Tayfun Tuzun, for instance, said on his company's fourth-quarter earnings call that it invested excess liquidity cautiously in the fourth quarter and did not reinvest all of its cash flows from the investment portfolio given the low rate environment.

Fifth Third did increase its short-term investments in the fourth quarter by $4.3 billion sequentially, reflecting higher cash balances held at the Federal Reserve. Fifth Third, however, unlike some other institutions, is subject to the liquidity coverage ratio, or LCR, which requires banks to hold enough liquidity on hand through a stressed scenario.

Any covered institution must hold "high-quality liquid assets," or HQLA, greater than, or equal to, its projected cash outflows minus its inflows during a 30-calendar-day stressed scenario. Given that requirement, Fifth Third Treasurer James Leonard suggested looking at the company's securities portfolio in the context of the LCR. He noted on the fourth-quarter call that the company was sitting on $7 billion of cash at year-end given the decline in long-term rates, but expects to see some of that cash deployed over the course of 2015.

Tuzun added that the company will invest opportunistically, but will remain cautious in its approach. "We will be patient, no question about it."

Even some smaller banks not subject to the LCR are taking a conservative investment approach. Old National Bancorp President and CEO Robert Jones said at the recent KBW Regional Bank Conference in Boston that his company has worked to shrink the duration of its securities portfolio. He said Old National uses that portfolio to manage rate risk rather than predict the future of interest rates. Jones said he would "rather be conservative for the long term rather than aggressive for the short term."

Still, some bankers say that they see other institutions reaching for yield in the bond markets. John Davis, senior executive vice president and director of financial strategy at IBERIABANK Corp., said at the KBW conference that he has seen some banks extend duration in their bond portfolios and expects those institutions to take "some hits" when the rate cycle turns. It depends on how much the yield curve moves and just how disciplined the bank in question has been, he said.

Low-rate picture keeps portfolios solid

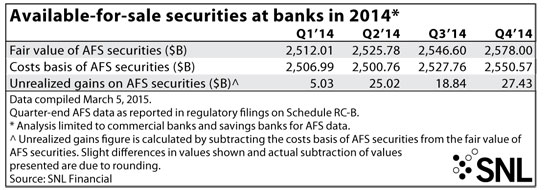

For now, with rates remaining low, the industry's securities portfolios remain firmly in the black. SNL data shows that U.S. commercial banks and savings banks reported net unrealized gains of $27.43 billion in their AFS portfolios, which are subject to mark-to-market adjustments on a quarterly basis, at the end of the 2014.

For a larger version, click on the image.

For a larger version, click on the image.

The move represented a nearly $8.6 billion positive swing from the $18.84 billion in net unrealized gains banks reported at the end of the third quarter.

About 70% of commercial banks reported a positive change in the value of their available-for-sale portfolios, while close to 20% of banks showed a negative change. Roughly 10% of banks reported no change in the value of their portfolios, according to SNL data.

Capital considerations

Changes in accumulated other comprehensive income, or AOCI, which captures unrealized gains and losses of banks' AFS securities, impacts tangible common equity. Under the final Basel III rules, though, changes in AOCI flow through regulatory capital. Banks with more than $250 billion in assets are subject to the rule. The final rule gave smaller institutions the opportunity to opt out of the provision. Banks looking to opt out of the provision have to make that election in the first call report after Jan. 1, 2015.

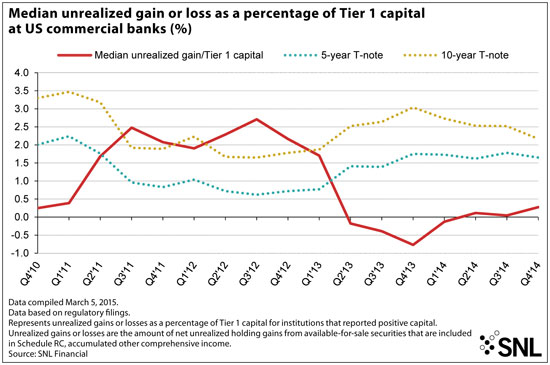

The inclusion of unrealized gains and losses in regulatory capital ratios would have inflated banks' capital levels for much of the last few years. That trend changed some in the second half of 2013 when long-term rates began rising off historical lows, but the declining rates in 2014 would have offered some banks a boost to the regulatory capital ratios.

SNL found that banks would have experienced an increase of 0.98% in their Tier 1 capital on average over the last 17 quarters beginning in the fourth quarter of 2010. In the fourth quarter, the median level of unrealized gains would have increased banks' Tier 1 capital by 28 basis points. Meanwhile, the median level of unrealized losses would have increased banks' Tier 1 capital by just 5 basis points in the third quarter.

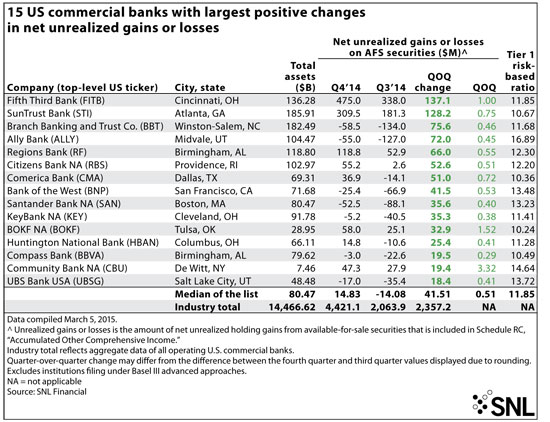

Fifth Third unit Fifth Third Bank reported the largest positive change in unrealized gains and losses in the fourth quarter, disclosing that unrealized gains rose by $137.1 million in the quarter.

SunTrust Banks Inc. unit SunTrust Bank followed closely behind, as its unrealized gains rose $128.2 million from the prior quarter.

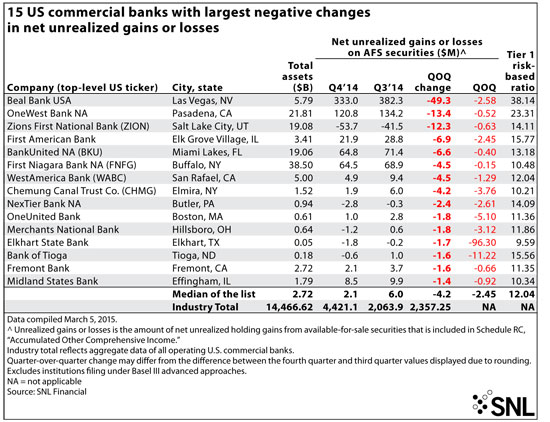

Few banks experienced negative swings in the value of their portfolios in the fourth quarter given the steady decline in rates through 2014. The institutions reported decreases in unrealized gains or losses largely showed only modest downward adjustments. Beal Financial Corp. unit Beal Bank USA reported the largest negative swing, though only saw the value of its portfolio fall by $49.3 million from the prior quarter.

Few expect banks to record more gains in the coming year, with many market-watchers waiting for the Fed to increase interest rates. The yield on the 10-year Treasury has actually fallen 6 basis points since the end of 2014, but many bankers are still preparing and waiting for rates to move higher at some point in 2015.

Print an SNL Financial reprint of this article

For a larger version, click on the image.

For a larger version, click on the image.

For a larger version, click on the image.

For a larger version, click on the image.

Tagged under ALCO, Management, Financial Trends, Risk Management, Rate Risk, Feature, Feature3,

Related items

- US Banks Rank as Largest Global Fossil Fuel Financers

- Credit One Executive Talks Fraud Prevention Technology at SAS Innovate Conference

- Homebuyers Uncertain of How to Secure a Mortgage

- ABA Supports Bill to Strengthen ATM Robbery Penalties

- Ray Dalio and Jamie Dimon Interviews Beg the Question: Where Is the Party for Fiscal Deficit Issues?