The cross-selling challenge: How to win the race

Management needs to understand what strategy it’s using

- |

- Written by Mike Moebs

- |

- Comments: DISQUS_COMMENTS

Mike Moebs, "The Prairie Economist," recently compared bank cross-sell ratios to credit union results and found lessons for all depository institutions.

Mike Moebs, "The Prairie Economist," recently compared bank cross-sell ratios to credit union results and found lessons for all depository institutions.

Cross-selling is a conundrum for nearly all banks and credit unions. For financial institutions, the challenge is a far cry from “You want fries with that?”

Financial institutions generally approach cross-selling in two ways.

In the first, a financial institution will have front-line people in a branch or on-line who multitask with tellering, servicing, and selling.

The alternative approach, at its extreme, is similar to the Wells Fargo cross-sell strategy. A financial institution will have designated sales representatives who are provided financial incentives and goals to cross-sell several services. In the case of Wells Fargo, this was a “take no prisoners” approach—as long as the bottom line was met. We know how that turned out.

How is cross-selling going?

My blogs in October 2016, “Weighing your options for cross-selling,” and “Do’s and Don’ts when selling financial services” received such a large response by executives at banks and credit unions that I collaborated with Danielle Martorano, head of research at Moebs $ervices, to further examine and determine the current state of selling in all depositories.

The following results and findings are from our 2017 Cross-Sell Study.

Our initial step was to compile the total number of accounts and the total number of customers or members from call reports for all banks and credit unions. We completed a comprehensive, statistical survey of 3,817 banks and credit unions in January 2017 to verify information compiled from the call reports.

The results helped us identify cross-sell ratios (total number of deposit and loan accounts divided by total number of customers or members) for all financial institutions (Definitions of what constitutes a service differ, of course. This study just took the basic accounts reported as the services provided)

Cross-selling benchmarks—and banks versus credit unions

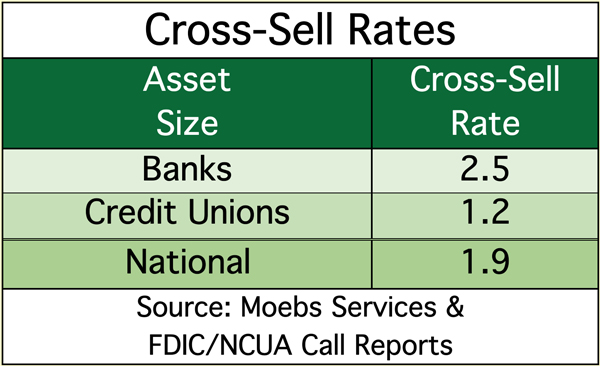

Overall, as the chart shows, all depositories, taken in total, sell 1.9 services (total deposit and loan accounts), or almost two per customer/member. Banks definitely outsell credit unions, selling 2.5 services to 1.2.

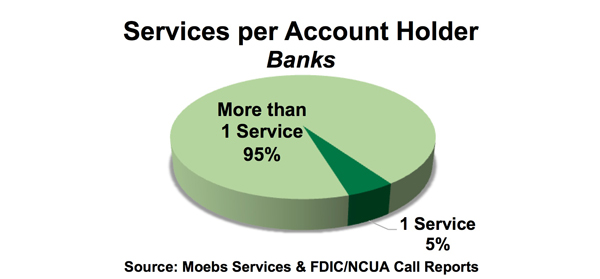

In many respects, banks are actively selling, whereas credit unions appear to rely heavily on mass marketing or word of mouth to drive the sale.

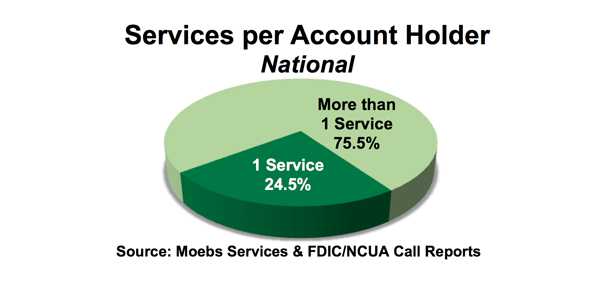

The numbers in the two pie charts below really depict the story: 95.0% of the banks sell more than one service, while the credit unions are split. On the other had, 56.6% of the credit unions sell more than one service, while the rest just fulfill the efforts of marketing both directly and indirectly.

So, is it wrong if 43.4% of the credit unions and 5.0% of the banks don’t actively sell?

These financial institutions more than likely rely on frontline multitaskers. This means two if not all three of the following are done by each employee: tellering, servicing, and selling—but the “selling” really amounts to availability for taking orders.

For many of these institutions, focusing on tellering and efficiently opening new services driven in the door by marketing efforts is an appropriate and effective approach, especially if it can be done efficiently.

Many depositories with less than $500 million in assets do not have the resources to train, support, and maintain dedicated sales specialists. So, for those organizations, being a good order taker is just fine.

These financial institutions focus resources on marketing strategies to get the customer or member into the branch or on contacts made via outbound calling campaigns.

Some financial institutions will incorporate a live online chat feature on their websites to address questions from current or prospective consumers. In these cases, no matter if branch, phone, or internet, multitasking employees can be the most efficient way to handle the prospect or existing user.

If you want sales, do you enable sales?

This is the apparent way things work. A question is, is this always by design or do some executives expect sales performance that they are not equipping their organization to deliver?

The problem is when employees are trained for multitasking, their sales skills are diluted. That’s at best. Often, they lack time to actively sell and also lack skill to close the sale. Or the organization can’t maintain large enough branch staffs to make specialization practical or possible.

In these resource dependent circumstances, being a good fulfiller of orders fits just right. If management wants more, it must provide the missing resources.

Honestly assess your institutions circumstances

Ultimately this is the key to solving the cross-sell puzzle. Here are some key points for consideration to help address and solve the cross-sell puzzle:

1. Know what you want to do. Can you afford to give people the time and skills to sell?

2. There is nothing wrong with good order fulfillment. It is critical with this approach to have a solid, honed marketing strategy in place and to promote your message efficiently across multimedia.

Especially vital is establishing a good website that’s monitored and updated frequently to promote your services and act as a selling tool to fulfill the marketing message.

Remember, in this strategy, your promotion is doing the heavy lifting.

3. Pay for what you expect. Whether a person is multitasking or selling, they must be properly compensated for what they are doing.

4. Anticipate your evolution. Organizations content with the ultimately passive order-taking approach may in time wish to shift gears. Then it will be time to transition to a full-time cross-selling approach, when you have the capacity and desire for more than 1 service per prospect, or 2 or more services per accountholder.

Semper,

Mike Moebs

(Mike will respond to questions at [email protected])

Danielle Martorano did all the research and data analysis for this blog.

Tagged under Bank Performance, Management, Lines of Business, Blogs, Community Banking, The Prairie Economist, Feature, Feature3,