American Express teams with Foursquare for small business push

Discount offers tie in with Amex small business push

- |

- Written by Andy Rooks, a research associate on Corporate Insight's Consulting Services team

- |

- Comments: DISQUS_COMMENTS

American Express is partnering with Foursquare to bring their customers deals as part of a location-based social media effort. While the partnership first debuted nationally in June 2011, American Express is now making a further push to coincide with its campaign for small businesses. The program, called Shop Small, began on Dec. 5, 2011 and will continue for a limited time, according to the firm.

Foursquare is a location-based mobile resource in which players “check in” to locations using their smartphones. Players receive points and badges for checking in, and broadcast their whereabouts to their friends and other Foursquare users. Local businesses have taken full advantage of this free word-of-mouth promotion system by providing check-in incentives, often in the form of discounts. LINK to homepage

A map on Foursquare displaying various check-in locations.

Groupon and Livingsocial have also partnered with Foursquare, using it as a proxy to promote their instant deals business. Foursquare users can check in and instantly use discounts at a given establishment. American Express has emulated this model for its small business initiative. LINKs: to homepages

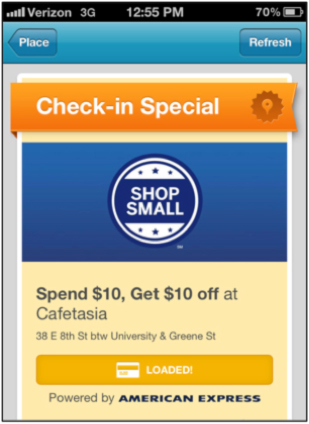

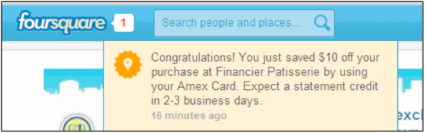

American Express now offers $10 off a $10 purchase at select small business partners on Foursquare, beating out competitors Groupon and Livingsocial. Moreover, the $10 incentive comes as a statement credit, meaning no scanners or offer codes. Check-in specials are marked with a special “Shop Small” icon and are credited within 2-3 business days.

The Shop Small check-in special from American Express.

This program offers effective incentives for all parties involved: consumers get a $10 credit, and small businesses get free word-of-mouth promotion and potentially, increased store traffic. From American Express’ perspective, customers have an extra incentive to use their credit cards and the program serves to strengthen the firm’s relationship with the small business community.

While innovative, the program also has some drawbacks. American Express only allows Foursquare users to use a $10 Shop Small coupon once, a detail that isn’t actively publicized by the firm. Shop Small check-in discounts still appear as available after usage, and a dialogue saying “Already Loaded” appears only after the user tries to use the special again.

After the special is used, the cardholder’s statement is credited directly.

Further, it is unclear how many American Express customers use smartphones or Foursquare. The program has been promoted on the American Express site and the Foursquare blog in a joint effort to spread the word.

Overall, the American Express Shop Small promotion on Foursquare marks a step forward toward further innovation in the social media and mobile finance space. Shop Small on Foursquare may not have the clearest terms and conditions, but it leads the way. The program has benefitted all parties involved and has brought new attention to American Express’ recent push to connect with small businesses.

Tagged under Blogs, Social Media,