Banks Must Rapidly Seize The New Digital Reality

“Digital sales have increased to 75% of total sales from 25% earlier in the year..."

- |

- Written by John Rodgers and Rajeev Aggarwal

For many years, banks have been on a digital journey to improve service and efficiency, but success has wildly been varied – customer adoption hasn’t universally achieved the desired levels impacting cost efficiency.

Covid-19 has provided a shock to their system which changed the dynamic and made it clear that inertia was not an option. Digital adoption has rapidly increased at the expense of physical channels. As the CEO of a bank highlighted “Digital sales have increased to 75% of total sales from 25% earlier in the year, and they have achieved a shift in customer behavior which would have taken 10 years in 2 months.” Concurrently, the work environment has also dramatically changed—employees can and want to continue working remotely.

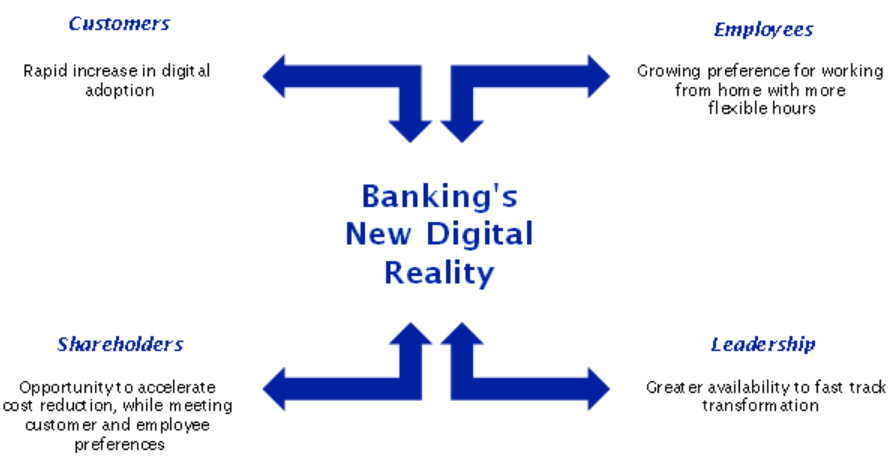

This presents banks with an opportunity to capitalize on these trends by accelerating digitization and cost reduction. Such transformation can be fast tracked, especially as leadership, having understood first-hand its benefits, will back initiatives to drive this change with far greater conviction.

This is banking’s new digital reality. With all the stakeholders, i.e. customers, employees, shareholders, and leadership, all aligned around this mutual goal, banks have a window of opportunity to react rapidly and lock in this digital adoption, thereby avoiding reversion to the old world.

Customer and Employee Preferences have Changed

The current environment has shifted customers online for convenience and safety at a faster pace than ever with greater than 27% more likely to use digital channels.

The current work environment has forced the pivot of traditional office and call center roles into work from home positions, resulting in several positive developments. The technology has been stress-tested, and employees have enjoyed the work from home experience. Indeed, 66% of these employees would prefer to carry on working more remotely. Likewise, 70% of employees who have been permitted more flexible hours during Covid-19 would like to continue working in this manner.

From an employer perspective, this environment has resulted in a more flexible, engaged workforce that can provide extra availability to customers and management alike for specialist as well as routine activities. In addition, Banks can now access new talent pools leading to a more skilled workforce.

Now is the Time to React and Lock in These Changes in this Window

Banks need to embrace the customer and employee changes to make this an inflection point for the new digital reality. There are four key priorities for banks:

- Accelerate channel and process digitization – Banks are already driving digitization of customer journeys and processes. When properly executed, digitization rapidly reduces process turnaround time, enhances customer experience, and improves efficiency. For example, you can open a new account in minutes, as opposed to multiple days. To further accelerate progress chatbots could be utilized to answer any questions regarding product and account information, apps featuring gamification to help customers meet an investment or savings goals could be offered, and video consultations should be available to provide regulated advice.

- Rationalize the footprint – Rapidly accelerate office consolidation, given the new working from home environment, to drive real estate savings. Evaluate branch format, size, and location with the current environment in mind and adjust accordingly

- Optimize supplier spend and model – Renegotiate supplier contracts for added flexibility and cost arbitrage. Reevaluate the supplier model and capabilities for which third parties could be leveraged.

- Capitalize on the changing work environment. Invest in mechanisms to ensure employees remain connected and motivated over the long term, while working remotely. Leverage technology to ensure staff is efficiently utilized while releasing excess capacity. Develop KPIs and metrics to ensure high-quality customer service and productivity.

It is critical for banks to react rapidly in this window to lock in this change now.

Driving Remote Transformation Takes Discipline

Delivering transformation under normal circumstances is hard. In today’s remote environment, that difficulty is amplified. In our experience of driving both large scale global transformation and smaller changes in this environment, success requires a calculated approach that considers both people and process – higher focus on people dimensions; robust discipline across the process of change delivery, supplemented with collaborative technology. Being flexible and adapting quickly is key.

|

People Factors |

Process Factors |

|---|---|

|

Display strong and decisive leadership: Define what goods look like and take steps toward achieving it |

Prioritize ruthlessly at all levels: Evaluate alignment with strategy and ROIs across the portfolio and specific projects to ensure resources are optimally deployed. |

|

Demonstrate compassion to Customers and Employees: Focus on well-being, embrace work-life balance and ensure inclusiveness |

Ensure robust program management: Establish clear activities, set timelines, and track progress to drive success and accountability. |

|

Deliver frequent and transparent communications |

Have daily standups to get the team aligned on what everyone is working on day to day. Our teams will typically do two or three standup meetings a day depending on the time deadlines of current work, so the team can operate in an agile manner. |

|

Drive horizontal as well as vertical alignment |

Use video as much as possible when talking with your team to maintain connectivity between team members and to limit opportunity for distractions. This encourages focus and engagement for the duration of team meetings. Use cloud-based collaboration tools like Teams, Webex, or Mural to share materials live during meetings. Using these tools with careful preparation and facilitation, we have run large multi-geography workshops to map processes and deliver digital transformation training. |

|

Nurture culture virtually |

In crunch periods, keep an open phone or video line to allow for rapid, real-time collaboration, similar to sitting in a conference room and working on a critical deliverable. |

|

Recognize achievements |

Keep any chat platforms you use at work, e.g. Teams or Skype for Business, active at all times to allow for quick “pings” in the event of questions or a quick connection. |

|

Develop and source new skills needed to succeed in the new world |

Over-emphasize good team and meeting hygiene: send agenda and meeting materials in advance, take detailed notes and send out a meeting synopsis and next steps. |

The companies who will succeed are those who are rapidly embracing the change in customer and employee behavior, exercising discipline, and building operating models with agility and flexibility. These leaders are already working on what they need to do to improve their outcomes, and with it, grow market share.

Customer research provided by Consumer Intelligence: Sample = 1,045, May 2020

About the Authors

John Rodgers is COO & Managing Partner of SSA & Company. He guides day-to-day operations, sets and steers SSA & Company’s business strategy, and oversees the Financial Services, Insurance, EMEA, and Healthcare practices.

Rajeev Aggarwal, Head of Financial Services, UK, SSA & Company, leads SSA & Company’s UK Financial Services practice and serves clients based in Europe, as well as global institutions with operations in Europe.

Tagged under The Economy, Technology, Financial Trends, Tech Management, Online, Mobile, Feature3, Feature,