Rx for deposit profitability?

SNL Report: Health savings accounts earn banks big maintenance fees

- |

- Written by SNL Financial

SNL Financial is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the subscriber side of SNL Financial's website.

SNL Financial is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the subscriber side of SNL Financial's website.

By Maria Tor, SNL Financial staff writer

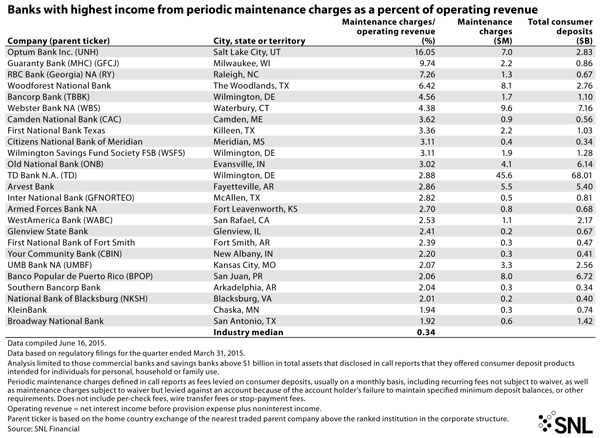

In 2015 banks began reporting their income from periodic maintenance charges on consumer deposits, revealing that institutions with health savings accounts see a relatively high amount of earnings from these fees.

Banks and thrifts above $1 billion in assets were required to begin reporting their income from periodic maintenance fees on consumer deposits in first-quarter call reports. The call report instructions define these fees in more detail as service charges levied on deposit accounts intended primarily for individuals for personal, household or family use. The instructions state that these fees are often labeled "monthly maintenance charges" and include both recurring fees that the account holder cannot avoid and nonrecurring fees, such as failure to maintain a minimum balance.

The new field was part of a larger call report rule change that also required banks above $1 billion in assets to report overdraft fees and ATM fees levied on consumer deposits. Consumer deposits, as reported in call reports, are comprised of transaction and nontransaction accounts, excluding CDs.

Click to enlarge image

Fee leader part of health specialty group

When ranking banks and thrifts by the percent of operating revenue comprised of periodic maintenance fees, Salt Lake City-based Optum Bank Inc., the industrial bank unit of Minnetonka, Minn.-based UnitedHealth Group Inc., rises to the top.

The institution is primarily in the business of offering health savings accounts and payment card services for flexible spending and health reimbursement arrangements, according to the application it filed Dec. 5, 2014, to acquire the health savings accounts of Columbus, Ohio-based Huntington Bancshares Inc.

In its first-quarter call report, Optum Bank reports holding $2.83 billion in consumer nontransaction accounts, of which 99.5% are classified as "other savings." Optum Bank earned $6.97 million in periodic maintenance charges on those deposits, which equates to 16.05% of its operating revenue in the first quarter.

Optum Bank's reliance on periodic maintenance fees is an outlier, and is much higher than the median of 0.34% for all banks above $1 billion in assets that offer consumer deposits. Other banks that offer health savings accounts also appear on the list of banks with highest reliance on periodic maintenance fees.

Health accounts significant for specialists

Wilmington, Del.-based Bancorp Bank, a unit of Bancorp Inc., ranks No. 5 on the list of banks with highest reliance on periodic maintenance charges. The bank offers health savings accounts through The Bancorp HSA.

The company said in an investor presentation filed Feb. 11 that health care deposit products make up 10.6% of its deposit products, excluding discontinued products. In its Form 10-K filed for 2013, the company said its service fees on deposits increased 40.3% during the year, "reflecting increases in the number of healthcare accounts." The company has not yet filed its Form 10-K for 2014, but in the call report for the first quarter, the bank disclosed $1.7 million in maintenance charges on consumer deposits.

Waterbury, Conn.-based Webster Bank NA, a unit of Webster Financial Corp., ranks as having the sixth-highest reliance on periodic maintenance fees. Webster Bank has an HSA division called "HSA Bank" that earned net income of $8.5 million during the first quarter. This was up from $4.2 million in the first quarter of 2014, according to Webster Financial's most recent Form 10-Q, which is filed separately from the call report. The $8.5 million in net income made up 17.1% of the bank's consolidated net income for the first quarter. Webster Bank said in its call report that it earned $9.6 million from consumer deposits maintenance charges, which equated to 4.38% of its operating revenue.

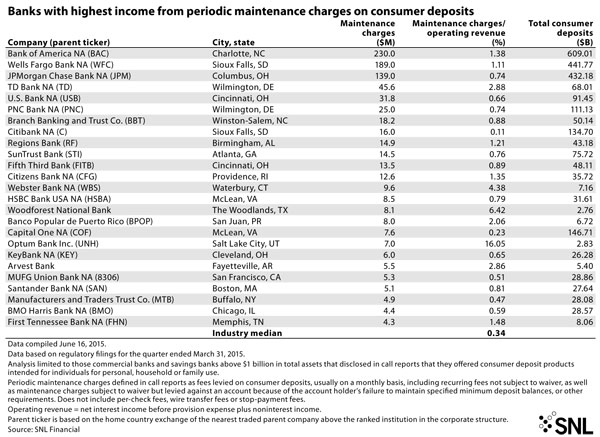

When ranking by total dollar amount of periodic maintenance fees earned, the top three banks are Charlotte, N.C.-based Bank of America Corp., San Francisco-based Wells Fargo & Co. and New York-based JPMorgan Chase & Co.

Click to enlarge image

Tagged under Management, Revenue, Fee Income, Feature, Feature3,