4 strategies to innovate without betting bank

Embrace change, but manage your risks as well

- |

- Written by John Epperson and Jason Henrichs

Most banks recognize that innovation, particularly technological advances and the new business strategies they enable, is critical to their ongoing success. The challenge is how to build a risk-tolerant culture that encourages and even enables innovation without compromising the necessary risk management capabilities of a sound financial services organization.

Need for innovation

The ability to embrace uncertainty and to recognize and respond nimbly to change is critical to any business. History offers numerous examples of companies that have failed to recognize the importance and urgency of innovation, particularly in the past few decades when technology has enabled game-changing, new business approaches. The pace of these changes continues to accelerate as both start-ups and large companies alike invest in disruptive change.

There are stark contrasts among companies in regard to change: some actively embraced it, some avoided it altogether, and others struggled and failed to manage it. For example, traditional brick-and-mortar retailers are struggling to survive as technologically nimble, online retailers offer customers unmatched convenience and pricing advantages. Companies like Amazon, having remade consumer sales, have even begun to venture into new twists on traditional retailing: through the Amazon Go concept and the Amazon Pop-Up stores, and Amazon’s recently announced purchase of Whole Foods Market.

The same pressures and trends can be seen in banking and in the broader financial services sector. One recent study, the “2017 Global Fintech Report” by PricewaterhouseCoopers, found that collaborative efforts between mainstream financial institutions and fintechs had led to a cumulative investment of more than $40 billion in fintech start-ups in the past four years. In fact, fintech investment grew at a 41% annual growth rate. Collectively, the financial industry now seems to be getting the message that it must adapt and embrace change in order to survive.

Banks eager, but lagging

Beyond overall industry awareness, there are signs that more individual banking organizations are coming to recognize the need to embrace change. At the same time, however, many organizations are struggling to address the challenge.

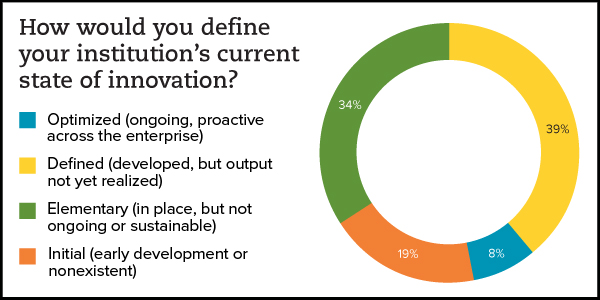

For example, a recent online webinar sponsored by Crowe Horwath LLP asked a diverse group of 270 banking executives to characterize the current state of innovation within their organizations, using one of the four following descriptions:

• Initial. Innovation processes, strategy, culture, and tools are in the early development stages.

• Elementary. Innovation processes, strategy, culture, and tools are in place and are sophisticated enough to support the occasional repetition, but they are not integrated to assure ongoing or sustainable innovation.

• Defined. Innovation processes, strategy, culture, and tools have been developed, documented, and integrated within the organization, but output may not be sufficient or has not yet been realized.

• Optimized. Innovation processes, strategy, culture, and tools have been optimized to a level of sophistication to support the ongoing, automated, integrated, and proactive innovation across the enterprise.

More than half the banking executives surveyed (53%) said their organizations were still in either the “initial” or “elementary” stages when it came to innovation (see chart, p. 26). Thirty-nine percent described their innovation efforts as “defined.” Only 8% of the participants characterized their organization’s approach as “optimized.”

Nevertheless, despite the relatively modest levels of innovation they perceived in their organizations, more than two-thirds (68%) of the participating executives indicated that their organizations have been eager to embrace change and financial services innovation.

Comparing the survey responses leads to the obvious question: If so many banks are approaching innovation eagerly, why have so few banks been successful in optimizing innovation in their organizations?

The struggle with innovation

Like many long-established businesses, financial institutions often find themselves at a disadvantage when trying to adapt to changing technology and the new opportunities it brings. This challenge is particularly true in heavily regulated industries, such as financial services. The need to maintain and continue to operate their core business securely, reliably, and in a compliant manner has historically resulted in people, processes, and technology that seek to eliminate risk. On the other hand, doing something new inherently involves taking on risk. These two conflicting approaches can seem like an inherent and insurmountable contradiction.

Among the survey respondents, nearly half (44%) said that compliance, risk, and legal issues were the biggest challenges that they faced in terms of innovation (see chart, right). This number far exceeded those who cited budget or resource restraints, lack of executive support, or fear of failure.

There are understandable reasons why compliance, risk, and legal issues are widely viewed as the most critical factors inhibiting innovation. Entirely new risks—that is, the invention of new products, new customer segments, new marketing strategies, or new strategic partners—present the risk management function with difficult challenges, because there may be no model for identifying, quantifying, and mitigating these new types of risk. These new initiatives often are targeted at problems that are not and cannot be well categorized in advance of a launch. The new world of innovation requires an iterative approach to problem discovery and solution development.

Many executives conclude that their organizations simply can’t respond nimbly enough. By the time the risks are fully assessed and addressed, they contend, the opportunity already has passed or the result is incremental to existing products and services.

At the same time, however, most of these same executives will concede that there are valid reasons for those multiple layers of approval and red tape.

The banking industry is inherently risk-averse; it’s the nature of the business. Moreover, that innate tendency is reinforced almost daily by news of significant fines and penalties for compliance failures—not to mention the adverse headlines and reputational risk that such failures generate.

The crucial challenge to overcome then is how to help develop an organizational culture that accepts and embraces reasonable levels of risk that support innovation, while still maintaining appropriate risk management as well as risk mitigation processes.

Four critical factors

Obviously, there is not only one approach for establishing an environment that supports innovation. By its very nature, innovation cannot be prescribed or mandated through a checklist. Nevertheless, industry observation suggests four broad areas in which effective management can have a direct impact on how well an organization overcomes inertia and encourages an environment in which appropriate levels of risk are viewed as acceptable. These areas are:

1. Culture. Adapting the culture to encourage a more entrepreneurial spirit as well as a more balanced approach to risk is essential.

This cultural shift starts at the top of the organization and requires many processes to be rebuilt. Critical first steps include establishing a common risk language and incorporating risk management into business planning; employee training; and individual performance evaluations.

Furthermore, as the financial services ecosystem continues to broaden with new strategic alliances, partnerships, and ventures, it is important that banking executives consider how these values and the culture are aligned.

2. Strategy. Banks also can benefit by adapting their business strategies to accommodate an environment of continuous change and to support strategic collaboration between risk management and the lines of business.

The ultimate goal then is to develop a mind-set that recognizes that compliance is simply good business and to encourage innovators to apply the same levels of ingenuity toward mitigating risk as they do when developing a new product or service.

Critical early steps in this effort include developing formalized, documented, and transparent risk appetite and tolerance statements, while also taking steps to encourage a more collaborative approach by seeing that the risk and compliance functions have a defined role in strategic decision-making.

3. Organization. To support the cultural and strategic elements just described, financial institutions also should be prepared to rework their internal leadership and organization structures.

The purpose of this reorganization effort is to establish a dedicated focus on innovation throughout the bank, while also breaking down silos to improve coordination and transparency across the three lines of defense: management control; risk and compliance oversight; and independent audit or assurance.

In many instances, another useful organizational change is establishing a formalized and dedicated innovation office with clearly defined responsibilities and priorities.

4. Change enablement. A significant challenge for many banks is how to enable change and innovation, while still maintaining stability within their core lines of business.

Successful change enablement approaches often involve establishing formalized incubation and accelerator programs. Such programs can be used to help mobilize multidisciplinary teams and establish plans for resilience and change management.

The risk management function should be included in these efforts, because risk professionals can make a valuable contribution to innovation by identifying early any potential compliance risk. Their involvement can help product developers adapt their offerings as necessary in order to “innovate the compliance risk out” of a new product or service.

By addressing these four critical areas, and by establishing greater collaboration among the risk management function, the dedicated innovation team, and the existing lines of business, banks can find the right balance between innovation and risk.

Ultimately, board members and senior executives must take the lead in establishing a risk-tolerant culture that encourages innovation while still maintaining the necessary risk management functions that are indispensable to a stable financial services organization.

John A. Epperson is principal at Crowe Horwath LLP. Jason Henrichs is managing director at Fintech Forge.

Tagged under Management, Duties, Risk Management, Operational Risk,