A liquidity stress scenario you may not have considered

Is your bank prepared for economic recovery?

- |

- Written by ALCO Beat

By Darnell Canada, managing director, Darling Consulting

Think back to the wonderful tech boom of the 1990s. Stock valuations in the technology sector grew at unprecedented speeds, based not on strong fundamentals, but on pure speculation, exacerbated by online investing.

The shoeshine guy was happy and jovial, even going so far as to offer investment advice to the same executives who may have been running the companies he coveted.

Over the past few years, that same shoeshine guy has been glum, often sitting alone in the chair that should be occupied by patrons.

More recently, we are finding that old strong spirit return, so we are inclined to believe that there may be some merit to the idea the economy is shifting to a higher gear.

How high? Who knows? In any case, banks should take notice.

Regulatory pressure has forced all community banking institutions alike to draft, develop, and implement comprehensive liquidity plans, regardless of financial condition. No longer is it acceptable to only monitor simple Canary Reports saturated with traditional liquidity ratios (e.g. Volatile Dependency, Loans/Deposits, Short-Term Investments/Assets, etc.). Banks need to develop a deeper understanding of their funding posturing by tracking and understanding:

• Core liquidity components (cash and equivalents)

• Qualifying collateral volumes, available borrowing channels, and related borrowing conditions

• Strategic funding reserves

• Contingency liquidity alternatives

Further, banks are charged with the responsibility of also understanding how loan and deposit growth will impact each of the above items in the future. And lastly, regulatory doctrine now require banks to stress-test liquidity projections to ensure adequate liquidity protection exists to sustain operations under “worst case” conditions. These “worst case” conditions may include downgrades in asset quality, depleted capital, net reductions in deposit balances, or loss of funding support from the street.

Interestingly, few banks consider the notion that their “worst case” scenario might result from an economic recovery and renewed success in the banking industry.

I find it interesting to speak with economists about their practice because their outlooks often vary so much and they all have their own special set of predictive indicators for economic and market activity. A few of my colleagues and I share our own special market indicator: the temperament of shoeshine men throughout the airports we travel.

Think back to the wonderful tech boom of the 1990s. Stock valuations in the technology sector grew at unprecedented speeds, based not on strong fundamentals, but on pure speculation, exacerbated by online investing.

The shoeshine guy was happy and jovial, even going so far as to offer investment advice to the same executives who may have been running the companies he coveted.

Over the past few years, that same shoeshine guy has been glum, often sitting alone in the chair that should be occupied by patrons.

More recently, we are finding that old strong spirit return, so we are inclined to believe that there may be some merit to the idea the economy is shifting to a higher gear.

How high? Who knows? In any case, banks should take notice.

Regulatory pressure has forced all community banking institutions alike to draft, develop, and implement comprehensive liquidity plans, regardless of financial condition. No longer is it acceptable to only monitor simple Canary Reports saturated with traditional liquidity ratios (e.g. Volatile Dependency, Loans/Deposits, Short-Term Investments/Assets, etc.). Banks need to develop a deeper understanding of their funding posturing by tracking and understanding:

• Core liquidity components (cash and equivalents)

• Qualifying collateral volumes, available borrowing channels, and related borrowing conditions

• Strategic funding reserves

• Contingency liquidity alternatives

Further, banks are charged with the responsibility of also understanding how loan and deposit growth will impact each of the above items in the future. And lastly, regulatory doctrine now require banks to stress-test liquidity projections to ensure adequate liquidity protection exists to sustain operations under “worst case” conditions. These “worst case” conditions may include downgrades in asset quality, depleted capital, net reductions in deposit balances, or loss of funding support from the street.

Interestingly, few banks consider the notion that their “worst case” scenario might result from an economic recovery and renewed success in the banking industry.

Looking at liquidity today

Liquidity for bank balance sheets is directly related to the gap between deposit growth and loan growth. It improves when the delta is positive and falls when the delta is negative. The degree to which this occurs depends on loan composition and related collateral qualifications, as well as deposit-related pledging requirements (i.e. municipals and commercial repos).

Presently, banks feel confident with their funding position because loan portfolios continue to shrink and deposit balances grow. In fact, many are attempting to reduce liquidity in the current marketplace to help mitigate downward pressure on margin levels.

It’s an understatement to say deposit growth was strong during the financial crisis that began in 2007-2008.

While some of this growth can be attributed to successful business development strategies, banks would be unwise to ignore the fact that retail and commercial customers increased average balances to protect their own balance sheets during the economic downturn.

Hence, growth experienced over the past few years is not fully sustainable.

Liquidity for bank balance sheets is directly related to the gap between deposit growth and loan growth. It improves when the delta is positive and falls when the delta is negative. The degree to which this occurs depends on loan composition and related collateral qualifications, as well as deposit-related pledging requirements (i.e. municipals and commercial repos).

Presently, banks feel confident with their funding position because loan portfolios continue to shrink and deposit balances grow. In fact, many are attempting to reduce liquidity in the current marketplace to help mitigate downward pressure on margin levels.

It’s an understatement to say deposit growth was strong during the financial crisis that began in 2007-2008.

While some of this growth can be attributed to successful business development strategies, banks would be unwise to ignore the fact that retail and commercial customers increased average balances to protect their own balance sheets during the economic downturn.

Hence, growth experienced over the past few years is not fully sustainable.

What’s coming, then?

Commercial clients will begin to deplete operating balances as capital investing unfolds. Larger deposit customers are likely to allocate more of their portfolios to equities and mutual funds as expected returns rise. And the savings rate for the average household will likely decline as job security is more certain.

At some point during this economic recovery, these “parked” monies will leave bank balance sheets … but wait!

Commercial clients will begin to deplete operating balances as capital investing unfolds. Larger deposit customers are likely to allocate more of their portfolios to equities and mutual funds as expected returns rise. And the savings rate for the average household will likely decline as job security is more certain.

At some point during this economic recovery, these “parked” monies will leave bank balance sheets … but wait!

Beginnings of a shift…

It appears depositors have already begun to modify their balance sheet tactics.

With the exception of the third quarter of 2010, during the well-publicized crisis in Portugal, Italy, Greece, and Spain, monthly aggregate deposit balances have been trending sideways since the end of 2009, as shown below in Exhibit 1.

EXHIBIT 1

For a larger version of this illustration, please click here or on the image.

Source: Bloomberg

It appears depositors have already begun to modify their balance sheet tactics.

With the exception of the third quarter of 2010, during the well-publicized crisis in Portugal, Italy, Greece, and Spain, monthly aggregate deposit balances have been trending sideways since the end of 2009, as shown below in Exhibit 1.

EXHIBIT 1

For a larger version of this illustration, please click here or on the image.

Source: Bloomberg

This trend has not been a concern for most since there is no need to gather raw material deposits when loan growth is sluggish and investment yields remain at historically low levels. In fact, many banks are moving to reduce liquidity by pricing deposits to encourage lower average balances, taking on more credit and/or duration risk in their investment portfolio or reallocating bond cash flows to support what little loan growth does materialize.

This achieves two key objectives for bank balance sheets. First, it helps to preserve tangible leverage capital. Second, it lowers costs and/or strengthens average asset yields in an effort to maintain/strengthen margins.

However, we suggest your bank’s ALCO contemplate and examine the degree to which long-term funding flexibility may be impacted.

Remember, liquidity used today will make it more difficult to support lending activity tomorrow.

While aggregate loan balances continue to be on a decline, the rate of decline is clearly abating (see the table below). Eventually, loan portfolios will begin to grow, likely with more attractive origination rates and higher profit margins than attainable in the current low-rate environment.

Only banks that have adequate funding flexibility will be in a position to take advantage of those opportunities.

This achieves two key objectives for bank balance sheets. First, it helps to preserve tangible leverage capital. Second, it lowers costs and/or strengthens average asset yields in an effort to maintain/strengthen margins.

However, we suggest your bank’s ALCO contemplate and examine the degree to which long-term funding flexibility may be impacted.

Remember, liquidity used today will make it more difficult to support lending activity tomorrow.

While aggregate loan balances continue to be on a decline, the rate of decline is clearly abating (see the table below). Eventually, loan portfolios will begin to grow, likely with more attractive origination rates and higher profit margins than attainable in the current low-rate environment.

Only banks that have adequate funding flexibility will be in a position to take advantage of those opportunities.

For a larger version of this illustration, please click here or on the image.

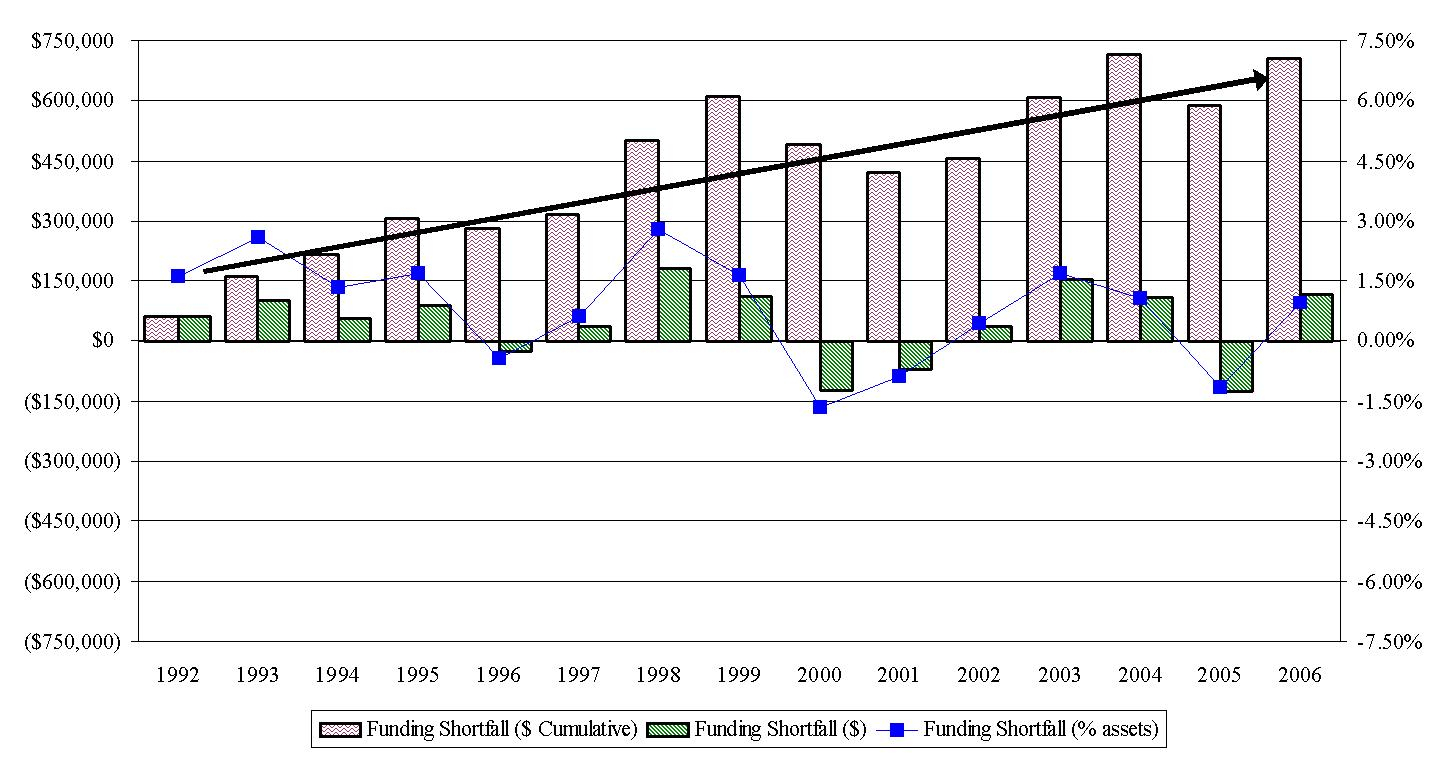

While we observed only modest average annualized funding shortfalls (deposit growth less loan growth) during the last period of sustained economic expansion, the cumulative effect and related impact on investment portfolios and wholesale funding levels played a significant role in determining survival or failure for many banks over the past three years (see Exhibit 2).

The related growth in wholesale funding levels, in particular brokered deposits, has also contributed to a series of painful exams for many bankers as well. We can expect this imbalance to resurface as the economic recovery gains traction and more cash in the system is allocated to capital investment and consumption.

Loan activity will increase; parked monies will fall off balance sheets; and the competitive landscape for new deposit relationships will be considerably more expensive. This liquidity risk is exacerbated to the degree that bond cash flows slow/extend and borrowing capacity diminishes due to higher interest rates and depreciating collateral values.

The related growth in wholesale funding levels, in particular brokered deposits, has also contributed to a series of painful exams for many bankers as well. We can expect this imbalance to resurface as the economic recovery gains traction and more cash in the system is allocated to capital investment and consumption.

Loan activity will increase; parked monies will fall off balance sheets; and the competitive landscape for new deposit relationships will be considerably more expensive. This liquidity risk is exacerbated to the degree that bond cash flows slow/extend and borrowing capacity diminishes due to higher interest rates and depreciating collateral values.

For a larger version of this illustration, please click here or on the image.

Source: FDIC SDI database

Implication of the shift for ALCO management

The ability of banks to profitably address these longer-term liquidity risks will be determined by their ability to interrelate the strategic plan for core business growth with their current and projected goals for liquidity (volume, composition, and reliability).

Lastly, it would be prudent to acknowledge that over the last economic expansion banks were able to make substantial use of wholesale funding markets to help fill liquidity gaps.

It would be easy to assume that this strategy will be employed once again.

However, banks should note that each regulatory body has made it very clear that they will be more highly critical of those tactics in the next business cycle. So proceed with caution, especially if history shows that borrowing and brokered funding strategies were a material part of your liquidity strategy in the past.

A wise man once said that “failing to plan is planning to fail.”

Banks would be wise to give contingency liquidity planning more attention than they have in the past.

The shoe shine man has been right before.

Oddly enough, I am both encouraged and worried that he may be right again.

ABOUT THE AUTHOR

Darnell Canada is managing director at Darling Consulting Group, Inc., and has been with the firm since 1996. He works extensively with community banks and is a speaker and active educator, participating in a wide range of educational programs, including ABA’s Stonier School of Banking. Prior to joining the firm, Canada was an FDIC safety and soundness examiner.

The ability of banks to profitably address these longer-term liquidity risks will be determined by their ability to interrelate the strategic plan for core business growth with their current and projected goals for liquidity (volume, composition, and reliability).

Lastly, it would be prudent to acknowledge that over the last economic expansion banks were able to make substantial use of wholesale funding markets to help fill liquidity gaps.

It would be easy to assume that this strategy will be employed once again.

However, banks should note that each regulatory body has made it very clear that they will be more highly critical of those tactics in the next business cycle. So proceed with caution, especially if history shows that borrowing and brokered funding strategies were a material part of your liquidity strategy in the past.

A wise man once said that “failing to plan is planning to fail.”

Banks would be wise to give contingency liquidity planning more attention than they have in the past.

The shoe shine man has been right before.

Oddly enough, I am both encouraged and worried that he may be right again.

ABOUT THE AUTHOR

Darnell Canada is managing director at Darling Consulting Group, Inc., and has been with the firm since 1996. He works extensively with community banks and is a speaker and active educator, participating in a wide range of educational programs, including ABA’s Stonier School of Banking. Prior to joining the firm, Canada was an FDIC safety and soundness examiner.

Tagged under Management, Financial Trends, Risk Management, ALCO, ALCO Beat,