'No Plan B*'

AML professionals meet in Vegas

- |

- Written by John Byrne

- |

- Comments: DISQUS_COMMENTS

The release this week of a new (and tremendous) Van Morrison album (*Born to Sing: No Plan B), serves as a good reminder that there is no Plan B to working together to combat illicit funds movement.

The timing of that reminder is fitting, as the ACAMS 11th Annual AML and Financial Crime Conference has just ended and 1,500 AML professionals are returning to their agencies, firms, and financial institutions to continue their commitment to fighting financial crime.

Highlights from the conference

The conference program began on a high note. It started with a comprehensive look into the tremendous efforts by the Internal Revenue Service in a myriad of financial crime cases by the Chief of IRS Criminal Investigation Rich Weber and his "thank-you" to the AML community for all the ways its members help.

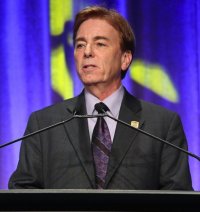

For the final session, the theme of unity continued. New Mexico Attorney General Gary King outlined the work against human trafficking by the Conference of Western Attorneys General (CWAG)/Alliance Partnership, as well as the coalition with the Mexican government against drug trafficking. King emphasized the importance of the private sector in this alliance as well as the need for federal and state working partnerships. (Note: In keeping with my musical references, King was in a band that once opened for Crosby, Stills, and Nash.)

As we have come to learn, AML is a broadly defined discipline and the conference reflected that through the coverage of sanctions, analytics, risk management, and even ethics. A plenary session on ethics gave the audience some new guidance regarding how AML professionals can include not simply ethics training but a revised ethics culture within their organizations. (FYI, ACAMS is now accepting ethics credits for the continuing education requirements of our CAMS credential)

A session with U.S. and Canadian regulators stressed the importance of not accepting limited resources even in these difficult economic times. There was also a consensus that risk assessment methodologies are considered deficient when they hinder the ability to accurately identify high-risk customers.

Related to risk issues is the call by regulators that before any new products or services are offered, the institution should ensure that its staff has the necessary knowledge, expertise, or resources to handle the new activities. In terms of training, several panelists emphasized the need for specialized and lines of business training--an area seemingly devoid of relevant compliance awareness to the business lines.

New survey could add rigor to AML learning

In addition to studying the themes of enforcement actions, the ACAMS audience was given a preview of a joint ACAMS-Dow Jones Survey (PDF/registration required) that offered insight into what is top of mind in the AML community this year.

For example, respondents were asked about current challenges, and challenges for 2013. A fourth of respondents identified "increased regulatory expectation" as the main current challenge. Equal responses after that were given for "Not enough staff in AML departments"; "insufficiently trained staff"; and "outdated technology."

The survey asked about increases in organizational workload of certain regulations or government recommendations and FATF (obviously a series of recommendations that could become regulations) led the way, followed by Dodd-Frank and FATCA.

We also asked the respondents about how their personal workload has increased in 2012 and they said the main reason was increased areas of responsibility--a theme we can all relate to.

On a positive note, the survey also showed that an increase in workload is related to increased AML focus by senior management. Even with more work, a commitment at the top will be useful for AML compliance is the long run.

As I hope I have been able to cover since this blog began, the question of AML and Fraud staff working is essential to a comprehensive enterprise response to all of the issues connected to these areas. The survey found that 62% of AML departments also handle fraud-a great sign in 2012.

Conference closes but work continues

After more years than I care to mention, when I have the opportunity to close a conference, I remind everyone to continue the dialogue, the peer information exchange, and the relationships with both the private and public sectors.

There is No Plan B--we need to continue our efforts together.

Disclaimer: John Byrne's views do not necessarily reflect those of the American Bankers Association.

Tagged under Compliance, Blogs, AML & Fraud, BSA/AML,

Related items

- Banking Exchange Hosts Expert on Lending Regulatory Compliance

- FinCEN Underestimates Time Required to File Suspicious Activity Report

- CFPB’s Auto Finance Data Collection Proposal Faces Backlash

- Trade Associations Urge Withdrawal of CFPB’s Proposed Overdraft Rules

- Banks, Mastercard and Visa Settle Antitrust Case