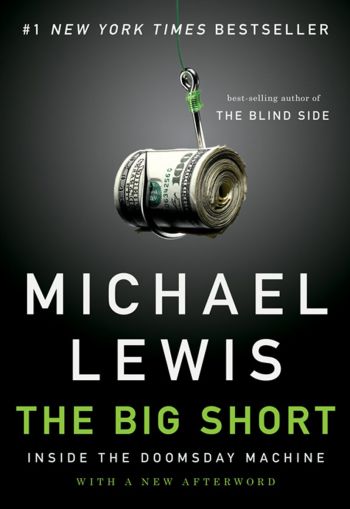

The Big Short: Inside the Doomsday Machine

Book Review: A true tall tale of the wild west style of the subprime mortgage business—and its inevitable demise

- |

- Written by Joe Frederick

- |

- Comments: DISQUS_COMMENTS

The Big Short: Inside the Doomsday Machine. By Michael Lewis. 288 pages W.W. Norton & Company, 2010.

The Big Short: Inside the Doomsday Machine. By Michael Lewis. 288 pages W.W. Norton & Company, 2010.

In financial markets, a “short” is a form of speculation. It rewards the owner when the value of a security falls in value. The owner of the short is anticipating that the current price of an investment is overvalued and a market correction will occur, whereby the owner will gain by a falling price. Michael Lewis’ The Big Short explores the collapse of the subprime mortgage market, its underlying assets, and its derivative securities. Lewis’ account of the subprime mortgage crash is told through the eyes of three maverick hedge fund managers who anticipated the fall of the subprime mortgage market, shorted the market, and were richly rewarded by their actions.

Lewis is no stranger to Wall Street and financial markets. His first book, Liar’s Poker (1980), told of his own four years of experience as a Salomon Brothers trainee. That bestseller criticized Wall Street practices and culture. His new book reads like a murder mystery. Filled with colorful characters too eccentric and flawed to be fictional, it gives a gripping account of the subprime market implosion and how three firms raked in profits in the aftermath.

“Short” cast of characters

The hedge funds that successfully shorted the subprime mortgage market, as described in the book, include:

• Scion Capital, created by Dr. Michael Burry, a prescient, one–eyed medical student with Asperger’s Syndrome, a form of autism. Asperger’s symptoms include intense focus and interest in often esoteric subjects. Burry’s disability was manifested in his thorough reading of the publicly available information in prospectuses of mortgage-backed securities.

• Cornwall Capital Management, a two-man hedge fund in Berkeley, Calif. The firm began trading with $110,000 of the founders’ own savings, in a Charles Schwab brokerage account, with offices, literally, initially, in a garage.

• FrontPoint Partners, where an acerbic and socially challenged former equity analyst with a law degree, whose industry research area included financial firms and mortgage companies, worked in a fund inside a group of funds.

Engineering the “Big Short”

These three companies took various routes to position themselves for what they saw was an inevitable fall of the multibillion dollar subprime mortgage industry. The hedge funds helped create the demand for a type of insurance contract that paid only if the financial instruments insured lost value. Like fire insurance, only a slight premium is paid to insure the value of the entire home and in the event of a total loss, the return on the insurance premium is enormous.

I imply no wrongdoing here. These firms were following their research and beliefs in what was going on in the market. Take the case of Dr. Burry. What Burry did was contact the firms that sold credit default swaps. He wanted to buy credit default swaps on specific mortgage securities. (He hated the bonds and never owned one, he owned the insurance or credit default swaps.) There was no market in that, he was told. So he helped create the necessary documents to make the swaps for mortgage-backed securities doable and purchased insurance against the default of the most flawed mortgage products. The other end of the transaction was AIG, among others,, as recounted in the book, and we know the end of that story.*

The financial machinations can get pretty complex and convoluted. I’m a community banker, mortgage banker, and a Chartered Financial Analyst, and even I found this something I had to get my mind around. Credit default swaps existed for highly unlikely events, something like GE or other AAA-rated company defaulting on their corporate bonds. Unfortunately this cheap form of insurance was applied to pools of investments that carried high ratings they weren’t worthy of. The leading two ratings agencies seemed to be in a competition of laxity, wanting the revenue from Wall Street firms selling mortgage-backed securities. That’s how I understand it went down.

The wrinkle was that the so-called AAA-rated mortgage-backed securities included larger and larger portions of subprime mortgages. In an effort to create more mortgage-backed securities, Wall Street bankers bought higher and higher amounts of subprime mortgages, and sold them to long-term investors.

Mortgage underwriting guidelines were loosened so that formerly unqualified borrowers were given access to large amounts of money to purchase homes at subsidized rates they ultimately could not afford nor repay. These relaxed credit terms also allowed traditional borrowers more options in financing, allowing the borrower to acquire more home for their mortgage payment dollar. Some of the loans had option features, which allowed the customer to merely pay the interest. This was generally based on an artificially low “teaser” rate.

The securities continued to receive AAA ratings, despite the increasing concentrations of subprime assets in the mortgage pools. It was no surprise that these loans were the most fragile and quickest to default.

Lewis provides an easy-to-read narrative to this at-times comic tragedy, simplifying the complexities of the rating agencies, Wall Street firms, and the thousands of people involved in the once very lucrative business of subprime lending. Few of those involved look noble, “financing the American dream,” when the magnitude of financial incentives are exposed by Lewis.

The story will infuriate the public. Unfortunately, community bankers will find they are painted with the same brush as Wall Street investment banks. That’s because Lewis uses the terms “bank,” “Wall Street bank,” and “investment bank” interchangeably.

Gleaning some lessons from Big Short

Yet, putting that aside, Lewis’ book is a great read, and a good reminder of the things that community bankers already know very well and may take for granted. They include:

• Know your customer lending. Banks may have looked stodgy and old school during the mortgage run-up, compared to mortgage lenders who practiced “don’t ask, don’t tell” analysis during the loan application process. Community bankers know that the vast majority of customers buying a home tell the truth, and are prepared to demonstrate a capacity to repay the amount requested. They often look to their banker for guidance in making affordable choices in home financing. The bank doesn’t ask for the documentation of income, assets, and employment because they think the customer is lying, but to prevent any opportunity for doing so.

Mortgage companies which needed to originate loans to sell into the Wall Street mortgage pools weren’t lending with the same burdens of analyzing repayment. The performance of the loans, once they were sold, was largely irrelevant to such originators. When loan repayment isn’t important and loan volume is, the results are very predictable.

• Historical loan loss estimates misrepresent new credit risks. Caution is a virtue and history is no predictor of something that hasn’t occurred, like lending without documentation and relaxing credit standards. You don’t need a degree in calculus to recognize that new risks change the risk profile.

• Good customer service requires a thorough underwriting of the borrower’s request. It also requires asking the uncomfortable questions—ones about debt loads, income diversity, and stability of employment.

In my part of the country, in Milwaukee, for example, a few decades ago working at a brewery was a guarantee of stable employment and good wages. But decades of consolidation and automation changed the brewing industry. Getting answers to debt service ability in extreme scenarios is superior to hope or luck.

• Credit analysis should not be delegated. The subprime mortgage crisis was facilitated by AAA-ratings of the underlying securities. A good banker does his own credit analysis. An old banker once told me, “If I can’t wake up each morning and see a security priced in an efficient and liquid market on my computer or in The Wall Street Journal, I don’t buy it.”

You don’t need a form of autism, like Scion Capital’s Dr. Michael Burry, to do analysis.

• Remember the banker’s role. Lewis quotes the good reminder, “A home without a down payment is just a rental with debt.” Bankers make loans.

Years from now we will be remembering this recent crisis and many other financial crises that began the same way: too much easy money, a need to deploy it, and opportunities that were expedient and unwise. Those who do not learn from the mistakes of history are bound to repeat it.

The Big Short is a history lesson which will benefit the reader.

* Here’s an interesting excerpt from Burry’s own website, www.scioncapital.com:

“Dr. Burry believed the financial system as we know it would collapse in 2008, as the contagion from the subprime meltdown in 2007 would not be contained. He also believed the government would intervene, but that any possible government intervention would have uncertain effect. As a result, Dr. Burry liquidated his credit default swap short positions by April of 2008, and he did not benefit at all from the taxpayer-funded bailouts of 2008 and 2009. Not one penny.”

If you'd like to review books for our online book column, or have recently read a book that you found helpful that we haven't already reviewed, please e-mail [email protected]

Want more banking news and analysis?

Get banking news, insights and solutions delivered to your inbox each week.

Tagged under Books for Bankers,