Auto Lending: Payment performance strong

Trend good despite higher levels, more nonprime borrowing

- |

- Written by Steve Cocheo

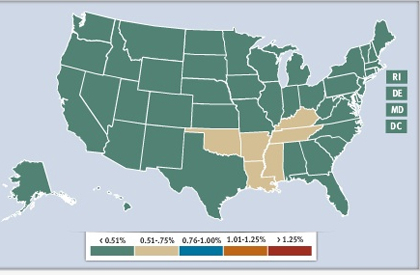

Most states saw delinquency rates below 0.51% in the second quarter, according to TransUnion research. The highest delinquency rates seen in the states were Louisiana (0.60%); Mississippi (0.60%); and Oklahoma (0.55%). The top three states in terms of rate of increase year over year in the second quarter were Delaware (up 45.16%); Idaho (up 36.84%); and Montana (up 4.175). Highest levels of auto debt--the level went up nationally--were seen in Texas (average of $15,232 per borrower); Louisiana ($14,973); and Alabama ($14.960). To access an interactive version of the map above, go to TransUnion's special web page.

Auto loan delinquency rates hit new lows for the second quarter in a row in the April-June period, reports TransUnion.

TransUnion has tracked auto lending delinquencies--which the company defines as the percentage of borrowers who are 60 or more days past due--since 1999. In the second quarter, delinquencies came to 0.33%. A year earlier, delinquencies came in at 0.44%, so year over year there was a 25% drop. In the first quarter of this year, delinquencies stood at 0.36%.

At the same time that borrowers' performance improved, their level of auto borrowing increased. TransUnion research found that average auto credit rose almost 6% year over year. In the second quarter of 2012, auto debt per borrower came to an average of $13,427, versus $12,689 in the second quarter of 2011.

TransUnion also found that performance improved even though nonprime borrowers' participation in auto credit has been growing again, at a rate of 9% in the second quarter versus the second quarter of 2011. (The company defines nonprime borrowers as those having VantageScores of less than 700, on a scale of 501-990.)

Reasons behind the numbers

Multiple reasons lay behind the improved delinquency numbers, according to TransUnion analyses and an Banking Exchange interview with Peter Turek, automotive vice-president in the company's financial services business unit.

"It's not surprising that auto loan delinquencies remain at record low levels," says Turek. He pointed out that recent TransUnion research has indicated that consumers today put more value on their auto loans than they do on their credit cards and mortgages.

"This is partly due to the need for transportation to get to work or to seek employment in a difficult job market," says Turek. However, he also pointed out that a strong used car market has given borrowers more equity in their vehicles than has traditionally been the case.

"They feel that they have some skin in the game now," Turek explains.

Overall, says Turek, "Consumers want to keep their auto loan relationships in good standing." The trend is a boon for lenders, he said, as funding rates are extremely low and auto lending is good business for creditors. More conservative underwriting combines with the factors already mentioned for a good outlook for lenders, Turek adds.

"It's a very attractive segment right now to lend in," with average maturities of 39 months, Turek points out.

And a potential bonus for all concerned will be that when some buyers come to trade in their vehicles for newer models, "they won't be rolling negative equity into new loans," says Turek.

Rise of nonprime borrowing

Overall, Turek says the company's research indicates that both auto dealers and lenders have grown much more responsible, in the aftermath of the credit crisis, in credit policies and practices.

Does this, then, mean that there is cause for concern in the growth of nonprime borrowing for autos?

Turek doesn't think so, pointing out that even at the higher levels reached in the second quarter, lenders have not yet reached the levels of nonprime lending seen during the buildup to the credit crisis. TransUnion reports that 33.6% of new auto loans were issued to non-prime borrowers in the second quarter of 2011, and in the second quarter of 2012 that number rose to 36.6% percent.

This is not to say that the nonprime lending increase will not have any effect.

"With the increase in nonprime borrowing, we do anticipate that auto loan delinquencies will begin to increase," Turek says. "We are at such a low auto loan delinquency level--far from normal standards--that a slight rise through the end of the year should be expected, though the overall rate will likely remain relatively low."

And then there is the potential impact on used-car prices of the new models for 2013. Introduction of the new season's offerings typically softens used card prices somewhat, Turek acknowledges, and there are an anticipated 25 new choices expected to come out.

Tagged under Retail Banking,