Improving banks' investment sales results

Expanding on existing trust, building relationships with younger investors are key factors

- |

- Written by Chris Brown, founder and principal of Sway Research LLC, and Laura Varas, president of Mast Hill Consulting Inc.

“If the investor doesn’t have a bank IRA, chances are low that the bank will be the investor’s primary provider of retirement advice”

“Banks can capitalize upon their position as institutions of savings to become savings advocates. This is a bigger need at the moment than retirement for the vast majority of customers”

“Banks can capitalize upon their position as institutions of savings to become savings advocates. This is a bigger need at the moment than retirement for the vast majority of customers”

Has your bank tried, or considered, investment services? How well has it gone for you?

Banks continue to improve their position in forming relationships with U.S. investors, but they could see further improvement with several changes to their approach to customers, a comprehensive new investor study reveals.

The Hearts & Wallets 2010 Quantitative Panel* of more than 4,000 U.S. households highlights five key opportunities for the banking industry to gain share, including:

• Enhancing communications to build investor trust—most notably, investors want a better understanding of how a bank or other investment provider will make money from them.

Banks continue to improve their position in forming relationships with U.S. investors, but they could see further improvement with several changes to their approach to customers, a comprehensive new investor study reveals.

The Hearts & Wallets 2010 Quantitative Panel* of more than 4,000 U.S. households highlights five key opportunities for the banking industry to gain share, including:

• Enhancing communications to build investor trust—most notably, investors want a better understanding of how a bank or other investment provider will make money from them.

• Expanding the industry’s perceived position as the primary provider of retirement advice.

• Becoming savings advocates—offering IRAs can be a critical entrée for the bank to deeper relationship with the investor.

• Focusing on neglected areas—such as smaller investors that full-service investment firms don’t want—or noticeable gaps.

• Courting younger investors who aren’t looking for retirement advice yet, but who want advice on current goals.

| After you finish this trend and advice article, read the story of how two community banks are approaching investment sales using third-party assistance, from the December 2010 Banking Exchange. |

The Hearts & Wallets survey tracks an investor shift from 2008 to 2010 toward banks and discount brokerage firms from full-service financial firms. The survey also found a concurrent drop in market share of relationships with American savers for insurers from 12% to 6% during that timeframe.

The segments of American savers where banks gained the most include affluent/high net-worth ($500,000+); Early-Career (ages 28-43); and Mid-Career (ages 44-52 who are not retired) investors.

Click here to open a larger PDF of this chart in another window.

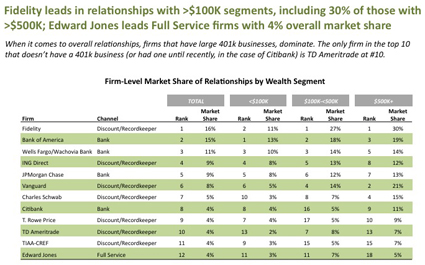

Four of the top 10 providers for U.S. investor assets are banks, according to the online survey. (Respondents interviewed who use banks’ investment services deal with banking institutions of all sizes, not just the large banks reflected in the accompanying graphics.)

In the study, nearly half of Americans say that banking and investing in the same location holds some appeal for them.

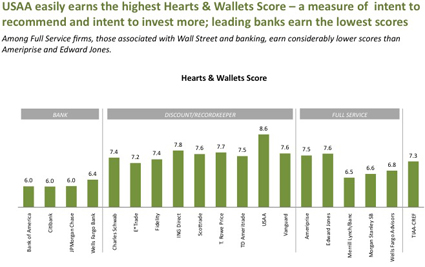

That desire signals an opportunity for the banking industry, given the often extensive brick-and-mortar networks of banking institutions. Yet, banks as a channel underperformed on two key drivers of the Hearts & Wallets score—a measure of intent to recommend and intent to invest more. Banks score on average a 7.1 as compared to 7.8 for discount firms.

Click here to open a larger PDF of this chart in another window.

The good news is that the study revealed there are ways that banking institutions can increase their score. By addressing critical unmet investor needs, the industry can win share from other channels. The primary drivers are:

• Helping investors understand how the institution makes its money—it’s a matter of building and maintaining trust.

• Doing a better job of being the customers’ primary source of retirement advice.

Know me, understand me, trust me

The first opportunity involves creating higher investor trust with better communications on how banks make money from the investing relationship. Banks as a primary provider come in with an average rating of 6.2 for how well the customer understands how the provider makes money.

The Hearts & Wallets 2010 Quantitative Update defines a primary provider as the firm holding the majority of a survey respondent’s assets. The bank primary provider rating of 6.2 is lower than 6.8 for full-service firms and 6.76 for discount firms.

Few investors understand how their providers earn money, which is a key driver of trust. This is true even among investors who use discounters, despite the firms’ straightforward fee schedules. USAA and ING Direct are the only firms where more than one-third of clients say they really understand how the firms made money from their business.

In focus groups conducted earlier this year by Hearts & Wallets, investors said a key unmet need was understanding how the financial firm made money. Investors wanted to know what their financial advisor did and how he or she was paid.

This is different from a legal or compliance disclosure. Investors yearn for a communication to explain the firm’s role in the economy; the primary revenue streams of its business units; and how its employees are compensated. (What they are getting now are the table of account types, associated annual fees, and number of permitted transactions.)

Another key factor in building trust is having reasonable fees. In the survey, 47% of respondents ranked this attribute as most important for a financial firm.

All financial services providers are challenged with winning back investor trust after recent market turbulence and scandals. This is especially true for the banking industry, which had more clients express distrust than other channels. The average trust numbers in the study are lower for banks as the primary provider, 7.7 compared to 7.9 for discounters and 8.0 for full-service brokers.

The variety of ways that banks make money create communication challenges. Still, transparency is crucial to winning investor trust. It’s part of the value proposition.

The study found that the more affluent the client, the more likely he or she is to work with multiple providers. Firms that help the investor understand economics and incentives will increase investor trust and be in a better position to capture more wallet share. Bringing more clarity to the firm’s incentives creates trust. A failure to do so leads to suspicion regarding the firm and/or advisor’s motive when recommending products.

Connect through savings and IRAs

The second opportunity for banks is increasing the number of investors for whom banks are the primary provider of retirement advice. This attribute is clearly linked to higher share of wallet.

The average share of wallet for primary providers of retirement advice among investors surveyed was 67%, versus only 18% for secondary providers. Combining both primary and secondary providers, full-service firms have the highest share of wallet at 63%. Banks have the lowest share of wallet at 32%.

Among Pre-/Post-Retirees, the single most important factor for higher share of wallet is being the primary provider of retirement advice. It adds 20 share points.

Providing recordkeeping services can also open the door to a broader relationship with investors. Nine of the top 10 firms in primary provider assets in the survey offer recordkeeping services. Even among investors with substantial savings, 401k plans are a way of converting workplace clients into full-service clients. The 401k account allows investors to become familiar with the firm’s other products and services.

A strength of the 401k is its connection to payroll. Banks need to work harder at connecting accounts that customers use on a daily basis for spending with savings. Approximately 10% of bank customers have IRAs at their banks. If the investor doesn’t have a bank IRA, chances are low that the bank will be the investor’s primary provider of retirement advice. The connection between spending and saving is key. Banks should make the most of their central role in this formula.

The third opportunity is for banks to capitalize upon their position as institutions of savings to become savings advocates. This is a bigger need at the moment than retirement for the vast majority of customers.

The Hearts & Wallets Quantitative Panel estimates that the Accumulator market, (investors ages 28 to 64 who are at least five years away from retirement) had assets of more than $12.9 trillion at the end of second quarter of 2010 and are building up savings quickly. Accumulator investable assets are projected to reach nearly $14.3 trillion by 2012 with most growth coming in younger market segments of savers in their 40s and younger.

These savers are not yet focused on retirement, but on saving for other needs. They find appeal in broad lifetime financial advice. Younger investors especially are focused on understanding how to allocate resources over their lifetime. Once more immediate financial needs are satisfied, retirement offerings can then be gradually phased in. This approach will help counter some of the negative marketplace perceptions that connect banks and credit card offerings to customer indebtedness in the minds of consumers.

Finding opportunities in gaps and neglected avenues

The fourth opportunity is to focus on areas other providers have neglected or where the banking industry has a noticeable gap.

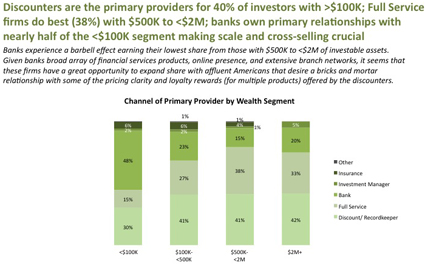

For example, investment firms ignore investors who have yet to accumulate $100,000 in investable assets. Banks are primary providers for nearly half of all Americans with less than $100,000 of investable assets. Special rewards programs could recognize different levels of savings, such as when a customer doubles an account balance or achieves a certain percentage, rather than a dollar amount. That way, consumers with limited funds could still see tangible progress.

There are challenges in a low-interest-rate environment, but with a focus on the balance, the result is positive for both the institution and the customer. The program can guide customers through a phased program to (a) spend within their means; (b) get them into savings accounts; and eventually (c) into IRAs.

Conversely, in the survey, banks experience a barbell effect. They have their lowest share from investors having mid-range of investable assets from $500,000 to less than $2 million. Given the broad array of financial services products, online presence, and extensive branch networks that many banks can offer, it would seem banking institutions have an opportunity to expand share with this affluent market segment. The keys will be providing some of the pricing clarity and loyalty rewards (for multiple products) offered by the discounters.

Click here to open a larger PDF of this chart in another window.

The fifth opportunity is for banks to reach out to younger customers who may not yet be peak investors.

Many full-service firms appear to be ceding younger segments to banks and discounters. That’s a risky long-term strategy.

ING Direct has made inroads in this market with its savvy online presence. It now ranks third, ahead of many leading banks and brokerage discounters. Bank of America/Merrill Lynch recently made a move to reach out to these customers with its introduction of Merrill Edge, its online discount brokerage arm, with the goal of ultimately transitioning them to full-service customers.

Remember, the younger investor of today will someday be the wealthier investor of tomorrow. It’s important to form a relationship now.

Opportunities for banks to expand share of wallet and cement customer loyalty are here for the taking. The challenge is offering the right mix of products and services, segmented not just by age and wealth, but more importantly by the lifestyles of their customers.

By Chris Brown, founder and principal of Sway Research LLC, and Laura Varas, president of Mast Hill Consulting Inc.. Brown and Varas are partners in Hearts & Wallets, a research firm offering multiyear retirement and savings investor research series. www.heartsandwallets.com.

By Chris Brown, founder and principal of Sway Research LLC, and Laura Varas, president of Mast Hill Consulting Inc.. Brown and Varas are partners in Hearts & Wallets, a research firm offering multiyear retirement and savings investor research series. www.heartsandwallets.com. *Online survey conducted at the end of June 2010 by Hearts & Wallets, an independent, third-party research firm. Investors were asked to list all financial firms they worked with and rate their primary financial firm and one other firm that they had a relationship with as part of an extensive survey of their beliefs and habits on savings and retirement.

Now that you’ve finished this trend and advice article, read the story of how two community banks are approaching investment sales using third-party assistance, from the December 2010 Banking Exchange.

Tagged under Management, Lines of Business,

Related items

- JP Morgan Drops Almost 5% After Disappointing Wall Street

- Banks Compromise NetZero Goals with Livestock Financing

- OakNorth’s Pre-Tax Profits Increase by 23% While Expanding Its Offering to The US

- Unlocking Digital Excellence: Lessons for Banking from eCommerce Titans

- NYCB Receives $1 Billion Lifeline