Carney Joins Brookfield for SRI Funds Push

The former central bank governor will lead the development of social and environmental themed funds

- |

- Written by Banking Exchange staff

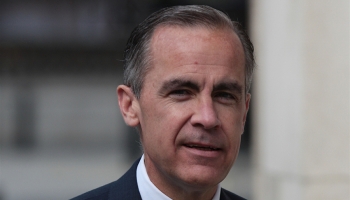

Mark Carney, Brookfield Asset Management

Mark Carney, Brookfield Asset Management

Former Bank of Canada and Bank of England governor Mark Carney has joined Brookfield Asset Management to help launch a range of funds specialising in social and environmental outcomes.

Carney has been appointed vice-chair and head of ESG and impact fund investing at the Toronto-headquartered asset manager. It is his first new position since he left the Bank of England earlier this year.

In a statement announcing his appointment, Brookfield said Carney would oversee the development of products that “combine positive social and environmental outcomes with strong risk-adjusted returns for investors”.

Carney said: “With an accelerated transition to a net zero economy imperative for climate sustainability and one of the greatest commercial opportunities of our time, I’m looking forward to building on Brookfield’s leading positions in renewable energy and sustainability to the benefit of its investors and society.”

Bruce Flatt, CEO of the $550 billion asset manager, added: “Building on our track record in renewable investing, Mark will help accelerate our efforts to combine better long-term outcomes for society with strong risk-adjusted returns. Mark’s insights and perspectives will add tremendous value to our global investing activities for the benefit of our investors.”

Brookfield specializes in alternative asset classes such as real estate, infrastructure and private equity. It has a dedicated renewable energy investment business, which it claims is the largest in the world with $52 billion in assets across more than 5,000 power generating facilities in North and South America, Europe, India and China.

Renewable energy has been growing in popularity in recent years. In April 2019, it outpaced coal in providing 23% of US power generation, compared to 20% for coal, according to Deloitte.

Data from Statista showed that annual investment into renewable energy sources in the US exceeded $45 billion from 2015 to 2018, while Bloomberg research estimated that 2019 total US investment in renewables totalled $55.5 billion, boosted by companies and investors rushing to take advantage of tax credits before they were scaled back.

Carney has been a leading global advocate for climate change action for many years. He was appointed as the United Nations’ special envoy for climate action and finance in December 2019 and has made a number of powerful speeches calling for co-ordinated action from governments and private sector organizations to address the impacts of climate change.

Carney, a former Goldman Sachs executive earlier in his career, was governor of the Bank of Canada from 2008 to 2013, and of the Bank of England from 2013 until 2020. He has also served as chair of the Financial Stability Board, vice-chair of the European Systemic Risk Board, and is a member of G30 and the Foundation Board of the World Economic Forum.

Tagged under Buyside Exchange, Socially Responsible Investing, SRI, ESG,

Related items

- CRS Report Highlights Regulatory Obstacles for Pension Plans

- Private Equity Managers Urged to Adjust Value Creation Approach

- Russell Investments warns of long-term risks of soft-landing optimism

- Private asset performance remains below historical averages

- GSAM Finds Reasons for Optimism for DB Pension Funds in 2024