Branches keep disappearing

Banks, thrifts close over 150 locations in September

- |

- Written by S&P Global Market Intelligence

S&P Global Market Intelligence, formerly S&P Capital IQ and SNL, is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the SNL subscriber side of S&P Global's website.

S&P Global Market Intelligence, formerly S&P Capital IQ and SNL, is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the SNL subscriber side of S&P Global's website.

By Zuhaib Gul, S&P Global Market Intelligence staff writer

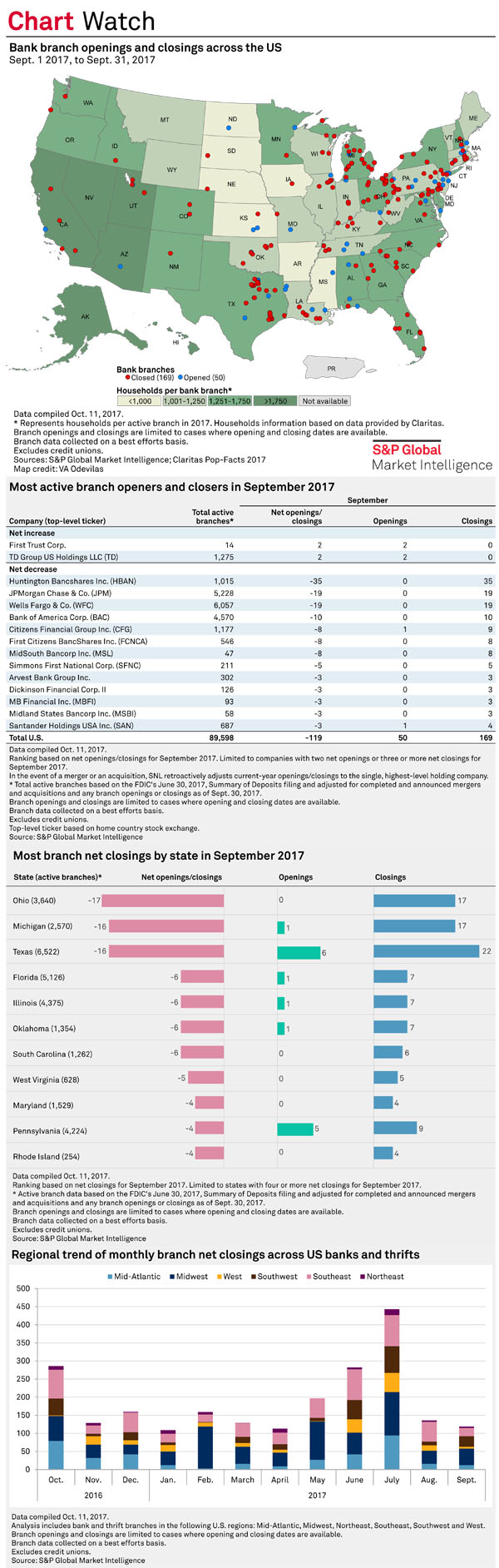

U.S. banks and thrifts continued to close their branches across the country in September, shutting down 169 branches while opening just 50, according to SNL data. As of Sept. 30, there were 89,598 active bank and thrift branches in the U.S.

During the first three quarters of the year, U.S. banks and thrifts closed a net 1,687 branches, with the Midwest region accounting for over 43% of the closures. In September, closures in the region totaled 46.

Focus on Ohio

By state, Ohio led the nation with 17 net closures, followed by Michigan and Texas with 16 apiece

Huntington Bancshares Inc. closed 35 branches across the U.S. in September, the most of any company. Thirty of the 46 net closures in the Midwest region were attributable to Huntington Bancshares. Out of the 30, the bank shut down 14 branches in both Michigan and Ohio. The remaining two closings in the Midwest region were in Indiana and Wisconsin. Over the course of the last 12 months, Huntington Bancshares has closed a net 144 branches, 123 of which were in Michigan and Ohio. A number of the closures are connected to the bank's acquisition of FirstMerit Corp., which was completed Aug. 8, 2016. Huntington Bancshares has since been consolidating its branch network in the Midwest region, and the closures in September can be linked to the bank's earlier announced consolidation plan for the third quarter.

In addition, three of the 'Big 4' banks continued to cut their branch footprint in September with JPMorgan Chase & Co. and Wells Fargo & Co. slashing 19 branches each, while Bank of America Corp. closed 10 offices.

Branch data is collected on a best-efforts basis by SNL, a platform owned by S&P Global Market Intelligence. Coverage includes FDIC-insured branches and excludes loan offices, mortgage branches, and other offices that may not primarily engage in deposit-taking activities.

This article originally appeared on S&P Global Market Intelligence’s website under the title, "Banks, thrifts close over 150 branches in September"

Tagged under Retail Banking, Channels,