Time to bring your ALCO in for a tune-up

4 key factors to check out sooner rather than later

- |

- Written by ALCO Beat

ALCO Beat articles featured exclusively on bankingexchange.com are written by the asset-liability management experts at Darling Consulting Group.

ALCO Beat articles featured exclusively on bankingexchange.com are written by the asset-liability management experts at Darling Consulting Group.

By Mark Haberland, managing director, Darling Consulting Group

During the almost decade-long period of historically low rates, ALCO was often put on the proverbial “back burner.” Only the most “time sensitive” decisions were discussed around the table. Bankers were lulled into a state of complacency after years of stagnation with rates not moving.

Even as we are fast approaching rate levels we have not seen in a very long time, many are finding it difficult to wake their ALCOs up from their long slumber.

While the industry has been in a period of rising rates since December 2015, that has been in name only, as banks have seen deposit rates lagging the market and loan rates struggling to keep pace. As we approach a 2.00% Fed funds rate for the first time since George W. Bush was in office, pressure to raise deposit rates will intensify. Margin pressure and liquidity concerns will require more of your attention.

Are these issues being talked about at the bank down the street or in the next town? You have to think they are.

Are they on the minds of your examiners? You’d better believe it!

Conditions keep changing

Banks find themselves at a crossroads. Decisions made regarding deposit account pricing have significant repercussions on loan pricing and liquidity. Those banks that utilize time spent in ALCO meetings to facilitate discussion and decision making based upon clear and concise information and interactive dialogue will be best positioned to succeed through this next rate cycle.

Take a look at your current ALCO and see if it could benefit from a tune-up. Are you focused on the right information? Open to new ideas? Forward looking and driven to action?

Ask yourself a few questions as you evaluate your current process:

1. How well do you really know your deposit base?

2. Do you know how much liquidity you have? How much you need? What could change that?

3. How does your interest rate risk profile affect your decision making?

4. Is your ALCO meeting a vehicle that facilitates strategic discussion and decision making? Or a compliance-focused “check the box” gathering?

Now, let’s take these one-by-one.

1. How well do you know your deposit base?

There is a certain psychology that comes into play with your customers as the 2.00% Fed funds level nears. Does that force you into finally moving your rates higher?

The response is often to offer a special, in line with others in the market. Alternatively, banks may choose to raise rates on current products. Banks may take such actions without having a deep understanding of their depositors and their behavior. Having such valuable insight into the full customer relationship with the bank makes pricing discussions much more meaningful.

Performing a market analysis—and understanding the depth of the customer relationship with the bank—before making adjustments is critical to managing funding costs. With every basis point being so important, the ability to identify the segment of your customers that is truly “core” versus those that have more rate-sensitive balances can have a significant impact on your overall cost of funds.

So why don’t more banks take this approach?

The answer usually comes down to time and resources. This information lies within the data that you have at your fingertips. But that data must be harnessed in such a way as to strengthen single-source relationships; develop new products that accomplish the strategic goals you set; and fit your customer base and provide timely information to ALCO to affect change as required—and before it is too late.

The importance of understanding the makeup and stability of your deposit base is not limited to managing your funding costs.

Consider “cannibalization.” Your ability to identify customers who are more rate-sensitive, and therefore more apt to shift into higher-rate specials that you may offer, will impact the overall marginal cost of new product offerings.

Attrition is another concern. The bank is potentially exposed to having rate-sensitive customers leave the bank for outside alternatives. This may happen over time, with a slower reduction in wallet share. Or it may happen suddenly, with customers closing accounts and relationships they have with your bank. So, monitoring this activity and understanding where the money is going and what is causing it to leave can help slow customer attrition levels or provide useful information for your liquidity forecasting and contingency planning.

2. How much liquidity do we have? Need? What could change that?

Many bankers have not viewed liquidity management as an area requiring a deep focus, as many banks have been flush with liquidity.

Regulators do not share that perspective.

FDIC’s Supervisory Insights from last summer outlines a rather specific focus that banks should adhere to in order to monitor liquidity levels today and look ahead.

Historically, many banks have focused on call report ratios (i.e loan/deposit) as a means for measuring liquidity. We are starting to see more of a trend toward collateral-based liquidity measurement—this puts the emphasis on liquidity the bank owns, in the sense that a readily marketable security can be sold to raise cash. (This is as opposed to requesting an advance that is supposed to be available from a third party.) So, with the regulatory focus on “on-balance sheet” liquidity (or liquidity “cushion”), banks must determine the level that fits with their risk profiles and business model.

However, while this “on-balance sheet” level is a current focus, banks must remember that their total liquidity levels and accessibility to funding goes beyond just this level. Loan collateral pledged to the Federal Home Loan Bank, access to brokered/national CDs, and the Federal Reserve must also be considered as potential available funding sources and factored into a bank’s overall liquidity profile.

And with the uncertainty of deposit stability, loan growth expectations and the potential for increased reliance on wholesale funding, it is important for banks to be incorporating dynamic forecasting into their liquidity management processes.

Building in assumptions and quantifying the impact on overall liquidity helps management support asset growth strategies by demonstrating the ability to fund the growth and replenish wholesale funding capacity by pledging new loans as collateral. Additionally, understanding your liquidity needs and availability helps in determining your deposit pricing strategy.

A strong liquidity position allows for a more defensive pricing posture and ability to continue to lag on rate increases. However, should liquidity levels be tighter and the “cushion” not be as robust, the bank may be forced into a more aggressive pricing campaign to retain more rate sensitive customers.

Deposits and liquidity are interconnected like never before.

When determining your asset growth strategy and the term structures for your CD specials or wholesale funding game plan, it is imperative to understand your sensitivity to changes in interest rates, both near-term and long-term.

3. How does your interest rate risk profile affect your decision making?

Everyone has been talking about rising rates. As expected, that tends to be the focus of most interest rate risk analyses. But how quickly rates rise—and the resulting shape of the yield curve—can change your perspective as to your benefit (or exposure).

While rates have, in fact, increased, movement has been focused on the short end of the yield curve, with little increase on the longer end. This has resulted in a flattening scenario which has proven detrimental to many institutions. This is a scenario that should be incorporated into every bank’s analysis to better understand the potential exposure to a non-parallel movement in rates.

The rate shocks that many banks run for their quarterly net interest income (NII) tend to overstate sensitivity in the near term as they move rates immediately.

History indicates that just does not happen. In fact, the pace of rate increases has been and is expected to be slower than in previous rising rate cycles.

Banks should understand the impact of more gradual increases in rates when determining their strategic direction.

Regardless of the speed with which rates increase (or decrease) or the shape of the curve, banks of all sizes should be including longer-term (i.e. five-year) NII simulations as part of their ALCO process.

Most banks include two-year simulations. When these are only performed with rate shocks, they can cause confusion regarding the bank’s true risk position. This makes strategic decisions more challenging.

Consider that your balance sheet is made up of assets and liabilities, the majority of which have lives exceeding two years. When discussing strategic initiatives such as how to fund fixed-rate loan growth, how do you determine the right funding mix and term if you are only looking at two years?

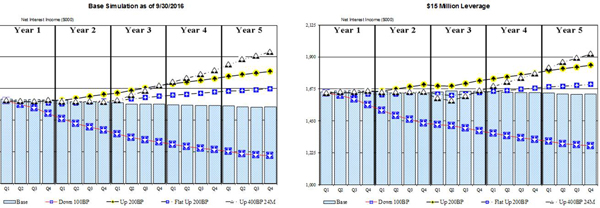

The graphs below in Exhibit 1 show a base simulation on the left and a leverage strategy on the right. The bank utilized the five-year simulation to determine that it only needed two-year funding for the longer-term assets it purchased. This was due to the longer-term asset sensitivity of its balance sheet—something that would not have been evident with only a one- or two-year simulation.

It is also a decision that can save the bank $60,000 per year in funding costs by not paying for insurance they do not need!

Click on the image for a larger version

4. Does your ALCO meeting facilitate strategic discussion?

The ALCO meeting allows for all of these types of conversations to take place, as long as you have the right people included and the right information available. Having Retail Banking and Lending involved to discuss product and pricing strategy will help make sure both sides are on the same page in terms of improving margin—as funding costs increase, loan rates will need to rise as well. The more each side knows about the other, the easier it becomes to find the right balance.

Understanding the liquidity sources available allows ALCO to find the right fit to fund loan growth, whether it is through deposit growth, wholesale funding, or a combination. The right mix will also be dictated by your interest rate risk profile—so being able to run multiple “what-if” scenarios prior to the ALCO meeting can help the discussions and provide the key decision makers with information on each strategy’s impact on earnings, liquidity, and sensitivity.

Don’t allow these opportunities to pass you by. Turning the ALCO meeting into a rehashing of history and review of ratios does nothing to drive the bank’s future performance. There is no “one size fits all” strategy for all banks, so it is incumbent upon each bank to find its best path to success. The ALCO meeting is the best vehicle to accomplish that.

ALCO must be a forward-looking, dynamic group that remains flexible and open to change. Particularly in this rate environment, which is unlike any we have experienced before, the old way of managing just won’t cut it.

It is time to tune up your ALCO and take your bank to the next level.

About the author

Mark Haberland is a managing director at Darling Consulting Group. In this role, he works directly with financial institutions to strengthen their asset/liability management process. He provides support to clients in the areas of liquidity risk management, capital, ALM modeling and reporting, and regulatory compliance.

Haberland has been with DCG since 1997 and oversaw the operations of the company’s Financial Analytics Group for many years. He has over 20 years of experience in the banking industry in the areas of asset-liability management and bank auditing.

Tagged under ALCO, Management, Financial Trends, Risk Management, Rate Risk, ALCO Beat,