Banks’ $10 billion question

SNL Report: Crossing line carries implications good—and challenging

- |

- Written by SNL Financial

By Kiah Lau Haslett and Robert Clark, SNL Financial staff writers

The $10 billion threshold is one that presents necessary evils, as well as opportunities for expansion, say community banks that are close to or have recently surpassed this asset mark.

“Joys” of passing the threshold

The Dodd-Frank Act effectively drew a line in the sand at $10 billion. Banks and thrifts above that limit are subject to a raft of added regulatory burdens, including the Durbin amendment; oversight from the Consumer Financial Protection Bureau; and certain elements of stress testing, among other heightened standards. But while passing the $10 billion mark presents some pitfalls, many executives say they are more focused on the opportunities available to an institution with regional and operational scale.

Dodd-Frank was the first time $10 billion in assets became a "hard-wired cut" figure for banks and regulators alike, said William Haas, the OCC deputy comptroller for mid-sized bank supervision. Haas noted that the OCC, the Federal Reserve, and FDIC all have regional midsize bank programs, which now start to work with institutions once they reach $8 billion or $9 billion in assets, to begin altering the structure of their supervision.

Those banks work with dedicated supervisory teams and a functional examiner-in-charge in areas such as commercial credit, retail credit, compliance, and capital markets. Often, this regulator is a resident at the institution or works in a nearby office. Haas said that at first, banks sometimes find this presence to be imposing, before deciding they appreciate having a "go-to examiner there to bounce off questions."

As banks approach the $10 billion mark, the OCC begins discussing expectations about strategic planning and risk management with company executives, as well as hosting district outreach meetings for CEOs and credit officers, with near perfect attendance.

Haas said regulators also speak with executives about the strength of their bench. "If they want to be a $20 billion bank, is there anyone in the institution who's been at a $20 billion bank?" he asked. The transition is "much easier" for companies that have management or board members with experience at a larger bank.

"[Those people] know what works," he said. "If you're talking about a bunch of $1 billion acquisitions rolled up, and everyone's been at a $1 billion bank and now they're a $10 billion bank, there are more acute growing pains, in general."

The OCC offered a handful of banks close to $10 billion in assets a chance to participate in the Dodd-Frank stress-testing review a year before they officially become tested companies. He said about half accepted the regulator's "generous offer" of early feedback the first year this opportunity was presented.

Bankers talk about $10 billion passage

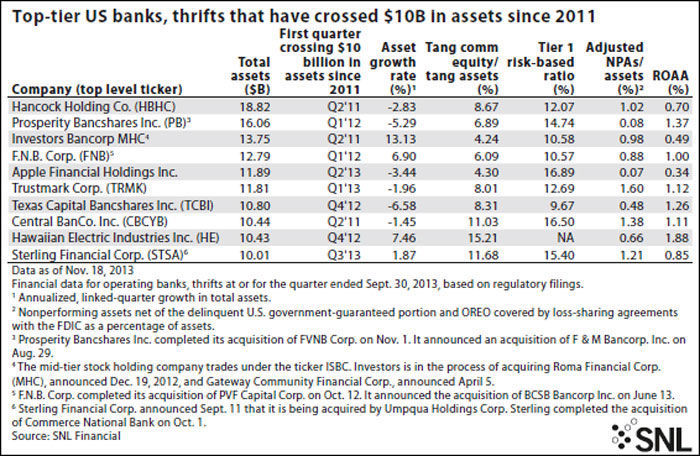

Investors Bancorp Inc., Short Hills, N.J., grew to slightly more than $10 billion in assets in the quarter ended June 30, 2011, making it one of the first institutions to surpass this threshold post Dodd-Frank.

Regulators "didn't know what to do with us," Investors Bancorp President and CEO Kevin Cummings told SNL.

Regulators began auditing Investors Bancorp on an around-the-clock basis, and the thrift beefed up its compliance department. Cummings said that additions to compliance and risk management and the forfeited interchange income are incremental costs associated with expansion. He said any bank nearing $10 billion in assets should be prepared for additional scrutiny, stress testing, and the CFPB.

"Regulatory risk is one of our biggest concerns right now and managing our growth is our biggest concern," Cummings said. Investors Bancorp had about $13.81 billion in assets at Sept. 30.

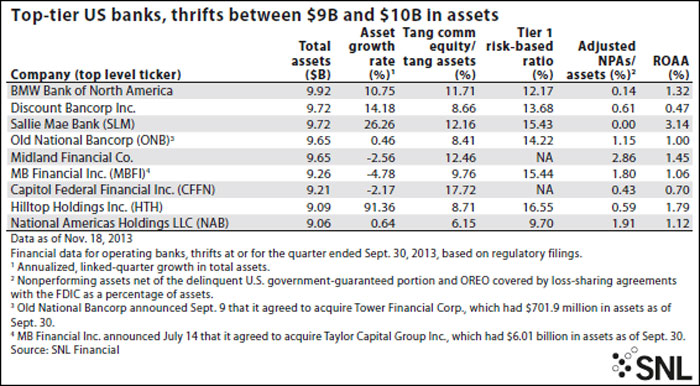

Evansville, Ind.-based Old National Bancorp has flirted with the $10 billion threshold for several quarters: The bank is highly acquisitive, but also reluctant to forfeit an estimated gross $2 million to $3 million quarterly in lost interchange income. President and CEO Robert Jones told SNL that Old National needs to reach $12 billion to $12.5 billion in assets to recoup that cost and provide value to shareholders.

Thus far the company has avoided going slightly over the threshold and becoming what Jones called "half-pregnant" by reducing its investment portfolio and selling a leasing portfolio, some mortgages and other lower-yielding assets.

The timing of the Durbin implementation may fall in Old National's favor. Durbin is measured at the end of year and then imposed in July. Jones said the bank, which has $9.65 billion in assets, will not reach $10 billion by the end of 2013, but could go over in the first half of the year either organically or through acquisitions, reaching $12 billion by the end of 2014. The pending acquisition of Fort Wayne, Ind.-based Tower Financial Corp., set to close in the first quarter of 2014, could be the catalyst that pushes the bank over $10 billion in the new year.

"Our whole growth strategy is both tracks: it's organic growth as well as acquisitions," Jones said. He noted that it is hard to predict when the next acquisition will be. "It's not an exact science so you can't expect anything," he said.

The Durbin amendment was less of a factor for Texas Capital Bancshares Inc., given the lack of "meaningful" interchange fees, said Sterne Agee & Leach analyst Brett Rabatin. Texas Capital grew over the $10 billion threshold between the third and fourth quarter of 2012. Rather than focus on regulatory hang-ups, Rabatin said management has focused on their lending platform and maintaining high asset growth.

"I think a lot of banks are making noise about the level of expenses that are required now to meet all of the modeling the FDIC, OCC and all these regulatory bodies want. [Texas Capital Bancshares doesn't] talk about that a whole lot," he said.

Acquiring your way over the threshold

Some banks are set to cross the $10 billion mark through acquisitions. MB Financial Inc. had $9.26 billion in assets at Sept. 30. The Chicago-based company is in the process of acquiring Rosemont, Ill.-based peer Taylor Capital Group Inc., which had about $6.01 billion in assets at Sept. 30.

Passing the $10 billion mark could be behind the delay of at least one merger. Charleston, W.Va.-based United Bankshares Inc., which had $8.51 billion in assets at the end of the third quarter, recently extended the termination deadline for its merger with Arlington, Va.-based Virginia Commerce Bancorp Inc., as the deal awaits approval from the Federal Reserve.

Sandler O'Neill analyst Kevin Fitzsimmons speculated in a Dec. 2 report that "the more likely explanation, in our opinion, is that the delay reflects the Fed's much more extensive and time-consuming regulatory approval process for proposed acquisitions, particularly a deal that would take the consolidated entity over $10 [billion] in assets."

Adjustments for regulators too

As regulators have heightened their expectations for banks nearing $10 billion, they have also worked to make internal adjustments. The OCC has sought to ensure consistency of rule implementation across geographies. The regulator refined the lead experts within business lines as well as appointing an independent risk officer to track emerging risks and specific issues as they arise.

In all of this, Haas said the OCC still balances its mandate of focusing on inherent risk at an institution, and sometimes pays more attention to firms with less than $10 billion in assets than it does to some that are over this threshold.

"We haven't lost sight of the [strategies] and business lines of our institutions and we try to preserve the whole idea of supervision by risk," said Haas.

Related items

- Banking Exchange Hosts Expert on Lending Regulatory Compliance

- Merger & Acquisition Round Up: MidFirst Bank, Provident

- FinCEN Underestimates Time Required to File Suspicious Activity Report

- Retirement Planning Creates Discord Among Couples

- Wall Street Looks at Big Bank Earnings, but Regional Banks Tell the Story