Why are checking balances so high?

2017 could mark the Checking Exodus. How to stop the keepers from going?

- |

- Written by Mike Moebs

- |

- Comments: DISQUS_COMMENTS

How long will your bank hold onto its deposit advantage? Mike Moebs has some ideas on how to hold onto your best accounts.

How long will your bank hold onto its deposit advantage? Mike Moebs has some ideas on how to hold onto your best accounts.

“Trust in God, my boys, and keep your powder dry!”—Oliver Cromwell, 1649, upon his army landing in Ireland.

The American consumer has heeded Cromwell’s advice since the start of the Great Recession in 2008 by keeping their dollars dry in checking and savings.

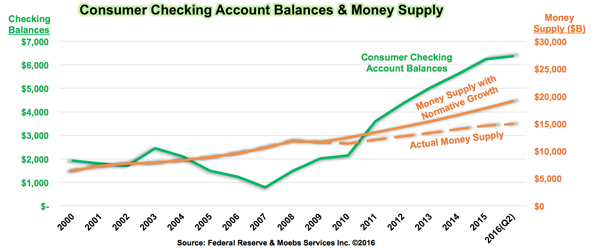

Consumer checking balances have reached a historic high at an average of $6,400 and savings is not far behind checking. Historically, we see checking balances at an average of $2,000.

Why are consumer checking balances three times the size and historically the highest in U.S. history? And what steps should this precipitate now?

Reasons and implications

The answer lies in the following:

1. For the American consumer, money has no safer place to go.

2. The consumer is not out of the recession, yet.

The implications for bankers are horrendous:

• Should budgets for 2017 reflect reduced DDA balances, stable balances, or increased balances?

• Is the risk only that checking balances will decrease as the consumer gains more confidence in the economy and begins to purchase more goods?

• Is there also a possibility that consumers might close their checking accounts, and take their relationships elsewhere?

When times are good, consumers leave little in checking.

However, when times are bad, consumers stockpile their money in checking and savings. At Moebs $ervices, we have studied consumer transaction account behavior since 1983 and confirm that checking account deposit behavior in particular is a reflection of economic activity.

Reading messages in balances

Moebs $ervices’ Transaction Account Metrics (TAM) measures the consumer checking behavior. It is the opposite of Gross Domestic Product (GDP). TAM reflects the consumption side of economics, whereas GDP demonstrates the production side. As the chart shows, in 2007, when the economy was good, the consumer kept on average about $700 in checking. Today, the average checking balance is $6,400.

What is the consumer telling us?

Various reasons govern consumers who are keeping money in checking and savings, while monitoring it very carefully. While the consumer cannot earn much interest on balances left in checking or savings—about 5 to 15 basis points—they do not want to risk investing in the stock market.

There are also many consumers who are currently underemployed or unemployed, and the checking account is a safe and liquid place to store dollars.

Two sides for high balances

Consumers keeping more money in checking is both good and bad for the banker.

• It’s good in the sense that the banker has access to inexpensive funds from checking dollars for lending.

• However, high checking account balances reduce overall service charges on checking, which means less fee revenue for the bank.

The dilemma is that financial institutions want both balances and fee revenue from the checking account.

Consumers aren’t out of recession yet

The Labor Department commonly reports unemployment (U-3) which it bases on workers with no jobs who have actively looked for a job in the last four weeks. The current rate of unemployment (U-3) is 4.9%, which has reached the prerecession levels (before 2008).

However, ask a millennial who has graduated from high school or college since the fall of 2008 and you will likely get a different answer. Millennials—and some economists—believe the U-6 measurement for unemployment provides a clearer picture of the labor market reflective of true economic conditions.

The U-6 unemployment measures workers with no jobs who have actively looked for work in last four weeks, discouraged workers, and part-time/temporary workers who want full-time positions. The U-6 unemployment rate is currently 9.7%, or double pre-recession levels.

Now ask the same millennials what’s in their transaction accounts and you will be surprised at the large amounts in checking and savings. This mirrors the TAM index or consumption. (See chart).

Recession not over for most Americans!

The Federal Reserve fixates on employment and inflation with a strong belief that these measures are only influenced by price. Since Chairman Janet Yellen took office, the money supply has increased at 4.4% annually; normal growth is about 7.4% per year. (See the chart showing average money supply growth since 2009.) Normal money supply growth would have put about $4 trillion more in the economy.

Yellen also ended Quantitative Easing, a good move. QE was a disaster, with only 29 cents out of every dollar injected into the economy ever making it to market. The gap in the chart between actual and normal or average money supply proves the point. This also swelled the Fed’s balance sheet to $4 trillion from an average balance of $500 billion to $800 billion prior to the recession.

How do you budget checking for 2017?

It appears monetary policy will remain stagnant. Fiscal policy will take Congress a year or more to get going. Therefore, checking balances and accounts should reflect 2016 and prior periods, or about a 4% growth rate in balances and accounts.

Based on these projections, here are some points to bear in mind as you work to maintain accounts, balances, and profits:

1. Monitoring imperative. All checking accounts with average balances more than $10,000 need to be tracked weekly or at least monthly for balance and transaction movement. The goal is not to lose a high-balance account.

2. Transactions are also important—especially if they carry interchange.

An account with 40 or more debit card transactions a month can generate about $20 per month in interchange, producing over $200 in revenue per year.

So, even if an account doesn’t have balances but does have high transaction usage, this transaction account may be more important than balances.

3. Tracking cross-sell for each checking account will determine a good transfer pricing process to associate profit from other services arising from the checking account.

Some checking accounts may have small balances and few transactions, but good profitable cross-sell services. It’s important to keep these checking accounts.

Keeping your powder dry in checking

What’s significant is to identify what checking users are important for your financial institution based on high balances, high number of transactions, and services sold. Protect these accounts at all costs.

Key steps to take by year end:

1. Determine a balance level for checking above which checking is profitable.

2. Determine a transaction level which produces enough fees to cover checking cost.

3. Determine the net revenue per service cross-sold.

4. Find your most profitable customers from the first three steps and keep them dry from the competition with lots of attention.

Semper,

Mike Moebs

(Mike will respond to questions at [email protected])

The October-November 2016 Banking Exchange magazine, October/November issue, includes “Could the GDP be wrong?” This article includes an in-depth explanation of Transaction Account Metrics.

Danielle Martorano, senior financial analyst & director of research and J.V. Proesel, director of client services, both at Moebs $ervices, Inc., contributed to this blog.

Tagged under Bank Performance, Management, Lines of Business, Blogs, Community Banking, The Prairie Economist, Feature, Feature3,