Some Basel III relief for some small banks

SNL Report: Recent legislation will help community banks make standards

- |

- Written by SNL Financial

By Nathan Stovall and Salman Aleem Khan, SNL Financial staff writers

While many small banks are still falling short of the Basel III capital requirements, recent legislation could help them meet the capital standards as compliance lies around the corner.

Progress made so far

Smaller banks have made progress to comply with the Basel III rules over the last 12 months, but a fairly large block of institutions are still falling short of the requirements even with compliance beginning in 2015, according to an analysis by SNL Financial. (See explanation of methodology at the end of this article.)

However, recent legislation increased the asset threshold to $1 billion for banks to qualify for an exemption from certain risk-based and leverage capital guidelines and to operate with higher levels of debt. The new provision just might help with Basel III compliance because the institutions could downstream cash from the holding company to their bank subsidiaries and count it as equity capital.

Under the final Basel III rules, large, internationally active banks had to begin phasing in Basel III requirements in January 2014. Smaller institutions, including all S&Ls, will have to begin phasing in the Basel III capital this month—in January 2015.

Banks have several years to reach full Basel III compliance, but some advisers have cautioned that institutions likely will need to show that they are moving toward full compliance even before the final effective date.

SNL has regularly measured banks' efforts to comply with the Basel III rules. SNL has measured the capital impact of the final Basel III rules by developing a template that examined two severity scenarios. The "conservative" and "moderate" scenarios took into account provisions outlined in the proposed rules, such as new risk-weightings of assets and new deductions of certain items from common equity Tier 1.

Small bank progress slows, but legislation offers new hope

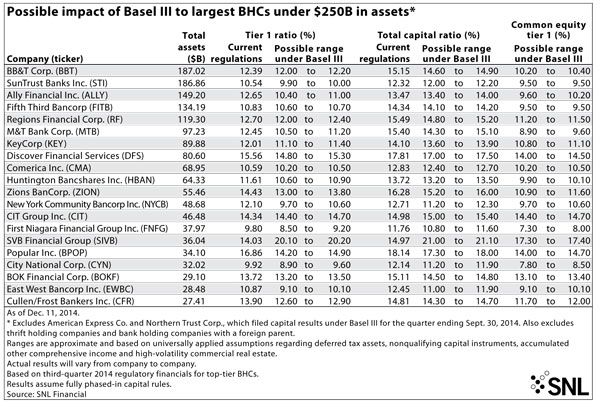

SNL's most recent analysis found that the capital bases of large banks continue to be well-prepared for the implementation of the final Basel III rules. SNL's analysis did not include institutions with more than $250 billion in assets that are subject to the advanced approach of the Basel III rules.

Larger banks have been better prepared to comply with the Basel III standards for quite a while, in part because they have less time to comply with the provision.

Large banks below the $250 billion asset threshold continue to find themselves standing on firm ground to comply with the Basel III rules. Assuming full implementation of Basel III, SNL found that the 20 largest banks with less than $250 billion in assets would report a median common equity Tier 1 ratio in a possible range of 10.20% to 10.55% and a Tier 1 ratio in a possible range of 10.85% to 11.30% at the end of the third quarter. Both ranges are well above the required minimums and are slightly above the levels SNL found at the end of the second quarter.

Most small banks have sufficient capital to comply with the Basel III standards, as well, but nearly 200 small banks still need to build their capital levels to meet the standards. Smaller institutions were just granted some regulatory relief that could help banks with less than $1 billion in assets comply with the capital standards.

President Barack Obama recently signed legislation directing the Federal Reserve to revise an existing provision that would allow small, noncomplex bank holding companies with less than $1 billion in assets to operate with higher levels of debt. That threshold previously stood at $500 million in assets. While observers believe the new provision could help bolster the M&A market by creating more acquisition financing, the legislation could also help some banks more easily bolster their capital bases. [Read the SNL Report posting, “Congress delivers M&A capital gift before Christmas”]

The Independent Community Bankers of America estimates that the change will impact close to 600 institutions and allow them to hold more debt at their holding companies. Those institutions could access financing through private placements of subordinated or senior debt, but many private banks are unlikely to access the public debt markets because they want to avoid registering with the SEC, according to Jones Day partner Chip MacDonald.

The attorney noted that institutions are even more likely to seek holding company loans from correspondent banks and to use those funds to either support growth or downstream the cash to their bank subsidiaries as equity. (The Fed still needs to adopt and implement the provision.) As it stands, MacDonald said, the holding company loan itself would not count as consolidated capital, but noted that the smallest banks are only evaluated on bank capital.

"They can take creditworthy smaller banks and actually help them put in capital because if you borrow money at the holding company level or a non-public offering situation like a bank debt, you can then downstream it to the bank as equity," MacDonald told SNL.

Small bank shortfall increases

The addition of another arrow in smaller banks' quiver comes after those institutions' progress in complying with the final Basel III rules has slowed in the last 12 months. That progress even appears to have reversed course in the third quarter of 2014.

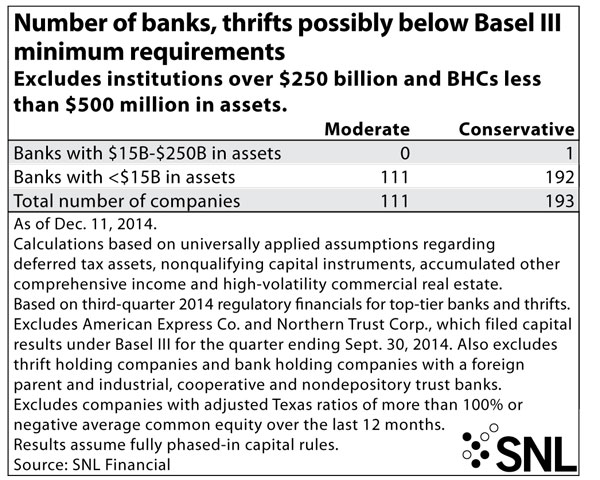

Smaller banks have long lagged larger institutions, accounting for a greater portion of the industry's shortfall under the rules despite their smaller size. In the second and third quarters of 2013, those institutions were responsible for the entire shortfall measured by SNL and accounted for the vast majority of the shortfall in the fourth quarter of 2013 and the first quarter of 2014. Smaller banks accounted for entire shortfall again in the second quarter, but one institution over $15 billion in assets fell short in the third quarter, according to SNL's analysis.

SNL tried to measure how relatively healthy banks stacked up against the Basel III requirements and accordingly excluded banks with adjusted Texas ratios, which excludes government-guaranteed loans, in excess of 100%, a widely considered threshold at which banks tend to fail. SNL also excluded institutions that had negative equity but still managed to report adjusted Texas ratios less than 100%.

When excluding those institutions, foreign-owned entities and BHCs with less than $500 million in assets, SNL found a $22.8 million capital shortfall at banks with assets between $15 billion and $250 billion under the "conservative" scenario at the end of the third quarter. SNL found no capital shortfall among banks in that asset range at the end of the second quarter and found a very small capital shortfall of $117.7 million at the end of the first quarter. SNL found an even smaller capital shortfall among those institutions in the fourth quarter of 2013 and found no shortfall at the end of the third or second quarters of 2013, after coming up short for several quarters.

Assuming the full phase-in of the final Basel III rules, SNL found that institutions with less than $15 billion in assets would post a capital shortfall below the minimum requirement based on third-quarter data of $1.52 billion, or 1.21% of their risk-weighted assets under the "conservative" scenario, up from $985.7 million, or 0.85% at the end of the second quarter, and $1.23 billion, or 1.31% at the end of the first quarter.

The higher shortfall marked a reverse in the recent trend as banks had posted improvements over much of the last year. SNL had found that the number of institutions falling short of the Basel III requirements fluctuated and even increased in several periods, and that remained the case in the third quarter.

For instance, SNL found that 192 U.S.-based banks with less than $15 billion in assets would fall short of the minimum requirements under the "conservative" scenario at the end of the third quarter, compared to 193 institutions in the second quarter. SNL found that 190 banks would fall short under the "conservative" scenario in the first quarter, compared to 210 fourth quarter of 2013, and 200 at the end of the third quarter of 2013.

SNL found that 111 would fall short under the "moderate" scenario in the third quarter, compared to 117 banks in the second quarter and 119 banks in the first quarter.

Still, SNL's analysis found that banks falling short of the minimums should be able to build their capital to the required levels in a relatively short time and even more quickly than in the second quarter.

When assuming at least a 5% return on common equity, SNL found that banks with less than $250 billion in assets, excluding bank holding companies with less than $500 million in assets, could earn back their shortfall to the minimum capital requirements on a median basis in just 0.72 year under the "conservative" scenario and 0.79 year under the "moderate" scenario. Comparatively, SNL measured the median earn-back period for banks at the end of the second quarter at 0.75 year under the "conservative" scenario and 0.91 year under the "moderate" scenario.

SNL’s methodology

To conduct the analysis, SNL developed a model that calculates capital ratios under Basel III. A range of assumptions were used to determine possible impacts to capital. All assumptions are universal and applied to each company. In actuality, assumptions will vary from company to company.

• Under SNL's "moderate" analysis, no deferred tax assets are considered related to operating losses and tax credit carryforwards. Concentration in high-volatility commercial real estate is estimated to be low.

• Under the "conservative" analysis, SNL categorizes a portion of deferred tax assets as related to operating losses and tax credit carryforwards. Concentration in high-volatility commercial real estate is estimated to be high.

Both the "moderate" and "conservative" scenarios include trust preferred and cumulative perpetual preferred securities in capital for those banks permitted to "grandfather" them in their capital ratios. Both scenarios also assume all banks opt out of including accumulated other comprehensive income (AOCI) in capital. Assumptions under the aforementioned scenarios remained the same between the original and final rules where applicable. Companies were considered to fall short of the Basel III requirements if they had a common equity Tier 1 ratio below 7%, a Tier 1 ratio below 8.5%, a total risk-based capital ratio below 10.5% or a leverage ratio below 5%. Where applicable, these thresholds include the capital conservation buffer.

The analysis treats Basel III as if it were presently implemented; however, sections of it will be implemented over a multiple-year time frame.

Tagged under Management, Financial Trends, CSuite, Community Banking, Feature, Feature3,