Picking the best provider of objective ESG and sustainability data for your needs

Companies within the financial sector can play a key role in the transition to a new and more sustainable economy

- |

- Written by Banking Exchange staff

Companies within the financial sector can play a key role in the transition to a new and more sustainable economy by making sure they implement high quality data when measuring the risk of their investments. This means that any decisions regarding investments should be backed by reliable, independent, and real-time data that best represents the current and future risks associated with the company.

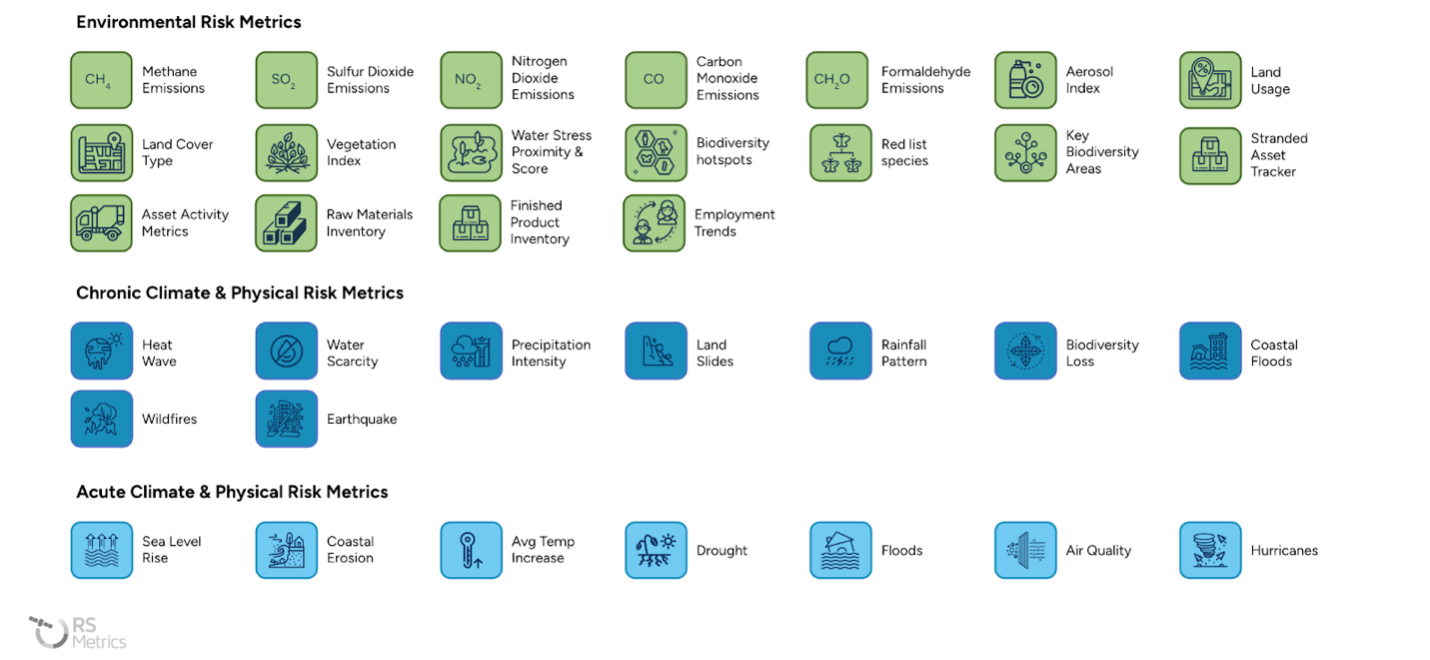

Addressing a variety of metrics, depending on the specific location that a company asset is situated in, can give a more holistic overview of its relationship to the surrounding environment. Currently, the type of data that most investors are turning their attention towards is commonly referred to as environmental, climate, and physical risk (ECP) metrics and it involves subcategories such as land usage / land cover, emissions, biodiversity hotspots, water stress, average temperature increase, and many more.

Getting the right type of data and using it in a strategic way can help not only meet current regulatory requirements, but also exceed expectations by pursuing opportunities that companies might have otherwise missed. An ECP data solution can allow financial companies to peer into the sustainability practices of the companies they invest in, benchmark their performance, and compare them with other industry leaders. But there are a lot of problems that financial companies need to be careful about when looking at environmental performance.

One of the largest issues that the industry has to deal with has been the problem of greenwashing, which is the misleading representation of a company as more sustainable than it actually is. To suppress that, regulators have started promoting more rigorous assessments and authentic disclosures that can detail the influence that companies have on their surrounding environment. As a result, financial companies now have to deal with the quickly changing regulations that have started to require them to provide extensive information about the type of companies they are allocating funds in and whether these businesses meet the requirements for green investments (Source).

To do that, financial companies need reliable and detailed data. Instead of looking at company-level aggregates based on self-disclosures, financial companies need to focus on the performance of important assets, such as office buildings, storage facilities, and factories, in context. By considering the specific location of assets, investors can learn about their opportunities and risks and make a better assessment of whether it is secure to invest in them. This type of ECP data is also referred to as asset-level and is particularly useful when looking at sectors like oil and gas, utilities, metals and mining, manufacturing, etc.

Choosing the best ECP data provider can be a difficult task depending on budget, areas of interest, available team members, and the existing data analysis processes that a company currently uses. A new white paper by RS Metrics, a leading data provider focused on independent asset-level ECP data derived through satellite analytics, aims to help with all of this. In “RS Metrics on the Role of Objective ESG and Sustainability Data in Financial Services”, they review existing regulation requirements, the role of financial companies in promoting a more sustainable future, and what companies should be looking for in order to meet the expectations set by new sustainability frameworks.

The piece presents their new SaaS tool, available through Google Cloud Marketplace, that has democratized this type of data and enabled financial companies of any size to find a solution for their specific needs. The product provides objective, verifiable, comparable, and timely data with an exciting option to BYOA — bring your own assets — for companies that may want to add additional assets to their dashboards. It also gives users access to direct measurements, consistent and relevant metrics, and enhanced analysis that is easy to understand.

You can access their white paper to learn more about what type of solution might be useful for your needs here.

Tagged under Community Banking, Feature3, Feature, Duties, ESG, Socially Responsible Investing, Sustainability, Sustainable Development Goals, Impact Investing,