Bank tries out Pokémon Go

But for CenterState Bank, there’s more to this than clambering aboard a fad

- |

- Written by Chris Nichols

- |

- Comments: DISQUS_COMMENTS

Who knows how long Pokémon Go will last? Banker Chris Nichols argues that when you get past the fun and the buzz, there’s a bigger issue at stake.

Who knows how long Pokémon Go will last? Banker Chris Nichols argues that when you get past the fun and the buzz, there’s a bigger issue at stake.

To be clear, earlier this week, we already had people in our bushes hunting around for small fictional characters, so the idea of being proactive and actually purchasing ”Lures” wasn’t that much of a stretch. The real hilarity ensues when you find yourself explaining why your avatar needs to go to the “Pokémon Gym” because there is an important battle with Charizard on the horizon instead of talking about BSA regulatory issues—but, this is the new world we find ourselves in.

If you are interested to find out why your bank should be interested or just curious from a business standpoint, then read on as this is one of the more interesting initiatives we have worked on.

The Pokémon Go craze

Unless you have been buried under a stack of CECL analysis, you have undoubtedly heard about Pokémon Go. This mobile game was released recently and has caught on like no other.

This game may be one of the best examples of how augmented reality will change our lives and revolves around users customizing an “avatar” and then physically walking around peering into their phone’s camera app.

Through their phone, users can “see” various Pokémon characters placed at various real locations. Once found, users throw a Pokéball to capture the character. Once they’ve captured the character, the user gets to add the character to their collection. That earns them the corresponding number of points.

The more points a user gets, the faster they move up a level. Once a user gets to Level Five, they can now join pre-established teams. (We are part of the Red Team, in case you were wondering.) Once part of a team, users can then go to a virtual gym, where you learn how to win battles against various characters.

What started out as an April Fool’s joke a couple of years ago on Google Maps is now the biggest mobile game in US history beating out Candy Crush. Values of Nintendo (that licensed Pokémon) and Niantic (the developer) have skyrocketed.

Pokémon Go has garnered millions of active daily users. That’s a lot of people walking around in bushes and, to put it in perspective, the game already has more active users than both Twitter and Tinder.

Getting involved

If your bank is interested in getting involved, we have a couple of suggestions.

This week, we experimented and have started to place “lures” around some of our branches. These lures are what attract Pokémon characters, which in turn attract players. We just started testing the game this week and have kicked our experimentation off at two of our branches (Lakeland and Jacksonville). From there, the plan is to expand the number of participating branches and the level of marketing. [Chris Nichols originally posted this on his LinkedIn page on July 13.]

If your bank is interested, start by downloading the app, get set up, and play the game for a little bit. Once acclimated, consider the cost. Banks need to purchase Pokémon coins that currently have an exchange rate of approximately 120 coins for $1. Banks then take these coins and purchase lures at a cost of about $5.67 each. Once placed, these lures last for 30 minutes and can produce a noticeable effect in traffic.

Step by step

If the game and the cost is something that interest your bank, it is then time to move into action.

• First, banks, of course, need to run through their risk process.

Sure there are players getting run over by cars, players getting robbed, and Google having the ability to harvest more information than needed, but all this is happening with or without this game. At 21 million users a day and growing, problems are bound to occur. Statistically the number of incidences that have been reported are far less than the number of bank employees that get food poisoning from snacks in the breakroom. Risk needs to be kept in perspective. Still, the process is important, so it is worth a discussion and subsequent documentation.

• Next, determine if your bank wants to do a marketing tie-in. This is a low-risk move, as there is little downside. Given the media uberhype, it is hard to pass this up.

Some businesses have provided “rest stops,” phone charging stations, or have just promoted products by mentioning the game. Down the road, licensing deals will be available as well for banks. The unique element here is that this is marketing in near-real time. It is rare that you can post something and receive substantial feedback in minutes.

• Simultaneously, find out what branches or bank locations are near Gyms or Pokéstops.

This is done by downloading the game and then having a staff member at each location look (and maybe walk) around to see stops. As of now, these Gyms and stops can’t be moved (but they will be) so some locations will benefit more than others.

There are many stops around and we have found that each branch often has at least one and usually two Gyms or stops within a three-block radius. While there is no downloadable map that banks can get, one little-known hack is to go here, sign in to one of Niantic’s other games called Ingress, and get their searchable map of the world. Here, each “portal” for Ingress is almost identical to the placement of Gyms or Pokéstops.

• If the Gyms or stops are close enough, it probably pays to experiment with Lures, particularly during non-peak branch times.

Tap the red/white Pokéball at the bottom of the screen, go “Shop,” scroll down, and find the package of Lures you want to purchase. Once tapped, you can use your app store’s payment (like Apple Pay) system to pay for the purchase. From there, tap the desired Pokéstop and a white, pill shape will appear just above the stop’s circular disc and just below the name of the stop.

Tap the Pokéstop module to activate and then tap the Lure Module. Pink hearts will now float around the stop letting you know you are live. This will last for 30 minutes. In our tests, in a suburban location during an afternoon, we attracted about 20 people within those 30 minutes. This is about as real-time as marketing gets and is one element that sets this game apart from other forms of marketing.

Turning traffic into revenue

Admittedly, traffic is not revenue—but it can be.

Some businesses, mostly restaurants and bars, have reported a 75% increase in revenue over the past couple of days as they placed a sign outside their establishment with a promotion and then dropped lures to drive traffic to the sign.

Banks can use a similar tactic and can offer giveaways or promotions to turn traffic into product usage.

Of course, the game is ripe for social media and you can chart customer scores (or offer the promotions for achieving different levels); use hashtags (for example, #CSBPokemon for us) or create a competition.

Specifically, banks can create a geographically constrained promotion on Facebook, for example, where a bank might promote a lure and then reward the player that gets it or a bank may reward for the capture of a rare Pokémon (evidenced by a screenshot). Banks can also offer to pay for game coins if certain actions are taken (opened accounts, referrals, etc.).

The new ideas are endless.

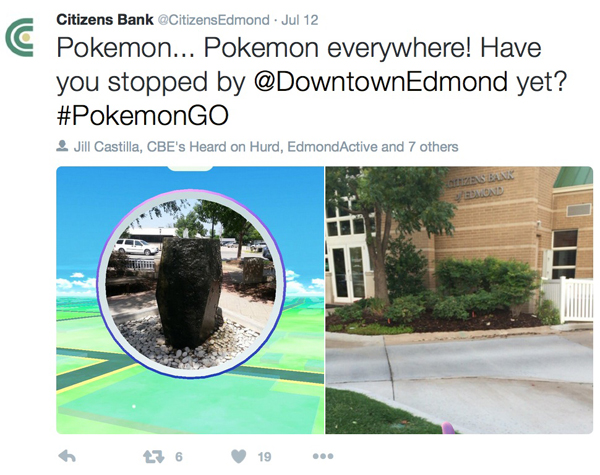

It is no surprise that Citizens Bank in Edmond, Oklahoma, is off and running with a series of efforts right along these lines.

Also, don’t overlook the simple. One huge advantage of leveraging the game is that banks can now figure out where groups of people are. By going to Pokéstops, banks can inexpensively promote a product or brand just as it would in any event.

The bigger picture

Undoubtedly, some bankers will scoff at the idea of getting involved with Pokémon Go. We get that and fully admit we felt ridiculous talking about some aspects of the game. We are unclear if this will create an emotional bond with customers or potential prospects, but the underlying passion for the game means that it stands to reason that any bank that aligns itself with the game will garner awareness and respect, particularly around millennials.

More importantly, some in the bank will dismiss this idea as a fad. It may be. However, dismissing this movement would be a mistake. In one week, we have all just witnessed the explosion of a phenomenon that is now approaching 95 million people. That is hard to ignore, even just for a couple of months.

The most important takeaway here is teaching your bank to react to the ever-increasing pace of change.

As a community bank, we had previously discussed our process, and when we put the idea of purchasing lures into action, we were able to get approval within hours instead of months.

That muscle memory of an innovative process is critical and mandatory going forward. For banks to thrive, getting a process in place to decipher the noise from the signal, to think creatively, to analyze the risks and to execute quickly, are all skills that need to be honed.

Banks are in the early stages of leveraging mobile, and experimenting with augmented reality will occur at every bank sooner or later.

This game can aid in helping employees understand what augmented reality is and get them thinking along how this technology can apply to our industry.

You can miss marketing around Pokémon Go, but your bank will need to learn how to handle new technology. Getting your branch staff, managers and board to download Pokémon Go, may just be the first step.

Happy hunting.

Tagged under Blogs, Social Media, HowTo, Community Banking, Feature, Feature3,

Related items

- Banking Exchange Hosts Expert on Lending Regulatory Compliance

- Merger & Acquisition Round Up: MidFirst Bank, Provident

- FinCEN Underestimates Time Required to File Suspicious Activity Report

- Retirement Planning Creates Discord Among Couples

- Wall Street Looks at Big Bank Earnings, but Regional Banks Tell the Story