Innovation in Banking

How to Ideate, Iterate, and Deliver the future

- |

- Written by Antonina Skrypnyk, Client Partner at SoftServe

To stay relevant and connected with customer needs, banks must constantly evolve through innovation. Customers expect highly personalized experiences and real-time transactions across multiple interactive devices. This need for on-demand and bespoke service drives banks to adapt new business models and invest in the latest technology to stay engaged with customer needs.

While banks recognize innovation as a need, many projects fail prior to launch. Lack of a unified vision, siloed communication, disparity among stakeholders, and inadequate planning are some of the key reasons innovation fails across an entire business. In order to successfully transform, banks must first identify where a bank’s innovation stands in relation to the bank's primary pain points and business needs.

This puts banks in a position to decide what type of innovation to invest in and create a universal plan for change. Then they should ideate through inter-departmental collaboration, iterate and incorporate feedback, before introducing new ideas to the market.

Innovation in Many Forms

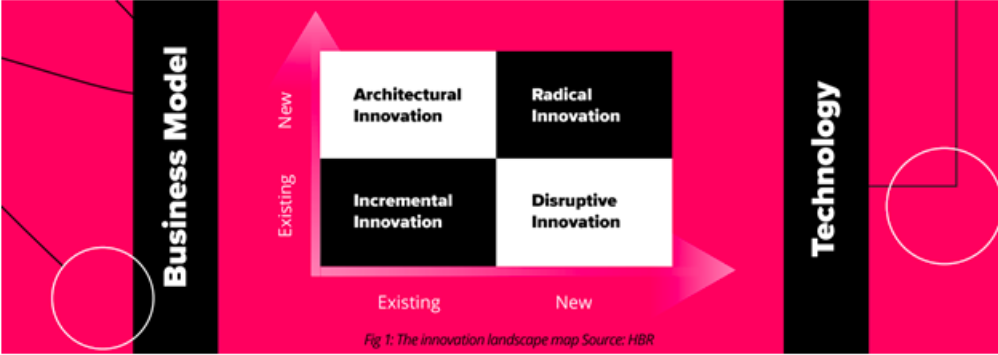

Determining where to innovate begins with an assessment of internal needs for technology versus business model evolution.

Fig 1 shows a landscape map characterizing innovation along two dimensions: change in technology and a change in business model.

Let’s look at the four innovation types in detail:

- Incremental—this is the most common type of innovation and uses technology to increase a customer’s value (i.e. features, design changes, and more) within an existing business model. Example: Instead of customers waiting in line to talk with human tellers at bank branches, Chase Bank installed self-serve teller kiosks in many branches, allowing customers to quickly help themselves.

- Disruptive—involves applying the latest technologies and processes to a bank within an existing business model. Example: Apple Pay via Apple Watch allows customers to pay for goods and services—mobile banking creates frictionless com

- Architectural—is used to apply learned lessons, skills, and processes to a different business model by combining technological and business model disruptions. Example: With the Habito app customers can apply for a mortgage and receive a decision within minutes instead of days or weeks, and then visit the physical branch to sign legal documents.

- Radical—the most disruptive type, radical innovation creates trends via revolutionary technology. Example: Blockchain technology replaces and improves current financial fraud prevention methods.

Banks must assess innovation type against readiness for change and available resources. Banks should start with incremental change because this model requires a relatively low internal disruption. Inherently FinTechs, however, are better suited to radical change, going after progressive markets. For instance, BBVA uses the incremental innovation strategy and consistently focuses its efforts on making banking products easier to use than a competitor's and provide a seamless banking experience across all its channels.

Innovation should be approached with a clear plan and structure to manage ideas from the outset. Banks must envision the future state and create a comprehensive but flexible plan to achieve this end. The plan must include stakeholders, resources, required systems and processes, milestones, and contingency protocols. A cohesive, well-communicated plan helps to ensure budget is not reallocated elsewhere prior to project completion. Not all the details need to be secured from the onset of an innovation project, but the plan's framework should be established so details can be added as the idea takes form.

Changing Focus

As challenges related to the introduction of new banking products and services are solved, new issues may emerge. Because of these new issues, banking executives need to adopt flexibility as activities and focus of a project could change over time. Banking executives need to consider key objectives for innovation, including the correct audience, end goals, and how progress or transformation is likely to be tracked and optimized throughout the project. Banks must solicit inputs from both internal and external stakeholders (i.e. consultants, advisors), and customers as a third-party vantage point may provide crucial insights unseen from a limited internal perspective.

Changing Ownership

The management may change over the course of a project as needs arise. When a key decision maker (i.e. CIO, CDO, or COO) leaves, there needs to be a smooth handover of ownership and responsibility with new members. Banks need to create a contingency plan for such a change. By documenting the project and planning for change, banks are best placed to bring new team members up to speed.

Once the type of innovation has been determined and the plan’s structure is in place, banks must begin ideation.

Ideating on Innovation

Misalignment with customer needs, siloed departments, and internal complacency form barriers to innovation. The ideation process confronts these obstacles through customer-focused methodology and a collaborative framework.

Empathize with design-thinking

A successful ideation process begins with a shift in perspective—identifying and addressing customer pain points is best accomplished through adopting an empathetic, design-thinking approach. Banks must step into a customer’s shoes to determine what they're struggling with and why, before finding the appropriate solution—this is the basis of design thinking. By leveraging design-thinking principles and practices, banks can create processes, products, personalized interactions, and more to enhance a customer's experience.

For example, Monzo, a UK challenger bank with over 2M customers, has been successful in digitally transforming the banking industry in a similar way Airbnb has done for the hospitality industry. The bank’s expansive growth rate is largely due to adopting an empathetic, customer-centric approach when designing customer experiences and products. With innovative features including instant categorizing of transactions and advising customers on real-time spend, Monzo has disrupted an industry by listening to customer feedback.

Collaborate with transparency

The purpose of the ideation process is to gather ideas, with the best ones often emerging from interdepartmental group collaboration—merging individual ideas with group exercises leads to a higher quantity and quality of ideas. Commencing an ideation session with an individual contribution provides the opportunity for thoughts to be shared and heard in an open forum. These ideas are captured, providing fuel for the subsequent group session.

Successful ideation is dependent on establishing a framework for stakeholders to safely and securely collaborate and co-create, contribute, and develop ideas. During the ideation phase, banking executives should align teams globally and ensure project-related responsibilities, systems, and structures are clearly assigned and everyone works with full transparency, irrespective of location. As part of the ideation process, hackathons can be facilitated by banks to allow business-minded team members to collaboratively investigate market potential ideas in a workshop environment while cultivating and maintaining an innovative spirit.

Ideas are selected by gathering detailed information from key stakeholders to enable evidence-based decision-making. Using an agile ‘fail-fast’ approach to uncover insights, banks can easily transform the idea into a solid value proposition. Key assumptions of the ideas are validated with stakeholders as quickly as possible using short sprints, by gathering and validating further information about the idea.

Participants should select and agree on two ideas—one final and one backup idea should the main idea fail because of budget constraints, ownership change, or if requisite system changes that haven’t been considered upfront.

Iterate to Track and Fail-Fast

Once a winning idea is agreed upon, innovation progress is heavily dependent on a bank's ability to iterate with an agile and fail-fast mindset and incorporate outside-in collaboration. This iterative approach helps banks validate proof of concepts (PoCs), collect feedback, and incorporate changes into design, prior to implementation, as this is widely acknowledged as the most expensive stage of innovation. Getting this stage wrong before implementing can present many challenges, not least an overspend in budget.

Working in iterations allows banks to gain transparent and real-time feedback about the PoC. Instead of waiting months for the decision to be signed off, project stakeholders can instantly view feedback, and decide on product changes.

With PoC development, the project’s scope and viability will become more apparent. It is critical for banks to complete the details of the project plan to ensure the project timelines, stakeholders, and resources are secured. Without having the correct structure and expertise in place, innovation initiatives are likely to fail and are difficult to monitor. The ideal plan will also manage change and continuous progress tracking, so the innovation project is executed quickly, efficiently, and at scale.

Deliver to Scale

The final stage allows banks an opportunity to accelerate the implementation of an idea with the creation of a validated Minimum Viable Product (MVP). After validation, ideas are promoted through mass consensus to ensure the best ideas have been considered. Objectives and key results (OKRs) must be set at the onset of MVP creation, to ensure expectations are met prior to full-scale implementation.

A primary goal of an MVP is to figure out which products clients don’t want, allowing for the development of products or features that are preferred by clients. The MVP also allows for testing of different types of product hypotheses, allowing stakeholders to determine whether there is a business need and a market to support the product.

After implementation, ROI should be constantly tracked to see if any product or idea features need to be improved. Creating a well-planned and executed implementation approach drives outcomes and delivers compelling experiences for a bank’s customers.

A bank’s innovation strategy can change over time so the business must stipulate how the different types of innovation fit into the overall business strategy and the resources needed for each. With our Innovation Platform, banks can not only generate great ideas, but enjoy an environment where innovation can thrive. Whether you are searching for new ideas, validating existing ones, or building a transformational process, our solutions and experts can help you realize innovation within banking.

Antonina Skrypnyk is a senior client partner, and global head of SoftServe’s financial services lab, with more than 11 years extensive industry experience delivering high-impact results.

Tagged under Bank Performance, Technology, Retail Banking, Performance, Customers, Branch Technology/ATMs, Core Systems, Tech Management, Mobile, Online, Feature, Financial Trends, Feature3,