Enforcement flips in industry favor

Twice as many severe enforcement actions terminated as issued so far in 2018

- |

- Written by S&P Global Market Intelligence

S&P Global Market Intelligence, formerly S&P Capital IQ and SNL, is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the SNL subscriber side of S&P Global's website.

S&P Global Market Intelligence, formerly S&P Capital IQ and SNL, is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the SNL subscriber side of S&P Global's website.

By Carolyn Duren, S&P Global Market Intelligence staff writer

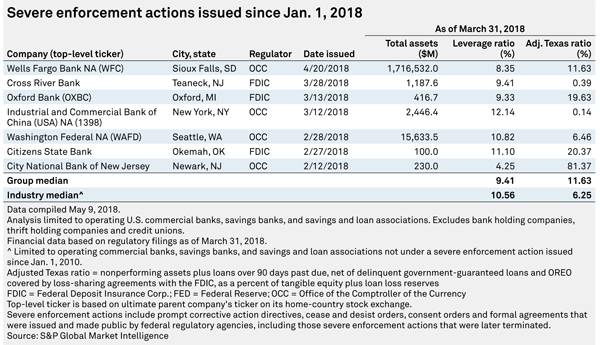

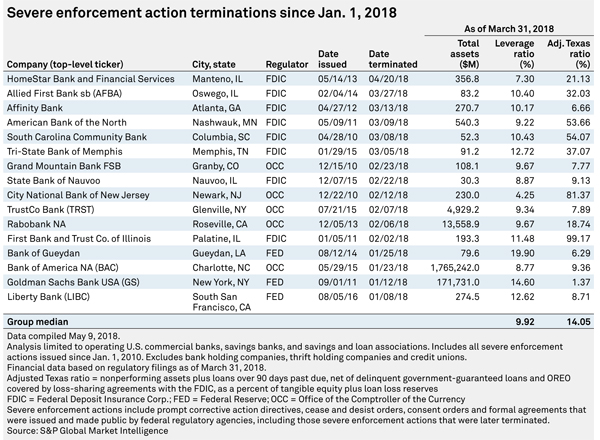

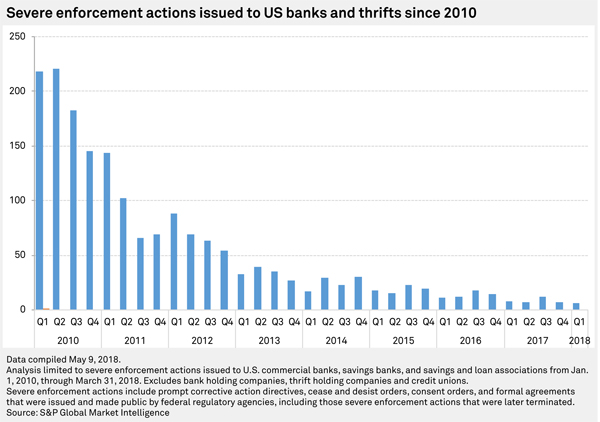

During the first four months of 2018, 16 severe enforcement actions issued since 2010 for currently operating companies were terminated, while only seven new severe enforcement actions were issued. As of May 1, 163 banks and thrifts were operating under a severe enforcement action.

Of the 16 banks that had severe enforcement actions terminated this year, 14 are now completely free of severe enforcement actions. Newark, N.J.-based City National Bank of New Jersey had a 2010 cease-and-desist order terminated and replaced by a new severe enforcement action Feb. 12. Bank of America NA had a 2015 cease-and-desist order terminated in January, but it remains under two severe enforcement actions.

Two severe enforcement actions issued in 2018 include enhanced capital requirements. City National Bank of New Jersey's Feb. 12 cease-and-desist order requires the bank to maintain total capital equal to at least 13% of risk-weighted assets and a Tier 1 capital ratio of at least 9%. As of March 31, City National's total capital was equal to 9.33% of risk-weighted assets, and its Tier 1 capital ratio was 8.06%.

Okemah, Okla.-based Citizens State Bank's severe enforcement action requires the bank to maintain a leverage ratio of at least 10% and a total capital ratio of at least 13%. As of March 31, the bank met these requirements, reporting a leverage ratio of 11.10% and a total capital ratio of 25.92%.

Most recently, Wells Fargo Bank NA received a cease-and-desist order from the Office of the Comptroller of the Currency regarding a variety of issues, including auto lending, mortgage rate lock extensions and risk management. The bank was also required to pay two $500 million penalties, one to the OCC and one to the Consumer Financial Protection Bureau. The $500 million payment to the CFPB is the highest penalty the agency has ever received.

This article originally appeared on S&P Global Market Intelligence’s website on May 16, 2018, under the title, "Twice as many severe enforcement actions terminated as issued so far in 2018"

Tagged under Compliance, Risk Management, Compliance Management, Compliance/Regulatory, Feature, Feature3,