6 features every bank app should have

Millennials want them, so you’d better know what they are

- |

- Written by David Lester, Brightworks Interactive Marketing

Is that a banking app being used, or something being offered by a fintech player that uses banking rails?

Is that a banking app being used, or something being offered by a fintech player that uses banking rails?

In a recent interview with David Lester, reported in our Counterintuitive column as “Time for a 'banker on your wrist'?,” the financial marketing and customer experience advisor from Brightworks Interactive Marketing spoke of the advantages of putting a “banker” right beside consumers via technology. Continuing that theme, Lester presents six features contained in nonbanks’ financial apps that he thinks banks should be building into their apps.

The digital assistant era is upon us and to keep millennials using your bank and digital services you need to add sought-after features that are available on third-party apps.

Some banks have dipped a toe into the never-ending work of enhancing and modernizing their capabilities.

For an example of digital assistants, Capital One and American Express work with Amazon’s Alexa to call out how much customers spend on categories, specific stores, or overall. Alexa can even isolate a month and calculate how much you spent, make transactions, and view offers. She can add money to Starbucks cards or Amazon cards too.

Think how dependent millennials will grow on their “banker in their phone.” Whose app do bankers want them to turn to in the future?

Bank of America is launching “Erica,” a bot that goes one step further to calculate complex solutions—all hands free. Launched from the banking app Erica can analyze spending to offer solutions to save the user money or pay back debt faster.

Users literally have a banker that not only recites and analyzes past transactions but also gives advice—all from a pocket device. The technology is in its infancy but think how great it will be to sit on the subway and do some financial planning on your way home.

“Erica? What should I do with my bonus?”

“Invest or pay back debt. Let’s do the calculations.”

So cool, right?

Here are six money app features that millennials are getting used to using … and loving.

Banks need to make sure that their apps are what people turn to, not only to bank with, but also to help them with planning, saving, goals, and overall financial literacy.

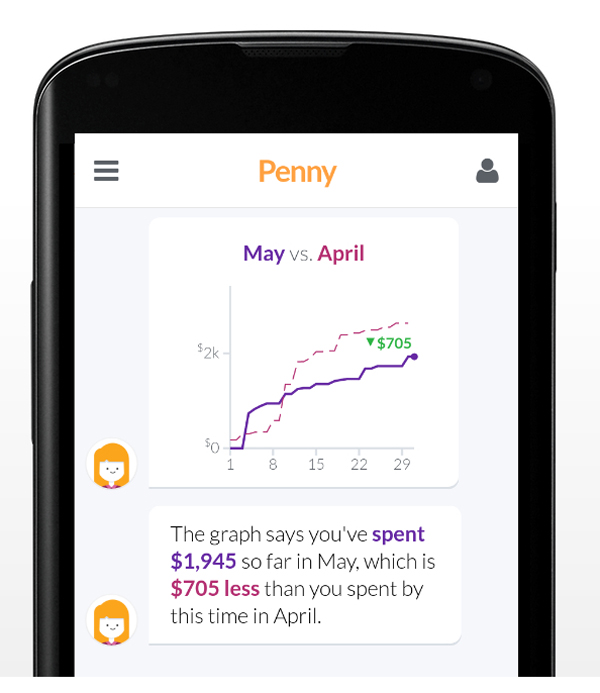

Penny: great messaging

Penny is a super cool app that direct messages with you iMessage style. It provides actionable advice, insight, and past trends on your money. It’ll compare your last two monthly spending cycles and predict your future monthly spending based on your past spending.

Compare this Gen Y friendly interface with the messaging in a normal banking app that looks more like email and comes in days versus seconds.

Penny is where messaging needs to go.

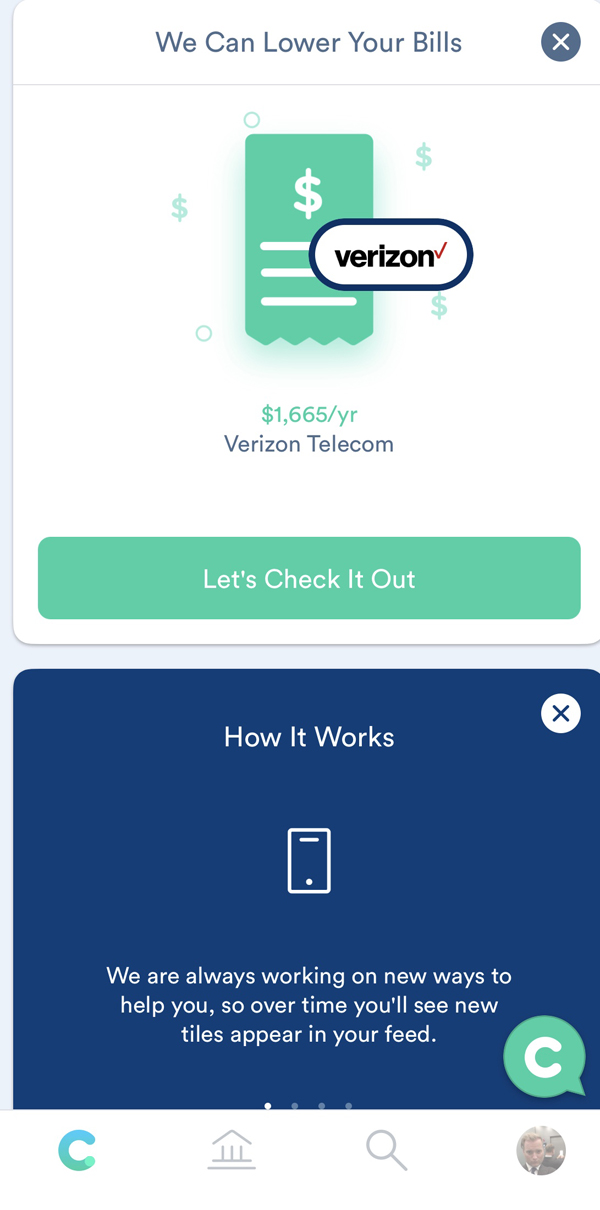

Clarity Money: lowering charges & cancelling costs

In a straightforward way Clarity brings just that to users’ spending and income—clarity.

My favorite feature in this app is how it shows the user how much they spend each year on bills and asks if it can lower them. Clarity will negotiate a user’s payments and then charge half the savings for one year. Clarity does the awkward part and the customer gets to enjoy the savings.

Think of the deals that a huge bank could swing for its own clients and partners.

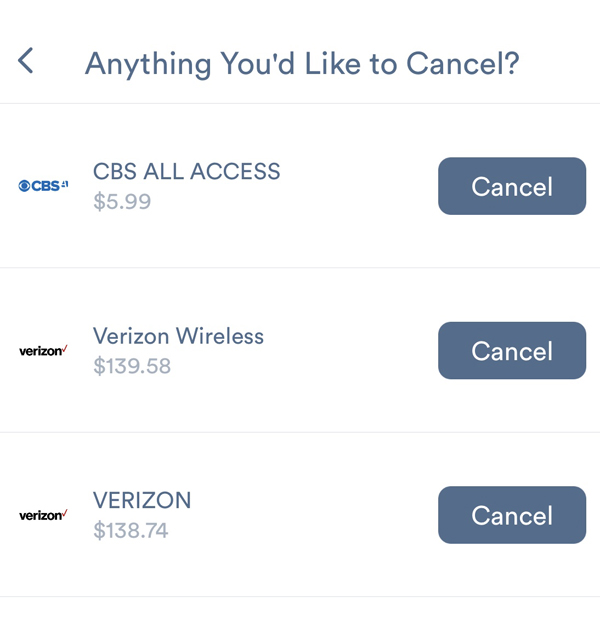

Clarity also has a feature where the user can easily cancel any or all of the expensive subscriptions that you pay monthly. Users can literally save thousands of dollars a year by simply clicking a few “Cancel” buttons.

It’s a great one-click way for busy millennials to save money.

Banks that offered such a feature could provide an investment or debt repayment plan using products under their own roofs. There is an example of using all the information the bank has to enhance their client’s financial life.

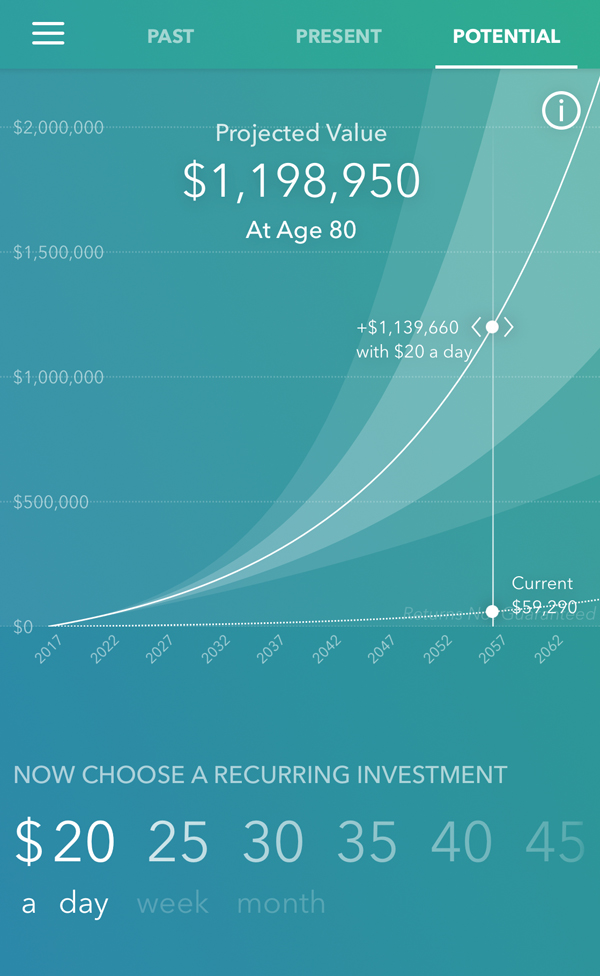

Acorns: rounding up & getting bucks from vendors

The main feature to Acorns is “microinvesting”—rounding up users’ purchase prices and investing the difference.

So if you pay $6.50 for a salad every lunch hour, Acorns will add 50 cents each time you swipe with your debit card and you’ll be investing $10 a month into an investment account, and just for your salads.

When Acorns rounds up all of a user’s purchases and adds $20 a day it can accumulate into millions over years.

This is visual retirement planning at its best and an easy way for banks to increase their robo-advisor offerings in a millennial friendly way.

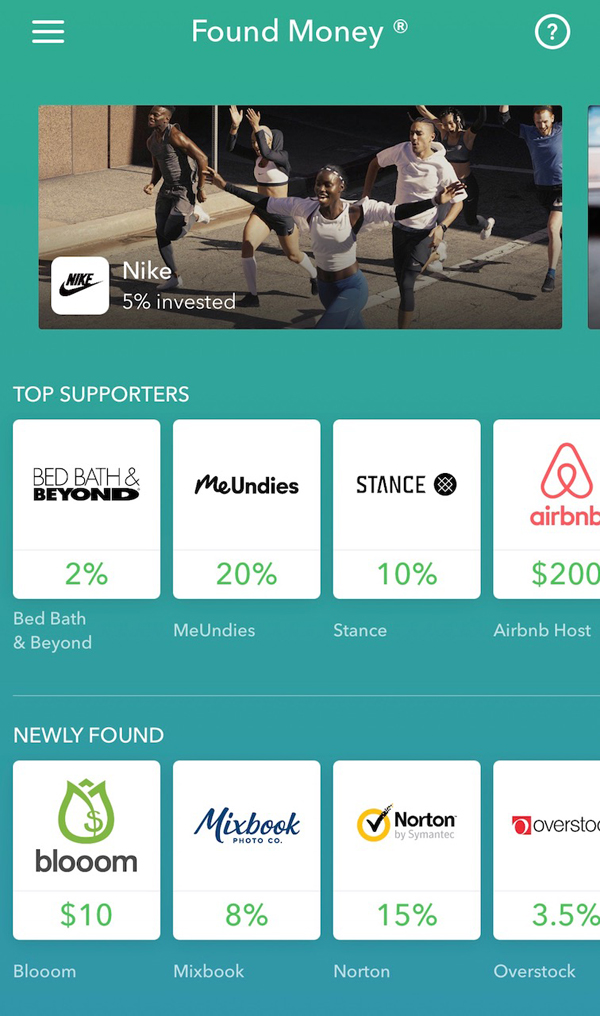

Acorns also adds value by finding “Found Money.”

If you shop at a ton of partner retailers they’ll give you a top up percent into your investment, as well as $5 when you refer friends. How easy is that to build your retirement fund over the long term?

Mint: credit score coaching

This is one of the first budgeting apps that combines all of the user’s accounts from different financial companies and consolidates it into one financial landscape.

Services like Mint make consumers ask questions like, “Why can’t I add my other bank credit card to my preferred banking app?”

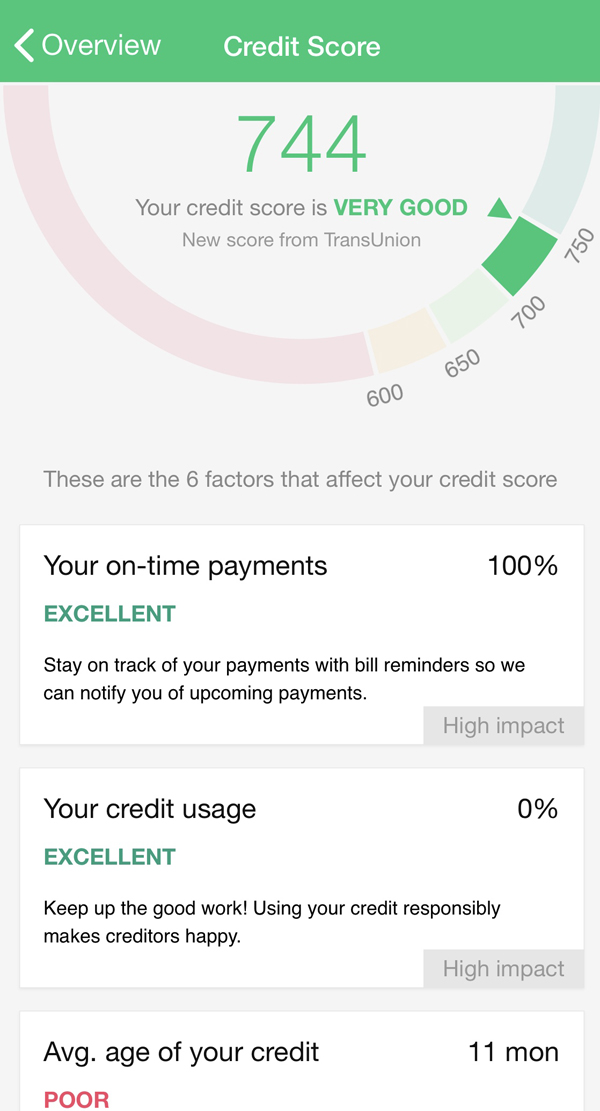

Mint also has a feature where it keeps track of your credit score and how you can improve it. It even updates your score monthly so you can see if you are heading in the right direction. This would very helpful for banks to add to their apps.

Living in a digital world

These are some of the most popular features from these non-bank apps that every bank needs to add.

Millennials have made Amazon and Uber huge successes based on their fickle tastes and preference for digital execution. Let’s not become the next taxi company or mall in this new economy. Falling too far behind will be a huge mistake.

Tagged under Retail Banking, Technology, Channels, Fintech, Feature, Feature3,