Location-based service a plus for banks

“Geofencing” and related GPS tech can help with fintech competition

- |

- Written by Abby Progin, Temenos

Banks are in a race to differentiate themselves as digital technology from new fintech providers speeds the commoditization of bank products. Being digital is no longer enough. Banks and credit unions must now look at the account holder experience as a whole, from checking and savings, to loan and credit origination, and on through the maintenance and service phases.

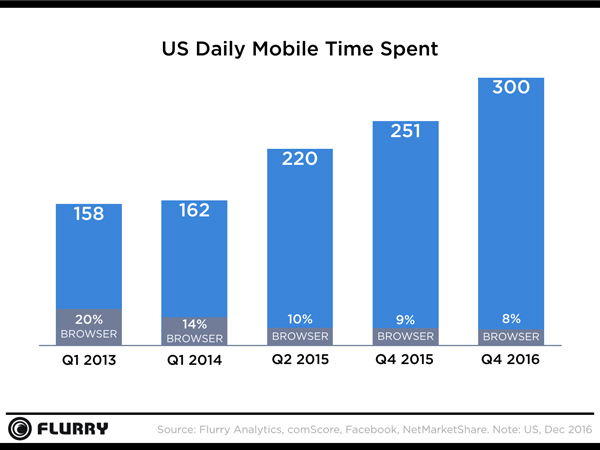

According to Flurry, an analytics firm, consumers are spending up to five hours a day on mobile devices (Figure 1). With technology advancements such as analytics and GPS solutions, banks should be looking beyond simply delivering a mobile offering and instead approach account holders with a “mobile-first” mindset.

Innovations in GPS technology such as the use of “geofences”—a defined digital geographic area—are driving growth in location-based services. Real-time geographical positioning data from smartphones is linked to user data to allow customized information and messages to be sent to consumers when they are in specific locations. The Waze navigation application, for example, uses geofence technology to allow retailers to advertise products or services relevant to drivers as they pass through various geofence areas. The ads are dynamically generated based on location and analytic data. The same concept can prove very powerful for marketers and strategists at financial institutions.

Although there have been concerns in the past with privacy issues associated with tracking users’ locations, nine out of ten smartphone owners now use the location services on their phone (up 74% since 2013), according to data from Pew Research Center. It is now common for social media users to “check in” from places such as restaurants, stores and events to let their followers know what they are up to.

The location-based services market is still in its infancy. Markets and Markets predicts that the overall market is expected to grow from $15.04 billion in 2016 to $77.74 billion by 2021.

3 ways to differentiate

Bank products today have been commoditized to the point that customers no longer distinguish between providers. Loyalty has decreased. Consumers jump from financial institution to financial institution or they open multiple accounts with a variety of providers.

One way to beat commoditization is to differentiate through marketing and an elevated brand “experience.” Tapping into location services can help bank marketers add value and differentiate their brand by engaging with consumers wherever they happen to be and collaborating with merchants to drive revenue. location services can also reduce transaction fraud. Combining these three elements can allow bankers to anticipate customer needs and fulfill them before their competition has a chance to raise its hand, increasing customer loyalty and improving the bottom line.

1. Engage customers where they are

The combination of data analytics and location services gives banks the opportunity to leverage mobile technologies to grow their customer base and drive loyalty. Identifying and analyzing consumer behavior patterns will allow bankers to reach out to their customers at the right time, in the right place, and with the right service or information to assist them.

For example, if the customer is browsing the Kelly Blue Book website almost every night, the bank should be prepared to offer them a line of credit when they walk onto a car lot. The bank will know when that customer is on the lot by incorporating location-based services into its IT strategy.

Mobile marketing based on location also provides financial institutions the opportunity to cross-sell and up-sell. For example, a customer browsing a furniture store could access a personal line of credit while shopping for a new living room set. This type of outreach can provide additional opportunities for banks to drive revenue.

2. Collaborate with merchants

Banks can also deploy location-based technology in their vendor relationships. Retailers can push relevant offers to consumers at an opportune time, and banks can assist them in accelerating the purchase decision with specialized offers such as discounts for using specific payment methods. This can increase wallet share and benefit the bank’s bottom line. This will assist with driving sales for the retailer and provide discounted pricing to the customer.

3. Reduce transaction fraud

More than 15.4 million U.S. consumers fell victim to fraud in 2016 costing them $16 billion, according to Javelin Strategy & Research’s 2017 Identity Fraud Study. Despite substantial efforts to improve bank card security, hackers have continued to outpace regulators and security officers.

Location services won’t solve the problem, but the technology can help reduce card fraud. With location services banks can monitor where a customer is based on the location of their mobile device. If transactions are made outside of the consumer’s standard geofence the technology platform should raise a red flag and the bank can send a push notification—text or email the customer, provided the account holder opted into the service—to verify the purchase and ensure there hasn’t been any fraudulent activity.

For customers who travel frequently, location services can eliminate the need to constantly alert their banks that they are on the move. For banks, it provides another way to verify that the account holder is not the victim of financial crime.

Automating the authentication process through the location of an account holder’s mobile device will be much more cost-effective than manual calls with bank staff about suspicious purchases. The deft use of location services can also help prevent customers feeling embarrassed and frustrated when their cards are unnecessarily rejected by retailers.

Privacy issues remain a concern for many consumers. While powerhouses Apple and Google both offer phone users the ability to see what apps have recently requested their location information, Apple has also recently experimented with additional notifications such as its “Blue Bar,” which was intended to notify users while an app is actively using their location in addition to their symbols for recently accessed, or apps with permissions. With continued advancements in security solutions, attention to consumer rights and experience, and increasing regular use of location access across industries, consumers are becoming more trusting and at the same time are seeing the day-to-day benefits of location services. They are becoming ever more likely to “opt-in” and agree to receive notifications from businesses they frequent.

Location services presents numerous opportunities for banks. By looking ahead and investigating and implementing technology like location services in support of an experience-driven approach, banks can differentiate themselves, provide value to their customers and stay a step ahead in today’s increasingly competitive marketplace.

About the author

Abby Progin is product evangelist for bank technology company Temenos. She has more than eight years experience in bank and credit union technology.

Tagged under Technology, Feature, Feature3,