Handling generational shifts

Book Review: Guide to smarter demographic analysis leaves reader with questions

- |

- Written by Andy Schornack

- |

- Comments: DISQUS_COMMENTS

Upside: Profiting From the Profound Demographic Shifts Ahead. By Kenneth Gronback with M.J. Moye. AMACOM. 276 pp.

Upside: Profiting From the Profound Demographic Shifts Ahead. By Kenneth Gronback with M.J. Moye. AMACOM. 276 pp.

Business is a numbers game. Everything is supply and demand. Understanding demographics is part of how businesses fathom what’s happening, and what could happen.

The topic driving Kenneth Gronbach’s recent book, written with M.J. Moye, Upside: Profiting From The Profound Demographic Shifts Ahead, is a very interesting one for a banker today. Gronbach, as both demographer and marketer, works to show how counting people and following their lifecycles will help you and your business harness the tsunamis and sinkholes ahead. Through a few examples and personal experiences, the book pulls you through these opportunities and challenges.

Looking at the generations

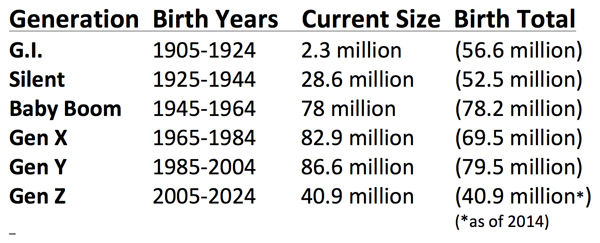

The book starts with an initial review and extensive refresher on the definition, make-up, location, and size of the generations as of 2014. Here’s the data on the size of the generations as of then, with their original size, by births, in parentheses:

(As bankers, you are doing the math and scratching your head. The authors explain the growth in Gen X and Gen Y over birth totals by pointing to immigration, noting that nearly 16% of the U.S. population immigrated to this country.)

Knowing your market

A major lesson throughout the book is to constantly update the addressable market data on the products in your business.

A particular example Gronbach uses to demonstrate the impact of these generational lifecycle shifts is the falloff in sales of Japanese motorcycles in 1992. Gronbach indicates that advertisers and the companies did not foresee the Baby Boomers exiting the critical age bracket of 16-24-year-old men who buy motorcycles and the 11% smaller (in native births) Gen X entering.

Citing the difference in birth numbers between the generations, the book states: “That’s a lot of people. It is almost equivalent to the population of Serbia.”

Similarly, in 2016, the book also indicates how Mattel also missed accurately sizing the Barbie market, as the 5-7 age group shrank 7% from 2012 to 2015.

The book notes that news reports did not relate slowing sales to a smaller addressable market, but instead advanced such theories for the slowdown as the toymaker falling out of touch with the market.

Even Mattel management bought into that idea.

“No one,” the book states, “seemed to even consider that just maybe there might be fewer potential customers. … Going forward, I don’t care how many changes Mattel makes to Barbie in an effort to make her more compelling to consumers, because that’s not going to change the fact that Mattel’s core customer base is getting smaller.”

The authors also outline that the growth today and likely into the future will be in the South, as critical mass and growth favor those states. This, coupled with “a favorable cost environment and fully developed and reliable infrastructure creates a perfect storm.”

As a result, the author concludes that this market of the country will see stronger GDP growth and success for businesses and individuals in the region.

Good overview, few original conclusions

Unfortunately, as the reader works through the book, authors Gronbach and Moye do little to drive original conclusions as they outline potential investment opportunities and impacts of the shifting demographics. Assisted living, funeral homes, healthcare, housing, technology, et, are all common investment themes for the Baby Boomer and Gen Y generations.

The disclosures provided prior to and after company ideas, and the consistent reassurance to the reader of Gronbach’s expertise and successes are also over-done. A particular item of concern on the investment successes is that the results do not have a consistent time frame. They appear to be cherry-picked examples with varying unsupported end dates.

In the end, the authors could have provided more value to the reader by showing more unique examples of demographic ripples occurring that are not commonly talked about by the mainstream media or investment houses.

Instead of broad topics, digging into more defined, niche areas that have seen a major movement over the past decade would have allowed readers to develop a better roadmap to mastering the art and science of managing the demographic shifts in their own businesses.